Navigating the world of student loans can feel overwhelming, especially when trying to determine the maximum amount you can borrow for your undergraduate education. Understanding the limits on both federal and private loans is crucial for responsible financial planning. This guide will break down the complexities of undergraduate student loan limits, helping you make informed decisions about financing your higher education.

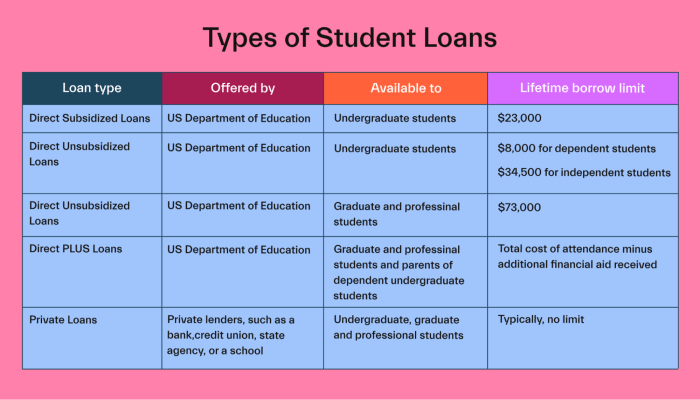

The maximum amount you can borrow depends on several factors, including your dependency status (dependent or independent), your chosen school, and whether you’re applying for federal or private loans. Federal loans, offered by the government, typically have lower interest rates and more flexible repayment options compared to private loans, which are offered by banks and other financial institutions. However, private loan limits and eligibility requirements can vary significantly depending on your creditworthiness and other financial factors.

Federal Student Loan Limits

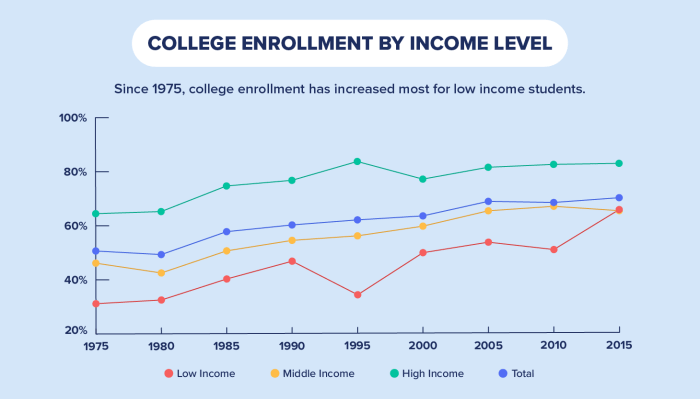

Understanding federal student loan limits is crucial for prospective undergraduate students and their families. These limits dictate the maximum amount of federal student loan funds a student can borrow each year and over the course of their undergraduate education. Knowing these limits allows for responsible financial planning and helps avoid accumulating excessive debt.

Annual and Aggregate Loan Limits for Undergraduate Students

The Federal Direct Loan Program sets annual and aggregate limits on how much students can borrow. These limits vary depending on the student’s dependency status (dependent or independent) and whether the loans are subsidized or unsubsidized. The annual limit represents the maximum a student can borrow in a single academic year, while the aggregate limit represents the total amount they can borrow over their entire undergraduate career. It’s important to note that these limits are subject to change, so always refer to the official Federal Student Aid website for the most up-to-date information.

Dependency Status and Loan Limits

A student’s dependency status significantly impacts their loan eligibility. Dependent students, typically those who are claimed as dependents on their parents’ tax returns, generally have lower loan limits than independent students. Independent students, those who are not claimed as dependents, can often borrow more to cover their educational expenses. This reflects the understanding that independent students may have greater financial responsibilities.

Subsidized and Unsubsidized Loan Limits

Federal Direct Subsidized Loans and Unsubsidized Loans have different eligibility criteria and interest accrual rules. Subsidized loans have the government pay the interest while the student is in school, during grace periods, and during deferment. Unsubsidized loans, however, accrue interest from the time the loan is disbursed. Both subsidized and unsubsidized loans have annual and aggregate limits. While the total amount a student can borrow might be the same across subsidized and unsubsidized loans, the amount of each loan type will affect the total interest paid over the life of the loan.

Undergraduate Loan Limits by Academic Year

The following table displays an example of how loan limits might vary across different academic years. Remember that these are examples and actual limits can change annually. Always check the official Federal Student Aid website for the most current information.

| Year | Dependent Student Limit | Independent Student Limit | Aggregate Limit |

|---|---|---|---|

| Year 1 | $5,500 | $9,500 | $23,000 |

| Year 2 | $5,500 | $10,500 | $23,000 |

| Year 3 | $5,500 | $10,500 | $23,000 |

| Year 4 | $5,500 | $10,500 | $23,000 |

Private Student Loan Limits

Unlike federal student loans, which have set maximum borrowing limits determined by the government, private student loan limits vary significantly depending on several factors. Understanding these variations is crucial for students and their families when planning for higher education financing.

