Navigating the world of student loans can feel overwhelming, especially when faced with the crucial question: what is the interest rate of a student loan? Understanding interest rates is paramount to making informed financial decisions that can significantly impact your long-term financial well-being. This guide will demystify student loan interest rates, exploring the various factors influencing them, the differences between federal and private loans, and the implications for your overall repayment costs.

From the different types of loans available and their associated interest rates, to the various repayment plans and their impact on total interest paid, we will provide a clear and comprehensive understanding of how student loan interest rates work. We’ll also delve into the calculation of interest and offer practical advice on finding the most up-to-date information on current rates.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed borrowing decisions. This section will clarify the key distinctions between federal and private student loans, outlining their features and eligibility requirements. Choosing the right loan type significantly impacts your repayment journey and overall financial health.

Federal Student Loans

Federal student loans are offered by the U.S. government through various programs. They generally offer more borrower protections and flexible repayment options compared to private loans. These loans are typically need-based or merit-based, with eligibility determined by factors like financial need and enrollment status.

Subsidized Federal Stafford Loans

These loans are need-based and the government pays the interest while you’re in school at least half-time, during grace periods, and during deferment. Eligibility is determined by your financial need as demonstrated on the FAFSA (Free Application for Federal Student Aid). Repayment begins six months after graduation or leaving school.

Unsubsidized Federal Stafford Loans

These loans are available to undergraduate and graduate students regardless of financial need. Interest accrues from the time the loan is disbursed, meaning interest charges accumulate even while you’re still studying. Repayment begins six months after graduation or leaving school.

Federal PLUS Loans

Parent PLUS Loans are available to parents of dependent undergraduate students to help cover education costs. Graduate PLUS Loans are available to graduate and professional students. Credit checks are conducted, and borrowers must meet specific credit requirements. Interest rates are generally higher than Stafford loans. Repayment begins within 60 days of the final loan disbursement.

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders. They are not backed by the federal government, meaning they often come with higher interest rates and fewer borrower protections. Eligibility is typically based on creditworthiness, income, and co-signer availability.

Examples of Private Student Loans

Many private lenders offer various student loan products, each with unique features. For instance, some might offer lower interest rates to borrowers with excellent credit scores or those who choose auto-pay options. Others might provide options for co-signers to reduce the risk for the lender, thereby potentially lowering the interest rate for the borrower. Specific loan terms and conditions vary widely depending on the lender and the borrower’s profile.

Comparison Table

| Loan Type | Lender | Interest Rate Type | Repayment Options |

|---|---|---|---|

| Subsidized Federal Stafford Loan | U.S. Department of Education | Fixed | Standard, Income-Driven Repayment (IDR), Deferment, Forbearance |

| Unsubsidized Federal Stafford Loan | U.S. Department of Education | Fixed | Standard, Income-Driven Repayment (IDR), Deferment, Forbearance |

| Federal PLUS Loan (Parent/Graduate) | U.S. Department of Education | Fixed | Standard, Income-Driven Repayment (IDR), Deferment, Forbearance |

| Private Student Loan | Various Banks, Credit Unions, and Private Lenders | Fixed or Variable | Standard, potentially some income-based options depending on lender |

Factors Influencing Student Loan Interest Rates

Understanding the factors that determine your student loan interest rate is crucial for planning your finances and choosing the best loan option. Interest rates directly impact the total cost of your education, so a thorough understanding of these factors can help you secure the most favorable terms. Several key elements influence both federal and private student loan interest rates.

Several key factors influence the interest rate you’ll receive on your student loan. These factors differ slightly between federal and private loans, reflecting the varying risk assessments undertaken by lenders.

Credit Score and History

A strong credit history significantly impacts private student loan interest rates. Lenders view a high credit score as an indicator of responsible borrowing behavior, leading to lower interest rates. Conversely, a poor credit history or a lack of credit history can result in higher interest rates or even loan denial. Federal student loans, while generally more accessible, may also consider credit history for certain loan programs, particularly those with higher loan amounts or extended repayment periods. For example, a borrower with a FICO score above 750 might qualify for a significantly lower interest rate on a private loan compared to a borrower with a score below 600.

