Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding the interest rate’s impact on your long-term financial health. This crucial number significantly influences your monthly payments and the total amount you ultimately repay. Understanding your student loan interest rate is the first step towards effective financial planning and responsible debt management. This guide will provide clarity and empower you to make informed decisions about your student loans.

We’ll explore the different types of interest rates (fixed versus variable), the factors influencing them, and how to locate this critical information. Furthermore, we’ll delve into the implications of various repayment plans and potential scenarios that might affect your interest rate, equipping you with the knowledge to manage your student loan debt effectively.

Understanding Student Loan Interest Rates

Understanding your student loan interest rate is crucial for managing your debt effectively. The interest rate determines how much extra you’ll pay on top of the principal loan amount. This extra cost accumulates over time, significantly impacting your total repayment amount. Therefore, it’s vital to grasp the mechanics of interest rates to make informed financial decisions.

Fixed vs. Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions.

Factors Influencing Student Loan Interest Rates

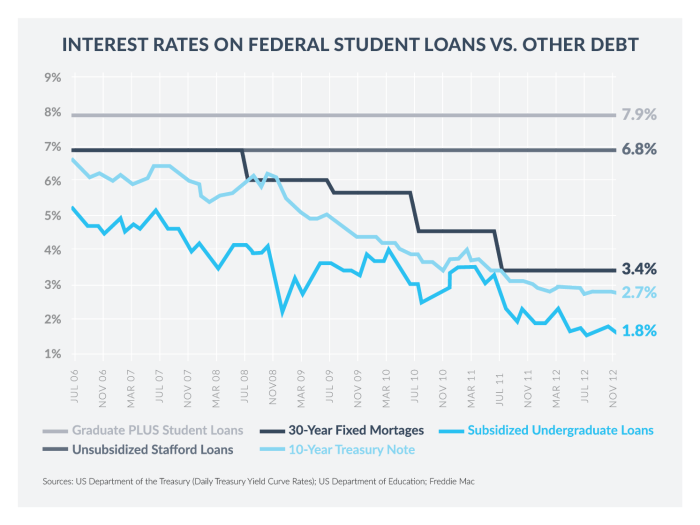

Several factors influence the interest rate you’ll receive on your student loan. These factors are assessed by lenders during the loan application process. Key factors include your credit history (if applicable), the type of loan (federal or private), the loan’s term length, and the prevailing economic conditions. For federal student loans, your credit history typically isn’t a factor, but your loan type (e.g., subsidized or unsubsidized) influences the rate. Private lenders, however, often consider your credit score and history when setting your interest rate. A strong credit history generally results in a lower interest rate. The prevailing interest rate environment also plays a role; higher interest rates in the broader economy often translate to higher student loan interest rates.

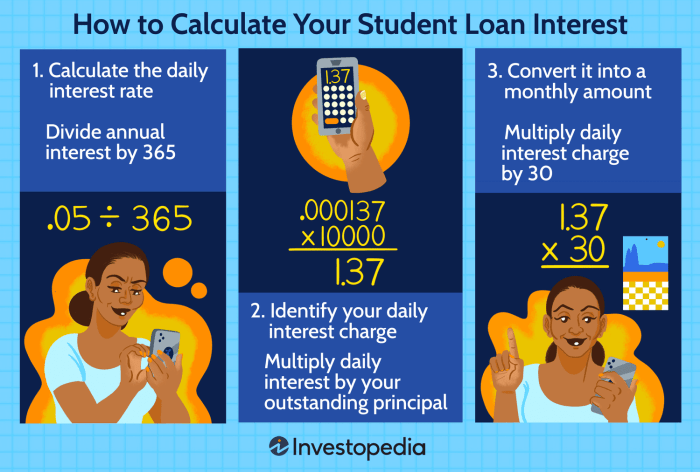

Interest Rate Calculation Examples

Let’s illustrate how interest is calculated on student loans. Assume you have a $10,000 loan with a 5% annual interest rate. With simple interest, the interest for the first year would be $10,000 * 0.05 = $500. However, most student loans use compound interest, where interest is calculated on both the principal and accumulated interest. This means that the interest for subsequent years will be higher than $500. For example, if the interest is compounded annually, after the first year, your balance would be $10,500. The interest for the second year would be calculated on this new balance. The exact calculation depends on the compounding frequency (daily, monthly, annually, etc.), which is specified in your loan agreement.