Factors Influencing Private Lender Loan Limits

Several key factors determine how much a private lender will loan an undergraduate student. Creditworthiness plays a significant role, with higher credit scores generally leading to higher loan offers. The student’s income and employment history also influence lending decisions; a demonstrable ability to repay the loan increases the likelihood of approval and a larger loan amount. The student’s chosen school and the cost of attendance are also important considerations; lenders assess the program’s reputation and potential return on investment when determining loan eligibility and amounts. Finally, the presence of a co-signer with a strong credit history can significantly increase both the likelihood of approval and the loan amount offered. Lenders often consider a co-signer’s creditworthiness as a form of risk mitigation.

Interest Rates and Fees of Private vs. Federal Loans

Private student loans typically carry higher interest rates and fees compared to federal student loans. Federal loans often offer subsidized options, meaning the government pays the interest while the student is in school (under certain circumstances), while private loans rarely offer such benefits. The interest rates on private loans are variable, meaning they can fluctuate over the life of the loan, unlike some federal loans which may offer fixed rates. Private lenders also frequently charge origination fees, which are upfront costs added to the loan amount. These fees can add significantly to the overall cost of borrowing. For example, a private loan might have an interest rate of 7-12% or more, compared to a federal subsidized loan with a rate potentially below 5% (rates change yearly).

Creditworthiness Requirements for Private Student Loans

Obtaining a private student loan often requires a higher level of creditworthiness than federal loans. Most lenders will check the student’s credit history, looking for a strong credit score and a history of responsible borrowing and repayment. Since undergraduates typically have limited or no credit history, many will need a co-signer with good credit to qualify. The co-signer’s credit score and history become a significant factor in determining loan eligibility and interest rates. Lenders might also review factors such as debt-to-income ratio and the length of credit history to assess risk. A poor credit history or lack of credit history can significantly reduce the chances of approval or result in higher interest rates.

Typical Application Process for Private Student Loans

The application process for private student loans generally involves several steps.

- Pre-qualification: Many lenders allow students to pre-qualify for a loan without impacting their credit score. This provides an estimate of the loan amount and interest rate they might qualify for.

- Application submission: The formal application requires personal information, educational details, and financial information. This may also include providing tax returns and proof of income for the student and co-signer (if applicable).

- Credit check: The lender will perform a credit check on the student and co-signer (if applicable) to assess creditworthiness.

- Loan approval or denial: The lender will review the application and either approve the loan, offering specific terms, or deny the application.

- Loan disbursement: Once approved, the funds are typically disbursed directly to the educational institution to cover tuition and fees.

Factors Affecting Loan Eligibility

Securing student loans, whether federal or private, hinges on several key factors. Understanding these factors is crucial for students aiming to maximize their borrowing potential and navigate the application process effectively. Eligibility criteria vary depending on the lender and loan type, making it essential to research thoroughly before applying.

A student’s eligibility for both federal and private student loans is determined by a combination of creditworthiness, financial stability, and academic performance. Federal loans generally have less stringent requirements than private loans, but both types consider these critical aspects. For instance, a student with a poor credit history might qualify for federal loans but be denied private loans or receive a significantly lower loan amount. Similarly, a student’s demonstrated academic progress impacts their eligibility, as lenders want assurance that the borrower is making satisfactory progress towards their degree.

Credit History and Score

Credit history and score significantly influence private loan eligibility. Lenders assess a student’s creditworthiness based on their past borrowing and repayment behavior. A strong credit history, reflected in a high credit score, typically leads to better loan terms and higher loan amounts. Conversely, a lack of credit history or a low credit score can result in loan denial or less favorable terms. Students with limited or poor credit history might need a co-signer to improve their chances of approval. For example, a student with a FICO score below 670 might face higher interest rates or even be denied a private loan, whereas a student with a score above 750 is likely to secure more favorable terms.

Income and Financial Stability

While not always a primary factor for federal loans (need-based programs aside), income and financial stability play a crucial role in private loan eligibility. Lenders evaluate a student’s ability to repay the loan based on their current and projected income. Students with stable income sources and a demonstrable capacity to manage their finances are more likely to be approved for larger loan amounts. Conversely, students with limited or unstable income might face restrictions on the loan amount they can borrow or require a co-signer. For example, a student with a part-time job and limited savings might qualify for a smaller loan amount compared to a student with a full-time job and substantial savings.