Loan Type and Repayment Plan

Different types of student loans carry different interest rates. Federal subsidized loans, for instance, typically have lower interest rates than unsubsidized loans because the government subsidizes the interest during periods of deferment. Private loans, lacking government backing, tend to have variable interest rates, often higher than federal loans, that fluctuate with market conditions. The chosen repayment plan can also affect the effective interest rate. Income-driven repayment plans may lower monthly payments but often extend the loan term, leading to a higher total interest paid over the life of the loan. For instance, a 10-year repayment plan will typically result in a lower overall interest cost compared to a 20-year plan, even if the monthly payments are higher.

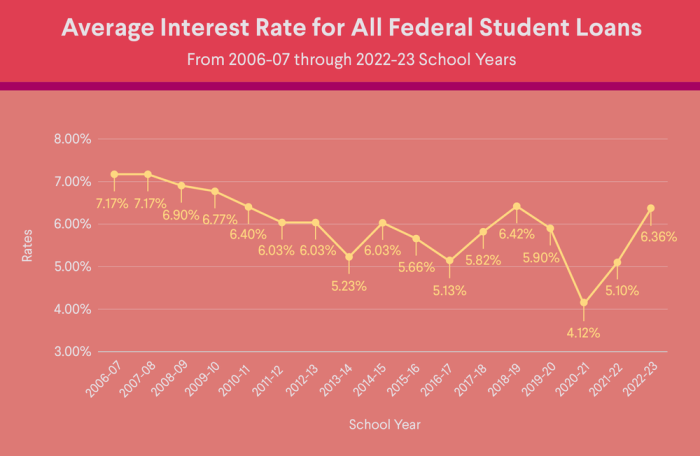

Market Interest Rates

The prevailing market interest rates significantly influence the interest rates offered on both federal and private student loans. When market interest rates rise, lenders tend to increase their loan interest rates to maintain profitability. Conversely, when market rates fall, borrowers may benefit from lower interest rates. This relationship is particularly evident with variable-rate loans, which directly reflect fluctuations in market conditions. For example, during periods of economic uncertainty or inflation, interest rates tend to rise, impacting both federal and private loan rates.

Comparison of Factors Impacting Interest Rates

| Factor | Impact on Federal Loans | Impact on Private Loans | Example |

|---|---|---|---|

| Credit Score | Minor impact; primarily affects eligibility for certain programs or loan amounts. | Major impact; higher scores lead to significantly lower rates. | A borrower with a 780 credit score may receive a significantly lower interest rate on a private loan than a borrower with a 620 score. |

| Loan Type (Subsidized vs. Unsubsidized) | Subsidized loans typically have lower rates than unsubsidized loans. | Not applicable; private loans don’t have this distinction. | A federal subsidized loan might have an interest rate of 4%, while a comparable unsubsidized loan has a rate of 5%. |

| Repayment Plan | Income-driven repayment plans may extend the loan term, increasing total interest paid. | Similar to federal loans; longer repayment terms result in higher total interest. | A 10-year repayment plan will generally have lower total interest than a 25-year plan, regardless of loan type. |

| Market Interest Rates | Indirect impact; rates are set by Congress but influenced by market conditions. | Direct impact; variable-rate loans fluctuate with market rates. | During periods of high inflation, both federal and private loan rates tend to increase. |

Fixed vs. Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan term, providing predictability in monthly payments. A variable interest rate, on the other hand, fluctuates based on market conditions, potentially leading to lower payments initially but exposing borrowers to the risk of increased payments later. Fixed-rate loans offer stability, while variable-rate loans offer the potential for lower initial costs but greater uncertainty. For example, a borrower with a fixed-rate loan will pay the same amount each month, regardless of market fluctuations, while a borrower with a variable-rate loan might see their monthly payments increase or decrease over time.

