Navigating the complexities of student loans can feel overwhelming, especially when understanding the nuances of interest rates. This guide delves into the specifics of unsubsidized student loans, exploring how interest rates are determined, how they accrue, and ultimately, how they impact your long-term financial health. We’ll cover everything from the factors influencing these rates to practical strategies for minimizing their impact and making informed decisions about repayment.

Understanding unsubsidized student loan interest rates is crucial for responsible financial planning. Unlike subsidized loans, interest begins accruing immediately on unsubsidized loans, even while you’re still in school. This means your loan balance grows faster, potentially leading to a higher total repayment amount. This guide aims to equip you with the knowledge necessary to confidently manage your unsubsidized student loan debt.

Understanding Unsubsidized Student Loan Interest Rates

Unsubsidized student loans are a common way for students to finance their education, but understanding their interest rates is crucial for responsible borrowing. This section will delve into the specifics of unsubsidized student loan interest rates, clarifying how they function and how they differ from subsidized loans. We’ll explore historical trends and illustrate various calculation methods.

The fundamental concept of an unsubsidized student loan interest rate is straightforward: it’s the annual percentage rate (APR) charged on the principal loan amount. Unlike subsidized loans, interest begins accruing from the moment the loan is disbursed, even while the borrower is still in school. This means the total amount owed at repayment will be higher than the initial loan amount due to accumulated interest.