Fixed vs. Variable Interest Rate Comparison

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate | Stays the same throughout the loan term | Changes periodically based on a benchmark index |

| Predictability | Highly predictable monthly payments | Unpredictable monthly payments; potential for increase or decrease |

| Advantages | Budgeting is easier; provides financial stability | Potentially lower initial interest rate |

| Disadvantages | May have a higher initial interest rate compared to variable rates | Risk of higher payments if the benchmark rate increases; budgeting is more challenging |

Locating Your Student Loan Interest Rate Information

Finding the interest rate on your student loan is crucial for understanding the total cost of your education and for planning your repayment strategy. This information is readily available through several channels, and knowing where to look can save you time and frustration. Understanding your interest rate allows you to make informed decisions about your repayment options and potentially save money in the long run.

Locating your student loan interest rate involves checking various sources, both online and offline. Each source provides slightly different information, but all should contain the key details needed to understand your loan’s cost. The method you choose will depend on your comfort level with online systems and the availability of your loan documents.

Accessing Loan Information Online

Many lenders provide online portals where borrowers can access their loan details, including interest rates. These portals usually require you to create an account using your loan information or Social Security number. Once logged in, you can typically view a summary of your loan(s) and detailed statements.

- Navigate to your lender’s website: Find the website of the institution that holds your student loan (e.g., Sallie Mae, Navient, federal student aid website).

- Log in to your account: Look for a “Login,” “Sign In,” or similar button. You’ll likely need your username and password, which you created during the loan application process or received in a welcome email. If you’ve forgotten your login credentials, there’s usually a “Forgot Password” option to help you recover access.

- Locate your loan details: Once logged in, navigate to the section that displays your loan information. This section might be labeled “My Loans,” “Account Summary,” “Loan Details,” or something similar. The exact location will vary depending on the lender’s website design.

- Review your loan statement: Your loan statement will contain all relevant information, including your interest rate. The interest rate is usually displayed as a percentage (e.g., 5.0%). Some lenders might show the annual percentage rate (APR), which includes other fees.

- Download or print your statement (optional): For your records, you might want to download or print a copy of your statement. This provides a readily accessible record of your interest rate and other important loan details.

Identifying the Interest Rate on Loan Statements

Your loan statement will clearly display your interest rate, typically expressed as an annual percentage rate (APR). Look for terms like “interest rate,” “annual percentage rate,” or “APR.” The interest rate is usually presented as a percentage, for example, 6.8%. Sometimes, different interest rates might apply to different portions of your loan, particularly if you have loans from various years or programs. In such cases, the statement will specify the rate for each loan component.

Sources of Student Loan Interest Rate Information

Several sources can provide your student loan interest rate information. It’s helpful to consult multiple sources to confirm the accuracy of the information.

- Your lender’s website: This is usually the most convenient and reliable source.

- Your loan documents: Your original loan documents, such as the promissory note, will state the interest rate.

- Your monthly loan statements: These statements provide a summary of your loan’s current status, including the interest rate.

- Your lender’s customer service: If you are unable to locate the information online or in your documents, contacting your lender’s customer service department is another option.

Interpreting Your Student Loan Interest Rate

Understanding your student loan interest rate is crucial for effectively managing your debt and minimizing your overall repayment costs. A seemingly small difference in interest rates can significantly impact the total amount you pay over the life of your loan. This section will help you interpret your interest rate and its implications.

Impact of Interest Rates on Total Repayment Cost

The interest rate directly influences the total cost of your student loan. A higher interest rate means you’ll pay more in interest charges over the loan’s lifespan. Conversely, a lower interest rate results in lower overall interest payments. This is because interest is calculated on the principal loan amount, and higher interest rates lead to a larger accumulation of interest over time. This accumulation is compounded, meaning interest is calculated not just on the principal but also on the accumulated interest. The longer the repayment period, the greater the impact of the interest rate.

Calculating Total Interest Paid

While precise calculation often requires specialized loan amortization calculators, a simplified approach provides a reasonable estimate. The total interest paid is the difference between the total amount repaid and the original loan principal. For example, if your loan principal is $20,000 and you repay $30,000 over the loan’s term, the total interest paid is $10,000 ($30,000 – $20,000). More accurate calculations consider the compounding effect of interest and are usually available through online loan calculators or your loan servicer’s website. Remember to input your loan amount, interest rate, and loan term for an accurate calculation.

Examples of Scenarios with Varying Interest Rates and Their Effect on Monthly Payments

Let’s consider a $10,000 loan with a 10-year repayment period. With a 5% interest rate, the estimated monthly payment might be around $106. However, if the interest rate increases to 7%, the monthly payment could rise to approximately $116. This seemingly small difference in monthly payments ($10) adds up significantly over 10 years, resulting in a much higher total repayment amount for the higher interest rate loan. A 10% interest rate would further increase the monthly payment and total repayment cost substantially. These are estimates, and the exact figures will vary based on the specific loan terms and calculation method.