Understanding Interest Rate Calculations

Understanding how interest is calculated on your student loans is crucial for effective financial planning and responsible repayment. This section will break down the calculation of simple and compound interest, illustrating their impact on your total loan cost and providing a step-by-step guide for calculating your monthly payments.

Student loan interest can be either simple or compound. Simple interest is calculated only on the principal amount borrowed, while compound interest is calculated on both the principal and accumulated interest. The type of interest applied significantly impacts the overall cost of your loan.

Simple Interest Calculation

Simple interest is calculated using a straightforward formula. It’s less common for student loans but understanding it provides a foundation for grasping compound interest calculations. The formula is: Simple Interest = Principal x Interest Rate x Time. Where ‘Principal’ is the original loan amount, ‘Interest Rate’ is the annual interest rate (expressed as a decimal), and ‘Time’ is the loan term in years.

For example, let’s say you have a $10,000 student loan with a 5% simple interest rate over a 10-year term. The simple interest accrued would be: $10,000 x 0.05 x 10 = $5,000. Your total repayment amount would be $15,000 ($10,000 principal + $5,000 interest).

Compound Interest Calculation

Compound interest is more common with student loans. It’s calculated on the principal amount plus any accumulated interest. This means that interest earns interest, leading to faster growth of the debt over time. The calculation is more complex and typically involves more frequent compounding periods (monthly, quarterly, etc.). While a precise calculation often requires specialized financial calculators or software, understanding the fundamental concept is key.

Using the same $10,000 loan with a 5% annual interest rate compounded annually over 10 years, the total interest accrued would be significantly higher than with simple interest. Each year, the interest is added to the principal, and the next year’s interest is calculated on this larger amount. This snowball effect results in a substantially larger total repayment amount. For instance, after 10 years, the total amount due could easily exceed $16,000, a considerable difference from the $15,000 calculated with simple interest.

Monthly Payment Calculation

Calculating the precise monthly payment requires a more complex formula, often utilizing amortization schedules. However, a simplified approximation can be helpful for understanding the basic components.

A common, albeit simplified, approach involves dividing the total loan amount (principal plus total interest) by the total number of months in the loan term. This provides a rough estimate of the monthly payment. Keep in mind that this method ignores the compounding effect and won’t accurately reflect the true monthly payment, particularly in the early stages of repayment where a larger proportion of the payment goes towards interest.

For example, using the simple interest example above ($15,000 total repayment over 10 years or 120 months), a simplified monthly payment would be approximately $125 ($15,000 / 120). However, a more accurate calculation using standard amortization formulas would likely yield a slightly higher monthly payment, reflecting the fact that interest is calculated and added to the balance throughout the loan term.

Federal vs. Private Student Loan Interest Rates

Choosing between federal and private student loans often hinges on the interest rates offered. Understanding the differences between these rates is crucial for making informed borrowing decisions and minimizing long-term repayment costs. Both types of loans have distinct characteristics that impact their interest rates and overall affordability.

Federal and private student loans differ significantly in how their interest rates are determined and the rates themselves. Federal loan interest rates are generally fixed and set by the government, offering predictability for borrowers. Private loan interest rates, conversely, are variable and influenced by market conditions, credit scores, and other factors, leading to less predictable repayment costs.