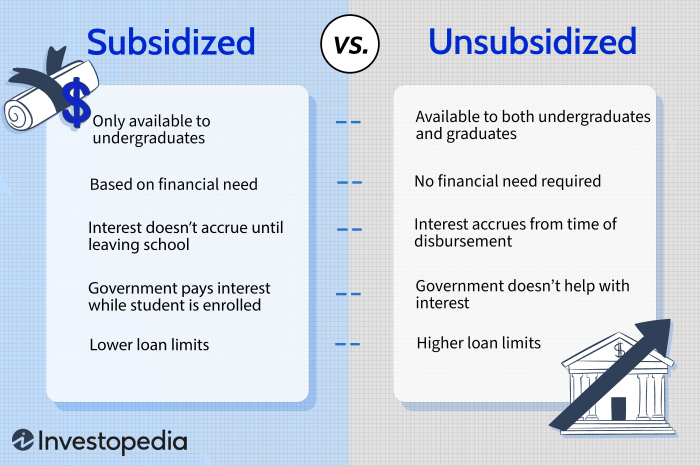

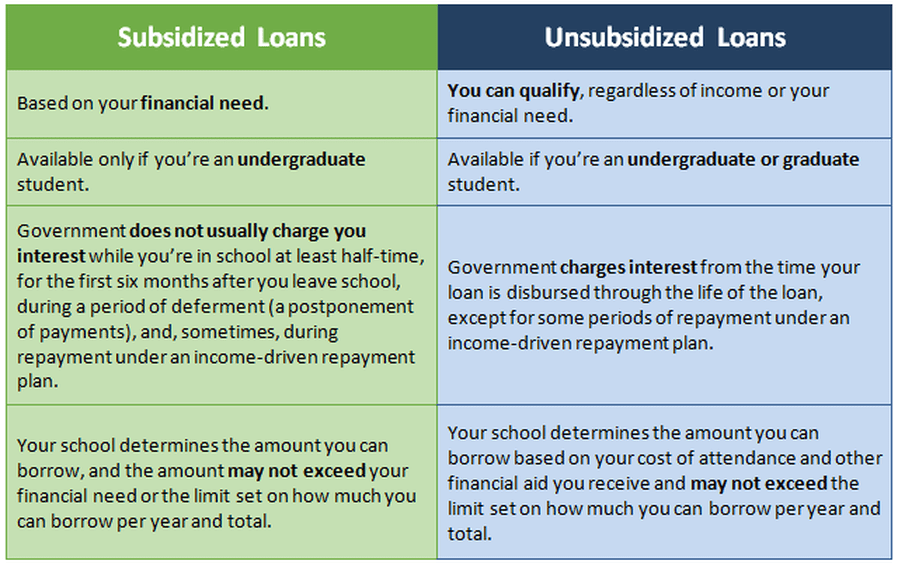

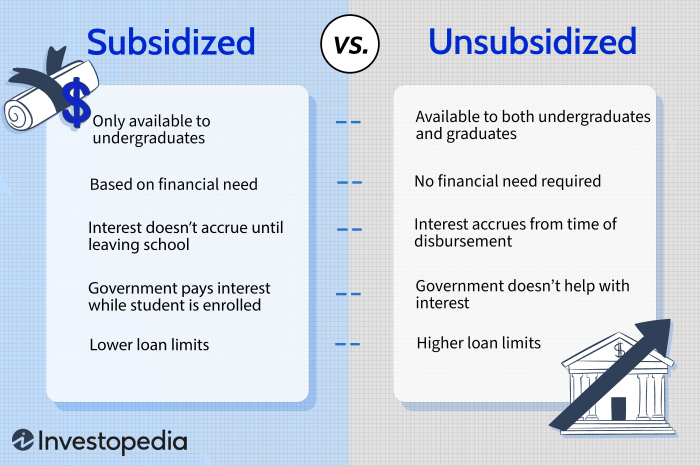

Unsubsidized vs. Subsidized Loan Interest Rates

The key difference between unsubsidized and subsidized loans lies in the interest accrual. With subsidized loans, the government pays the interest while the borrower is enrolled at least half-time in an eligible program and during certain grace periods. Unsubsidized loans, however, accrue interest throughout the entire loan term, regardless of the borrower’s enrollment status. This leads to a significantly larger total repayment amount for unsubsidized loans over the life of the loan, especially for longer repayment periods.

Historical Fluctuations in Unsubsidized Student Loan Interest Rates

Unsubsidized student loan interest rates are not fixed; they fluctuate based on market conditions and government policies. Historically, these rates have varied considerably. For instance, rates were significantly lower in the early 2000s compared to the period between 2008 and 2012, which saw higher rates reflecting economic instability. More recently, rates have shown some volatility, influenced by factors such as inflation and the Federal Reserve’s monetary policy. Analyzing historical trends can provide insight into potential future rate adjustments, although predicting future rates with certainty is impossible.

Interest Rate Calculation Methods for Unsubsidized Loans

The calculation of interest on unsubsidized loans generally follows a simple interest formula, although the specific method can vary slightly depending on the lender. The most common method is calculating simple interest on the outstanding principal balance. This means interest is calculated periodically (e.g., monthly) on the remaining loan amount. For example, a $10,000 loan with a 5% annual interest rate would accrue $500 in interest annually ($10,000 x 0.05), or approximately $41.67 monthly ($500/12). However, some lenders might use slightly different methods, such as daily compounding, which can lead to minor variations in the total interest accrued. It’s essential to review the loan terms and conditions carefully to understand the exact calculation method used by your lender.

Factors Influencing Unsubsidized Student Loan Interest Rates

Several key factors interact to determine the interest rate applied to unsubsidized federal student loans. These rates aren’t arbitrary; they’re a reflection of broader economic conditions and government policy decisions. Understanding these influences provides a clearer picture of how your loan’s interest rate is set.

Market Conditions and Interest Rates

The prevailing market interest rates significantly impact the rates offered on unsubsidized student loans. When overall interest rates are high, reflecting a robust economy or increased investor demand for fixed-income securities, the government will generally set higher interest rates on federal student loans to reflect these market conditions. Conversely, during periods of low market interest rates, often associated with economic slowdowns, the rates on these loans tend to decrease. This relationship is not perfectly linear, however, as government policy plays a crucial moderating role. For example, during periods of economic uncertainty, the government might choose to keep rates artificially low to stimulate borrowing and economic activity, even if market conditions suggest otherwise. This could be achieved through direct subsidies or by adjusting the calculation methodology used to set the interest rates.

Government Policy and Interest Rate Determination

Federal government policies directly influence the interest rate calculations for unsubsidized student loans. The government sets the interest rate for these loans annually, often based on a formula that considers the 10-year Treasury note auction rate plus a predetermined fixed margin. This margin acts as a buffer to account for the risk associated with student loan lending. Changes in government policy, such as adjustments to this margin or the choice of benchmark interest rate, can significantly alter the final interest rate. Furthermore, the government may implement programs designed to temporarily lower interest rates on student loans as a form of economic stimulus or to address specific concerns within the higher education sector. Such policies are subject to change based on prevailing economic and political priorities. For example, during periods of economic recession, the government might reduce the margin to lower borrowing costs for students.