Relationship Between Interest Rate, Loan Amount, and Total Repayment Cost

The following table illustrates the impact of varying interest rates and loan amounts on total repayment costs, assuming a 10-year repayment period. These are simplified estimations and do not include any fees or additional charges. Actual figures may vary.

| Interest Rate | Loan Amount ($10,000) | Loan Amount ($20,000) | Loan Amount ($30,000) |

|---|---|---|---|

| 5% | ~ $12,700 (Total Repayment) | ~ $25,400 (Total Repayment) | ~ $38,100 (Total Repayment) |

| 7% | ~ $14,200 (Total Repayment) | ~ $28,400 (Total Repayment) | ~ $42,600 (Total Repayment) |

| 10% | ~ $16,400 (Total Repayment) | ~ $32,800 (Total Repayment) | ~ $49,200 (Total Repayment) |

Understanding Loan Repayment Plans and Interest

Choosing the right student loan repayment plan is crucial, as it significantly impacts your monthly payments and the total interest you’ll pay over the life of your loan. Different plans offer varying levels of flexibility and affordability, but understanding their implications for interest accumulation is essential for making an informed decision. This section compares three common repayment plans: standard, graduated, and income-driven.

Standard Repayment Plans

Standard repayment plans involve fixed monthly payments over a 10-year period. This approach offers predictability and generally leads to the lowest total interest paid because of the shorter repayment period. However, the fixed monthly payment might be higher than other plans, potentially creating a financial burden for some borrowers. Interest is calculated daily on the outstanding principal balance.

Graduated Repayment Plans

Graduated repayment plans offer lower monthly payments initially, which gradually increase over time. This structure can be beneficial for borrowers who anticipate higher earning potential in the future. While the initial payments are more manageable, the extended repayment period (often 10 years) leads to a higher total interest paid compared to standard repayment plans. Similar to standard plans, interest is calculated daily on the outstanding principal.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) tie your monthly payment to your income and family size. These plans offer the most flexibility and affordability, particularly for borrowers with lower incomes or high loan balances. Payments are typically lower than standard or graduated plans, but the repayment period is significantly longer (often 20-25 years). This extended repayment period generally results in the highest total interest paid over the loan’s lifetime. Interest capitalization, a crucial factor in IDR plans, is discussed below.

Interest Capitalization Across Repayment Plans

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, effectively compounding interest charges. The impact of interest capitalization varies across repayment plans. Standard and graduated plans typically do not have significant capitalization unless payments are missed. However, income-driven repayment plans often involve capitalization during periods of reduced or deferred payments. For example, if a borrower experiences a period of unemployment and their payments are temporarily suspended under an IDR plan, the accrued interest during that period might be capitalized, leading to a larger final loan balance.

Pros and Cons of Repayment Plans Regarding Interest

The following table summarizes the advantages and disadvantages of each repayment plan concerning interest accumulation:

| Repayment Plan | Pros Regarding Interest | Cons Regarding Interest |

|---|---|---|

| Standard | Lowest total interest paid due to shorter repayment period. | Higher monthly payments can be a burden. |

| Graduated | Lower initial payments are manageable. | Higher total interest paid due to a longer repayment period and increasing payments. |

| Income-Driven | Lower monthly payments based on income; more manageable for low-income borrowers. | Highest total interest paid due to a much longer repayment period and potential interest capitalization during periods of reduced or deferred payments. |

Potential Scenarios Affecting Interest Rates

Understanding how various situations can impact your student loan interest rate is crucial for effective financial planning. Several scenarios can significantly alter your overall interest costs and monthly payments. This section will explore some key examples.

Loan Consolidation’s Impact on Interest Rates

Loan consolidation combines multiple student loans into a single loan. While this simplifies repayment, the impact on your interest rate depends on the type of consolidation and the interest rate offered on the new loan. A weighted average of your existing loan interest rates is often used to determine the new rate. In some cases, you might secure a lower interest rate, resulting in long-term savings. However, if the new loan’s interest rate is higher than the average of your existing loans, you could end up paying more in interest over the life of the loan. For example, if you consolidate three loans with rates of 5%, 6%, and 7%, your new rate might be around 6%, but it could potentially be higher or lower depending on the lender and market conditions. It’s essential to compare offers carefully before consolidating.

Deferment and Forbearance Effects on Accrued Interest

Deferment and forbearance are temporary pauses in your loan repayments. While helpful in managing short-term financial hardship, they typically don’t stop interest from accruing on subsidized loans. For unsubsidized loans, interest continues to accumulate during both deferment and forbearance, adding to your principal balance. This means that when repayment resumes, you’ll be paying interest on a larger principal amount, potentially extending your repayment period and increasing your overall interest costs. For instance, imagine a $10,000 unsubsidized loan with a 6% interest rate. During a one-year forbearance period, approximately $600 in interest would accumulate, increasing the principal to $10,600. The longer the deferment or forbearance, the more significant this effect becomes.