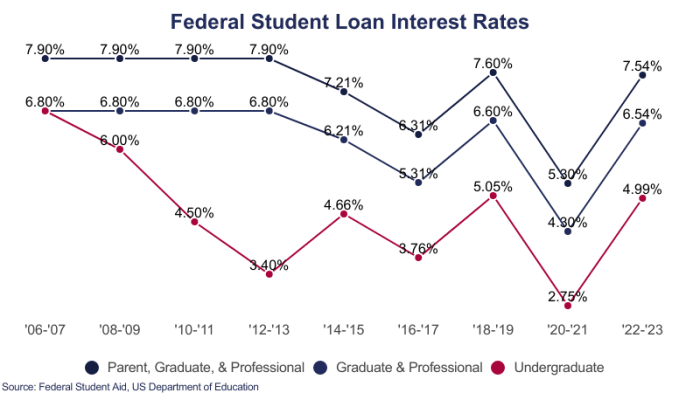

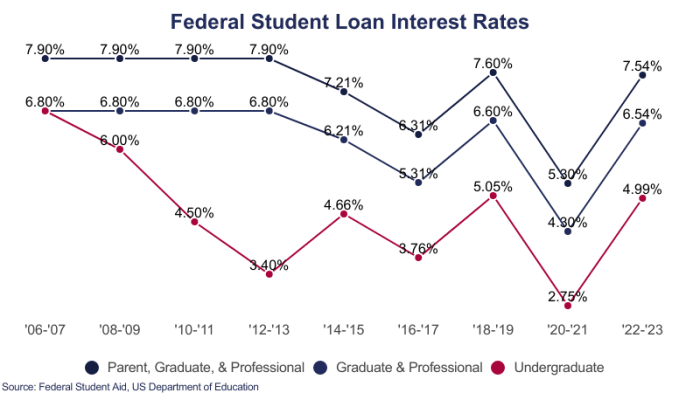

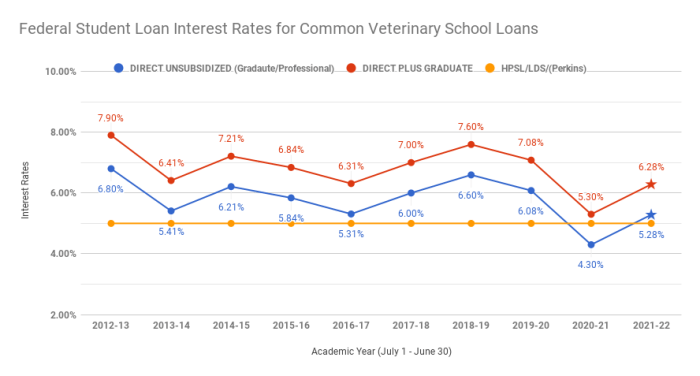

Federal Student Loan Interest Rates

Federal student loan interest rates are established by the government and are typically lower than those offered by private lenders. The specific rate depends on the type of federal loan (e.g., subsidized or unsubsidized Stafford loans, PLUS loans), the loan’s disbursement date, and the borrower’s creditworthiness (though creditworthiness plays a smaller role than with private loans). These rates are generally fixed for the life of the loan, meaning your monthly payment remains consistent (excluding potential changes based on repayment plans). For example, in a recent academic year, the interest rate for a subsidized Stafford loan might have been 4.99%, while an unsubsidized loan for the same period might have had a slightly higher rate. This fixed nature provides borrowers with a degree of financial certainty.

Private Student Loan Interest Rates

Private student loan interest rates are variable and determined by a lender’s assessment of the borrower’s creditworthiness and the prevailing market interest rates. A borrower’s credit history, credit score, income, and the presence of a co-signer significantly influence the interest rate. Borrowers with excellent credit scores and stable incomes typically qualify for lower rates. Conversely, those with poor credit or limited income might face substantially higher interest rates. These rates can also fluctuate throughout the loan’s term, potentially increasing monthly payments over time. For instance, a private loan might start with an interest rate of 7%, but could increase to 8% or more depending on market fluctuations. This variability introduces an element of risk for borrowers.

Advantages and Disadvantages of Federal vs. Private Student Loan Interest Rates

Understanding the advantages and disadvantages of each loan type concerning interest rates is vital for financial planning.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rate | Generally lower, fixed | Generally higher, variable or fixed |

| Repayment Options | More flexible repayment plans available (income-driven repayment, etc.) | Fewer flexible repayment options |

| Deferment/Forbearance | Options available under certain circumstances | Limited or no options, potentially impacting credit score |

| Loan Forgiveness Programs | Eligibility for certain forgiveness programs (depending on career path and loan type) | No government-backed forgiveness programs |

Repayment Plans and Interest Rates

Choosing the right student loan repayment plan significantly impacts your overall borrowing costs. The plan you select determines your monthly payment amount and, consequently, the total amount of interest you’ll pay over the life of the loan. Understanding the various options is crucial for effective financial planning.