Comparison of Interest Rate Setting Across Unsubsidized Loan Types

While the core principle of reflecting market conditions and government policy remains consistent across different types of unsubsidized federal student loans (such as Stafford Loans, Grad PLUS Loans), minor variations exist in how these factors are applied. The primary distinction lies in the specific risk assessments undertaken for different loan categories. For instance, Graduate PLUS loans, intended for graduate students, may carry a slightly higher interest rate than undergraduate Stafford loans due to the perceived higher risk associated with graduate borrowers. This higher rate is a reflection of the potential for higher default rates and longer repayment periods. However, the underlying methodology for determining the rates remains broadly similar, incorporating market benchmarks and a government-set margin. The precise margin applied can vary depending on the type of loan to reflect differences in risk profiles.

Calculating and Understanding Accrued Interest on Unsubsidized Loans

Understanding how accrued interest works on unsubsidized student loans is crucial for effective financial planning. Accrued interest represents the accumulated interest that builds up on your loan balance over time. Unlike subsidized loans, interest on unsubsidized loans begins accruing from the moment the loan is disbursed, even while you’re still in school. This means your loan balance grows larger even before you start making repayments.

Accrued interest is calculated daily based on your loan’s principal balance and the applicable interest rate. This daily interest is added to your principal, increasing the total amount you owe. This compounding effect can significantly increase your total loan cost over the life of the loan.

Accrued Interest Calculation

The calculation of accrued interest is relatively straightforward. The basic formula is: Interest = Principal x Interest Rate x Time. However, for student loans, the time is typically expressed as a fraction of a year (since interest accrues daily). Let’s illustrate with examples.

Scenario 1: A student has a $10,000 unsubsidized loan with a 5% annual interest rate. After one year, the accrued interest would be $10,000 * 0.05 * 1 = $500. Their new loan balance would be $10,500.

Scenario 2: The same student, now in their second year, has a balance of $10,500. If the interest rate remains at 5%, the interest accrued during the second year would be $10,500 * 0.05 * 1 = $525. Their new loan balance would now be $11,025. Notice how the interest is calculated on the increasingly larger principal balance.

Scenario 3: To demonstrate daily accrual, let’s consider a single day. Using the initial $10,000 loan, the daily interest at a 5% annual rate would be approximately $10,000 * 0.05 / 365 ≈ $1.37. This small amount, when compounded daily over several years, leads to substantial growth in the loan balance.

Capitalized Interest and its Impact

Capitalized interest refers to the process of adding accrued interest to the principal loan balance. This typically happens when you leave school and enter a grace period before starting repayment, or if you defer payments. Capitalizing interest significantly increases the total amount you eventually have to repay. For instance, if $500 in interest accrued during school and is then capitalized, your new principal becomes $10,500 instead of $10,000. Subsequent interest calculations will be based on this higher principal, leading to even more interest charges over the loan’s life.

Impact of Interest Rates and Repayment Plans

The following table illustrates how different interest rates and repayment plans affect the total cost of a $10,000 unsubsidized loan over a 10-year period. Note that these are simplified examples and do not include fees or other potential charges. Actual results may vary.

| Interest Rate | Standard Repayment Plan (Monthly Payment) | Total Paid Over 10 Years | Total Interest Paid |