Academic Standing

Maintaining good academic standing is important for both federal and private loan eligibility. Lenders want to ensure that students are making satisfactory academic progress towards their degree. Poor academic performance, such as failing grades or academic probation, can negatively impact a student’s eligibility. In some cases, lenders may require students to demonstrate improvement in their academic standing before approving further loans. For example, a student on academic probation might find it challenging to secure additional loans until their academic standing improves.

Impact of Factors on Loan Eligibility

The following table summarizes how credit score, income, and academic standing affect loan eligibility for both federal and private student loans.

| Factor | Federal Student Loans | Private Student Loans |

|---|---|---|

| Credit Score | Generally not a major factor | Significant factor; higher scores lead to better terms and higher loan amounts. |

| Income | May influence eligibility for need-based programs | Significant factor; higher income indicates greater repayment capacity. |

| Academic Standing | Satisfactory academic progress is required for continued eligibility. | Satisfactory academic progress is often a requirement for loan approval and continuation. |

Appealing a Loan Eligibility Decision

Students who are denied a loan or offered a lower loan amount than expected have the right to appeal the decision. The appeals process varies depending on the lender. For federal loans, students can contact the lender to understand the reasons for the denial and explore options for improving their eligibility. For private loans, the appeals process is usually Artikeld in the lender’s terms and conditions. This might involve providing additional documentation or explaining extenuating circumstances that may have affected their application. It’s crucial to thoroughly review the lender’s decision and follow the Artikeld appeals process carefully.

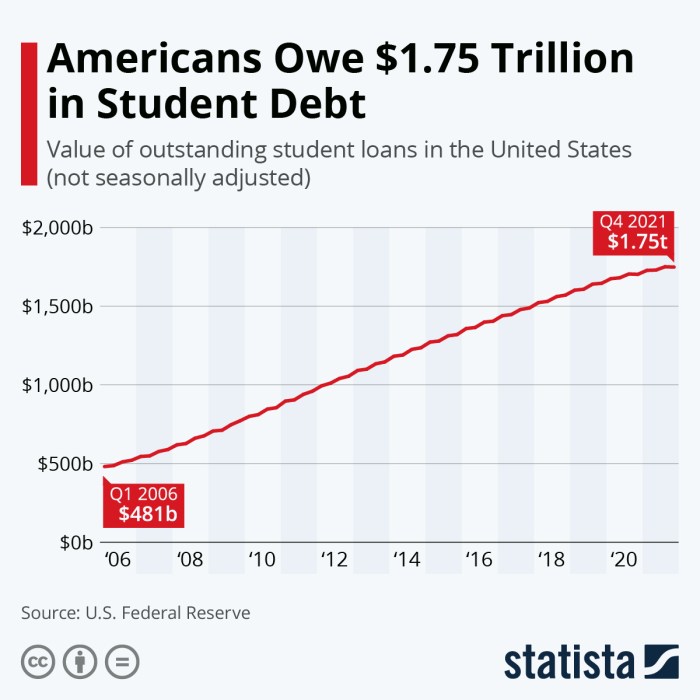

Managing Student Loan Debt

Successfully navigating the complexities of student loan debt requires proactive planning and informed decision-making throughout your undergraduate years and beyond. Understanding your borrowing options, developing responsible spending habits, and exploring various repayment strategies are crucial steps towards minimizing long-term financial burdens.

Minimizing Student Loan Debt During Undergraduate Studies

Effective strategies for minimizing student loan debt begin with careful budgeting and financial planning before even stepping onto campus. Prioritizing academic performance to qualify for merit-based scholarships and grants significantly reduces reliance on loans. Exploring work-study opportunities or part-time employment can supplement income and lessen the need for borrowing. Furthermore, diligently tracking expenses and identifying areas for savings can free up funds to be applied towards tuition or living costs, thereby lowering the overall loan amount needed. Living at home or in affordable housing options also reduces expenses and decreases the overall loan burden. A realistic assessment of the chosen field of study and its potential post-graduation earning potential is crucial to ensure that the debt incurred is commensurate with future income.

Understanding Loan Repayment Plans and Options

Various repayment plans are available, each tailored to individual financial circumstances. Standard repayment plans involve fixed monthly payments over a set period (typically 10 years), while extended repayment plans spread payments over a longer timeframe, resulting in lower monthly payments but higher overall interest costs. Income-driven repayment (IDR) plans adjust monthly payments based on income and family size, offering more flexibility for those facing financial hardship. Deferment or forbearance temporarily suspends or reduces payments during periods of financial difficulty, but interest may continue to accrue. Careful consideration of the advantages and disadvantages of each plan is essential to choose the most suitable option based on individual financial projections and long-term goals. For instance, a graduate pursuing a high-earning career might opt for a standard repayment plan to pay off the debt quickly, while someone entering a lower-paying profession might choose an IDR plan to manage monthly payments more effectively.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe repercussions. This includes damage to credit scores, making it challenging to obtain loans, mortgages, or credit cards in the future. Wage garnishment, where a portion of your earnings is seized to repay the debt, is a possibility. Tax refunds can be withheld, and collection agencies may aggressively pursue repayment. In some cases, professional licenses can be revoked, significantly impacting career prospects. Furthermore, the accumulation of additional fees and interest significantly increases the total amount owed. The consequences can be financially devastating and long-lasting, making responsible repayment a crucial aspect of managing student loan debt.