Different repayment plans offer varying levels of flexibility and affordability. Some prioritize lower monthly payments, while others aim for faster loan payoff and reduced overall interest. The optimal choice depends on your individual financial situation and long-term goals.

Standard Repayment Plan

The standard repayment plan is the default option for most federal student loans. It typically involves fixed monthly payments over a 10-year period. This plan is straightforward and easy to understand, but it often results in higher monthly payments compared to income-driven plans.

- Key Feature: Fixed monthly payments over 10 years.

- Interest Implications: Generally leads to higher total interest paid due to the shorter repayment period.

- Example: A $30,000 loan at 5% interest would have a monthly payment of approximately $330 and a total interest paid of around $10,000 over 10 years.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, resulting in lower monthly payments. However, the trade-off is that you’ll pay significantly more interest over the loan’s life. This option can be beneficial for borrowers with limited immediate income.

- Key Feature: Longer repayment period (up to 25 years for some loans).

- Interest Implications: Significantly higher total interest paid due to the extended repayment period.

- Example: The same $30,000 loan at 5% interest, spread over 25 years, might have a monthly payment of approximately $180, but total interest paid could exceed $20,000.

Graduated Repayment Plan

Under this plan, monthly payments start low and gradually increase over time. This can be helpful in the early stages of a career when income is typically lower. However, similar to the extended plan, the total interest paid will likely be higher than under the standard plan due to the longer repayment timeline.

- Key Feature: Payments increase gradually over time.

- Interest Implications: Higher total interest paid compared to the standard plan.

- Example: Initial payments might be lower than the standard plan, but they increase each year, eventually exceeding the standard payment amount. Total interest paid will be higher than the standard plan, although less than the extended plan.

Income-Driven Repayment Plans (IDR Plans)

IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. These plans are designed to make student loan repayment more manageable for borrowers with lower incomes. While monthly payments are lower, the repayment period is often extended to 20 or 25 years, leading to higher total interest paid.

- Key Feature: Monthly payments are based on your income and family size.

- Interest Implications: Higher total interest paid due to the longer repayment period, but potentially more manageable monthly payments.

- Example: A borrower with a low income might have a significantly lower monthly payment than under a standard plan, but their loan could remain outstanding for 20 or 25 years, accumulating substantial interest.

Impact of Interest Rates on Total Loan Cost

Understanding the impact of interest rates on your student loan is crucial for long-term financial planning. Even seemingly small differences in interest rates can significantly affect the total amount you repay over the life of the loan. This is because interest accrues on the principal balance over time, compounding the cost.

The total cost of a student loan is directly influenced by the interest rate. A higher interest rate means you’ll pay more in interest charges over the loan’s lifespan, resulting in a substantially larger total repayment amount compared to a loan with a lower interest rate. This difference becomes increasingly pronounced over longer repayment periods. This section will explore this relationship through examples and a visual representation.

Interest Rate Differences and Total Loan Cost

Let’s consider two scenarios involving a $20,000 student loan with a 10-year repayment period. In the first scenario, the loan has a 5% interest rate. In the second, the interest rate is 7%. While the initial loan amount is the same, the total amount repaid will differ significantly. Using a standard amortization calculator (readily available online), we can determine that the total cost of the 5% loan would be approximately $25,500, while the total cost of the 7% loan would be approximately $28,100. This demonstrates a difference of $2,600 solely due to a 2% interest rate difference. This disparity grows even larger with higher loan amounts and longer repayment terms.

Illustrative Examples of Long-Term Financial Implications

Consider a $30,000 loan. If the interest rate is 4%, the total repayment over 15 years might be around $44,000. However, if the interest rate were 6%, the total repayment could rise to over $50,000, an increase of $6,000 solely due to the higher interest rate. This highlights the significant long-term impact of seemingly small interest rate variations. Another example might involve comparing a 10-year repayment plan at 5% versus a 20-year plan at the same rate. The longer repayment period, although resulting in smaller monthly payments, will lead to a considerably higher total repayment due to accumulated interest over the extended timeframe.