Interest Rate Changes and Their Effect on Monthly Payments

Fluctuations in interest rates, particularly with variable-rate loans, directly affect your monthly payments. An increase in the interest rate will lead to higher monthly payments, while a decrease will result in lower payments. For example, a 1% increase on a $20,000 loan could result in an extra $20-$50 per month, depending on the loan term. Conversely, a 1% decrease could lead to a similar reduction in your monthly payment. Understanding these potential shifts is vital for budgeting and financial planning. It’s advisable to carefully consider the implications of variable versus fixed interest rates when choosing a student loan.

Illustrative Flowchart of Scenarios and Interest Rate Impacts

A flowchart visualizing these scenarios would show branching paths. The starting point would be the initial loan status (fixed or variable rate). Branches would lead to scenarios like loan consolidation (resulting in a new, potentially different rate), deferment or forbearance (leading to interest accrual), and interest rate changes (resulting in altered monthly payments). Each branch would clearly indicate the impact on the overall interest paid and the monthly payment amount. The flowchart would visually represent how these scenarios interrelate and their cumulative effects on the total cost of the loan. For example, a path might show consolidation leading to a lower rate, then a period of forbearance resulting in added interest, ultimately showing the final interest paid and monthly payment.

Visualizing Interest Accrual

Understanding how interest accrues on your student loan is crucial for effective financial planning. This section will illustrate the process with a detailed example and visual representations to help you grasp the concept of compounding interest and its impact on your total repayment amount.

Interest accrual on a student loan is the process where interest charges are added to your principal loan balance over time. This means you’re paying interest not only on the original amount you borrowed but also on the accumulated interest itself. This compounding effect can significantly increase the total cost of your loan.

Interest Accrual Example

Let’s consider a $10,000 student loan with a 5% annual interest rate. If interest is calculated annually, the first year’s interest would be $10,000 * 0.05 = $500. This $500 is added to the principal, resulting in a new balance of $10,500. The second year’s interest is calculated on this new balance: $10,500 * 0.05 = $525. Notice that the interest amount increases each year because it’s calculated on a larger balance. This continues until the loan is repaid. The longer the loan term, the greater the impact of compounding interest. More frequent compounding (e.g., monthly) would lead to even faster growth of the total amount owed.

Visual Representation of Compound Interest

Imagine a steadily growing tree. The trunk represents the initial loan principal ($10,000 in our example). Each year, new branches grow, representing the interest accrued. These branches themselves grow new branches in subsequent years, illustrating the compounding effect. The larger the tree gets (the higher the interest rate and the longer the loan term), the more branches (interest) are added, resulting in a significantly larger tree (total amount owed) than just the initial trunk. The branches from year to year get progressively larger to reflect the compounding effect, visually demonstrating how the interest grows exponentially.

Comparison of High and Low Interest Rates Over 10 Years

Let’s compare two scenarios: a 5% interest rate and a 10% interest rate, both on a $10,000 loan over 10 years, assuming simple interest for easier comparison. We’ll represent this visually as two bar graphs side-by-side. The first bar graph would show the total interest paid at 5% after 10 years. The second bar graph, placed next to it, would show the total interest paid at 10% after 10 years. The bar for the 10% interest rate would be significantly taller than the bar for the 5% rate, visually demonstrating the substantial difference in total interest paid due to the higher interest rate. The difference in height would represent the extra interest paid due to the higher interest rate, highlighting the financial impact of even small percentage point differences in interest rates over a longer period. While this example uses simple interest for simplification, the principle remains the same with compound interest – a higher rate results in substantially more interest paid over time.

Conclusion

Successfully managing your student loan debt requires a clear understanding of your interest rate. By utilizing the methods Artikeld in this guide to locate your interest rate, and by comprehending the impact of different repayment plans and potential scenarios, you can make informed decisions to minimize your overall repayment costs. Remember to regularly review your loan statements and proactively manage your debt to achieve long-term financial stability.

FAQ Corner

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially accelerate interest accrual.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may be possible, but it depends on your credit score and current interest rates. Compare offers carefully before refinancing.

How often does my student loan interest rate change?

This depends on whether you have a fixed or variable rate. Fixed rates remain constant, while variable rates fluctuate based on market conditions.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the amount you owe.

Where can I find a student loan amortization schedule?

Your loan servicer’s online portal usually provides access to an amortization schedule, showing your payment breakdown over time.