Resources for Managing Student Loan Debt

Understanding the available resources for managing student loan debt is critical for effective repayment.

- National Student Loan Data System (NSLDS): This system provides a centralized location to view federal student loan information.

- Your Loan Servicer: Contact your loan servicer directly for personalized guidance on repayment plans and options.

- Federal Student Aid Website: This website offers comprehensive information on federal student loan programs and repayment options.

- Financial Aid Office at Your College/University: Your college or university’s financial aid office can provide valuable support and resources.

- Nonprofit Credit Counseling Agencies: These agencies offer free or low-cost credit counseling and debt management services.

Cost of Attendance and Loan Amounts

Understanding the cost of attendance is crucial for prospective students to effectively plan their financing strategy. This involves comparing costs across different institutions and calculating the total cost of a degree program to determine the necessary loan amount. Failing to accurately assess these costs can lead to unexpected debt burdens.

The average cost of attendance varies significantly depending on the type of institution and its location. Public universities generally have lower tuition fees than private universities, particularly for in-state residents. However, even within these categories, costs can vary widely. Factors such as room and board, books, and other fees contribute to the overall cost. Private universities, for example, often have higher endowments and more extensive resources, which can translate into higher tuition and fees. Location also plays a role; institutions in urban areas may have higher living expenses compared to those in rural areas.

Average Cost Comparison Across Institution Types

Public universities typically offer significantly lower tuition rates for in-state students compared to out-of-state students and private institutions. For instance, a four-year public university in a state with relatively low tuition might cost around $10,000 annually for in-state students, including tuition, fees, and room and board, while an out-of-state student at the same university might pay double that amount. A private university, on the other hand, might charge $50,000 or more annually for tuition, fees, and room and board. These are just estimates, and actual costs vary depending on the specific institution and student’s circumstances.

Calculating Total Cost of Attendance for a Four-Year Degree Program

To determine the total cost of attendance for a four-year program, one must sum the annual costs across all four years. For example, consider a student attending a private university with an annual cost of $50,000. The total cost over four years would be $200,000 ($50,000/year * 4 years). This calculation should include tuition, fees, room and board, books, transportation, and other personal expenses. It’s essential to be realistic and include all potential expenses. Unexpected costs can significantly impact the total amount needed.

Maximum Loan Amount Variation Based on Institution and Program

The maximum loan amount a student can receive varies depending on several factors, including the type of institution, the student’s year of study, and the program of study. For instance, consider two students pursuing a bachelor’s degree: one at a public university and another at a private university. The student at the public university, let’s say, is eligible for a maximum annual federal loan amount of $5,500 (as an example, actual amounts vary by year and dependency status), while the student at the private university might be eligible for a higher amount, perhaps $12,500 annually (again, an example). Over four years, the student at the public university could borrow a maximum of $22,000, while the student at the private university could borrow up to $50,000, assuming they maintain eligibility each year. The difference in maximum loan amounts reflects the higher cost of attendance at the private university. Furthermore, professional programs like medicine or law often have significantly higher costs and potentially higher maximum loan amounts, reflecting the greater financial investment in those fields. It is important to note that these are illustrative examples and actual loan limits are subject to change.

Final Wrap-Up

Securing funding for your undergraduate education requires careful consideration of federal and private loan options. By understanding the maximum loan amounts available, the factors affecting eligibility, and the importance of responsible debt management, you can create a sound financial plan for your college journey. Remember to explore all available resources and seek guidance from financial aid professionals to make informed decisions that align with your long-term financial goals. Proper planning and understanding can ease the financial burden of higher education.

Q&A

What happens if I borrow the maximum amount and still need more money for college?

You may need to explore additional funding options such as scholarships, grants, part-time jobs, or work-study programs to cover the remaining costs.

Can I refinance my student loans after graduation?

Yes, refinancing your student loans after graduation may be possible, potentially leading to a lower interest rate. However, carefully consider the terms and conditions before refinancing.

What are the consequences of defaulting on my student loans?

Defaulting on student loans can severely impact your credit score, making it difficult to obtain loans or credit cards in the future. It can also lead to wage garnishment and tax refund offset.

How can I estimate my total cost of attendance?

Your school’s financial aid office provides a net price calculator and cost of attendance information, which includes tuition, fees, room and board, and other expenses.