Visual Representation of Interest Rate and Total Loan Cost

Imagine a graph with the x-axis representing the interest rate (ranging from, for example, 3% to 10%) and the y-axis representing the total loan cost (for a fixed loan amount, say $25,000). Multiple lines could be plotted on this graph, each representing a different repayment period (e.g., 5 years, 10 years, 15 years). Each line would show an upward trend, indicating that as the interest rate increases, so does the total loan cost. Furthermore, the lines representing longer repayment periods would be steeper, illustrating the greater impact of interest rate on total cost over longer durations. The graph would clearly visualize how both interest rate and loan term interact to determine the final cost of borrowing. For example, the line for a 15-year repayment plan would be significantly higher than the line for a 5-year plan at any given interest rate, demonstrating the impact of loan term on the total cost.

Resources for Finding Current Interest Rates

Staying informed about current student loan interest rates is crucial for making informed borrowing decisions. Understanding these rates allows you to compare loan options effectively and plan for repayment. This section Artikels reliable sources for accessing the most up-to-date interest rate information.

Knowing where to find accurate and current information is key to making informed decisions about student loans. Different sources provide information on federal and private loans, so understanding the distinctions is important for a comprehensive overview.

Federal Student Loan Interest Rates

The official source for federal student loan interest rates is the U.S. Department of Education. Specific rates vary depending on the loan type (subsidized, unsubsidized, PLUS loans), the loan’s disbursement date, and the student’s borrowing history. The rates are set annually and are usually announced prior to the start of the academic year. You can find this information on the Federal Student Aid website (StudentAid.gov). This website provides detailed rate information, including tables showing rates for different loan types and periods. Additionally, the National Student Loan Data System (NSLDS) provides access to your individual loan information, including interest rates.

Private Student Loan Interest Rates

Unlike federal loans, private student loan interest rates are not set by the government. These rates are determined by individual lenders and are influenced by factors such as the borrower’s creditworthiness, the loan amount, and the prevailing market interest rates. Finding current rates for private loans requires checking the websites of various lenders. Major banks, credit unions, and private lending institutions all offer student loans, each with its own interest rate structure. It’s advisable to compare rates from multiple lenders before selecting a loan. Many lenders provide online rate calculators which can give an estimate based on provided information, but it is crucial to obtain a formal loan offer for the exact interest rate. Examples of lenders to check include Sallie Mae, Discover Student Loans, and other similar institutions. Be aware that the advertised rates are often only the starting point; your actual rate will depend on your individual creditworthiness.

Outcome Summary

Securing a student loan is a significant financial commitment, and understanding the intricacies of interest rates is essential for responsible borrowing. By carefully considering the factors that influence interest rates, comparing different loan types and repayment plans, and utilizing the resources available to find current rate information, you can make informed decisions that minimize your long-term financial burden. Remember to always prioritize responsible borrowing and plan strategically for repayment to ensure a smoother path towards financial independence.

Questions and Answers

What is the difference between a fixed and variable interest rate on a student loan?

A fixed interest rate remains constant throughout the loan’s life, while a variable interest rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates could potentially lead to lower payments initially but higher payments later if rates rise.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing your student loans may allow you to secure a lower interest rate, but it’s crucial to compare offers carefully and consider the terms and conditions before making a decision. Refinancing might also affect your eligibility for certain federal loan forgiveness programs.

What happens if I don’t make my student loan payments?

Failure to make student loan payments can lead to serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your loan servicer immediately if you are experiencing financial difficulties to explore options such as forbearance or deferment.

How does my credit score affect my student loan interest rate?

Your credit score is a major factor in determining the interest rate you’ll receive on private student loans. A higher credit score typically qualifies you for a lower interest rate. Federal student loan interest rates are generally not directly tied to credit score, but your credit history may affect your eligibility for certain loan types or repayment plans.