|---|---|---|---|

| 4% | $95.56 | $11,467.20 | $1,467.20 |

| 6% | $106.07 | $12,728.40 | $2,728.40 |

| 8% | $116.83 | $14,019.60 | $4,019.60 |

Repayment Options and Their Impact on Interest

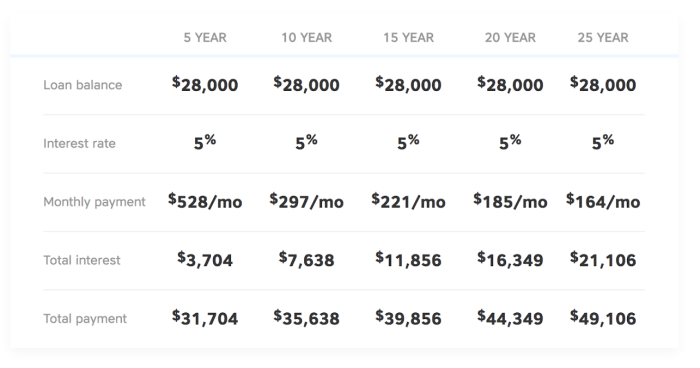

Choosing the right repayment plan for your unsubsidized student loans significantly impacts the total amount of interest you’ll pay over the life of the loan. Understanding the different options and their implications is crucial for effective financial planning. This section will explore various repayment plans and their effect on your overall loan cost.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment plan spread over 10 years. This plan offers predictable monthly payments, but it often results in higher total interest paid compared to income-driven plans, due to the shorter repayment period. For example, a $30,000 loan at 7% interest would require approximately $350 monthly payments and result in a total interest payment of roughly $11,000 over the 10-year period.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. While this can be beneficial in the early years, especially for those with limited income, the longer repayment period usually leads to significantly higher total interest paid compared to the standard plan. Using the same $30,000 loan example at 7% interest, the total interest paid could exceed $15,000 over a longer repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base your monthly payments on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans typically result in lower monthly payments, but the repayment period extends beyond 10 years, often to 20 or 25 years. This longer repayment period can lead to higher overall interest paid, but the lower monthly payments can be more manageable, especially during periods of lower income. The total interest on a $30,000 loan at 7% under an IDR plan could range from $15,000 to $25,000 or more, depending on the specific plan and income fluctuations.

Comparison of Repayment Plans

The following table compares the total interest paid under different repayment plans for a sample loan of $30,000 with a 7% interest rate. These figures are estimates and may vary based on individual circumstances and specific loan terms.

| Repayment Plan | Monthly Payment (Approximate) | Repayment Period | Total Interest Paid (Approximate) |

|---|---|---|---|

| Standard | $350 | 10 years | $11,000 |

| Graduated | Variable, starting lower | 10-20 years | $15,000+ |

| Income-Driven | Variable, based on income | 20-25 years | $15,000 – $25,000+ |

Loan Forbearance and Deferment

Loan forbearance and deferment temporarily postpone your loan payments. However, interest continues to accrue during these periods, increasing the total loan balance. This means you’ll end up paying more in interest over the life of the loan. For example, if you defer payments for a year on a $30,000 loan at 7%, the interest accrued during that year would add to your principal balance, ultimately increasing the total interest you pay over the repayment period. It’s crucial to understand that while these options offer temporary relief, they ultimately increase the overall cost of the loan.

Avoiding High Interest Rates on Unsubsidized Loans

Navigating unsubsidized student loans requires a proactive approach to minimize the long-term financial burden of high interest rates. Understanding the strategies for managing these loans effectively can significantly reduce the total amount paid over the life of the loan. This involves careful planning, diligent repayment, and leveraging available resources.

Effective strategies for minimizing the impact of high interest rates on unsubsidized student loans center around proactive repayment and financial planning. By understanding your loan terms and employing smart financial strategies, you can significantly reduce your overall interest costs and accelerate your path to becoming debt-free.

Making Extra Payments to Reduce Principal and Interest

Making extra payments on your unsubsidized student loans can dramatically decrease the total interest paid and shorten the repayment period. Even small, consistent extra payments can have a significant cumulative effect over time. For example, consider a $30,000 loan with a 7% interest rate and a 10-year repayment plan. Making an extra $100 payment each month would reduce the total interest paid by approximately $4,000 and shorten the repayment period by roughly two years. The power of compounding interest works in your favor when you make extra payments, reducing the principal faster and thus the amount of interest that accrues on the remaining balance. This strategy directly impacts the total cost of borrowing.

Utilizing Financial Planning Tools for Effective Debt Management

Several financial planning tools can assist in effectively managing student loan debt. Budgeting apps, such as Mint or YNAB (You Need A Budget), allow you to track your income and expenses, providing a clear picture of your financial situation and helping you identify areas where you can save to allocate more towards loan repayments. Amortization calculators, readily available online, show the impact of different payment amounts and repayment schedules on the total interest paid. These tools provide a visual representation of the benefits of extra payments and allow you to explore various repayment scenarios. Finally, debt management software can consolidate and organize your loan information, simplifying the repayment process and providing a centralized view of your debt.

Resources Available to Borrowers Seeking Assistance with Student Loan Repayment

Numerous resources are available to assist borrowers in managing their student loan repayment. The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, loan forgiveness programs, and other assistance options. Many non-profit organizations offer free financial counseling and guidance on managing student loan debt. These organizations can help you create a personalized repayment plan based on your financial situation and explore options like income-driven repayment plans. Your loan servicer can also provide information on repayment options and available assistance programs. Contacting them directly to discuss your options and explore potential solutions is a crucial step in navigating your student loan repayment journey.

The Impact of Interest Rates on Long-Term Financial Planning

Unsubsidized student loan interest rates significantly influence long-term financial health, potentially impacting major life decisions and overall financial well-being. The accumulating interest can dramatically affect the total amount owed, leaving a considerable burden that extends far beyond graduation. Understanding this impact is crucial for effective financial planning.

The accumulation of interest on unsubsidized student loans can significantly hinder the achievement of long-term financial goals. High interest rates can dramatically increase the total loan amount over time, diverting funds that could otherwise be allocated towards other crucial objectives.

Homeownership

High student loan debt, compounded by substantial interest, can severely restrict the ability to save for a down payment on a home. The larger monthly loan payments reduce disposable income, making it challenging to accumulate the necessary savings. For example, someone with a $50,000 unsubsidized loan at 7% interest might find their monthly payments significantly higher than someone with the same loan at 4%, leaving less money for saving towards a house. This delay in homeownership can have cascading effects, preventing access to the equity building and potential tax benefits associated with homeownership.

Retirement Planning

Similarly, high interest payments on student loans can severely impede retirement savings. The considerable monthly payments leave less disposable income for contributions to retirement accounts such as 401(k)s or IRAs. The longer it takes to pay off student loans, the less time individuals have to benefit from the power of compound interest in their retirement savings. A hypothetical example: An individual paying off a high-interest loan might delay contributing to their retirement plan by 5-10 years, resulting in significantly less accumulated savings by retirement age compared to someone with a lower interest rate.

Other Major Life Decisions

The weight of high student loan debt and interest can constrain other major life decisions, such as starting a family, pursuing further education, or investing in a business. The financial burden associated with high-interest loans limits financial flexibility and can delay or prevent individuals from pursuing opportunities that would otherwise improve their quality of life and long-term financial security. For instance, the need to prioritize student loan repayment might force someone to postpone having children or delay starting their own business, which might have been financially viable with a lower debt burden.

Hypothetical Scenario: Long-Term Financial Consequences

Consider two individuals, both graduating with $40,000 in unsubsidized student loans. Individual A has a loan with a 4% interest rate, while Individual B has a loan with a 7% interest rate. Over a 10-year repayment period, Individual A might pay approximately $46,000 in total (principal and interest), while Individual B might pay closer to $55,000. This $9,000 difference represents a significant impact on their long-term financial planning. Individual B’s higher interest rate has reduced their disposable income, potentially hindering their ability to save for a down payment on a home, contribute meaningfully to retirement savings, or pursue other significant financial goals. The difference in total repayment becomes even more significant over longer repayment periods.

Closing Notes

Successfully managing unsubsidized student loan debt requires a proactive and informed approach. By understanding the factors that influence interest rates, employing effective repayment strategies, and utilizing available resources, borrowers can significantly mitigate the long-term financial burden. Remember that careful planning and diligent management are key to navigating this significant financial commitment and achieving your long-term financial goals. Taking control of your student loan debt empowers you to build a secure financial future.

FAQ Compilation

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while you’re in school (or during grace periods), whereas unsubsidized loans do. This means you’ll owe more on an unsubsidized loan by the time you start repayment.

Can I refinance my unsubsidized student loan?

Yes, refinancing may be an option to lower your interest rate, but be aware of the potential implications, such as losing federal protections.

What happens if I don’t repay my unsubsidized student loan?

Failure to repay can result in negative consequences, including damage to your credit score, wage garnishment, and potential legal action.

Are there any government programs to help with unsubsidized student loan repayment?

Yes, several income-driven repayment plans can adjust your monthly payments based on your income and family size. Explore options through the federal government’s student aid website.