Navigating the complexities of student loan repayment is a significant challenge for many. Understanding the available tax benefits, such as the student loan interest deduction, can provide crucial financial relief. This deduction allows eligible taxpayers to reduce their taxable income by the amount of interest they paid on qualified student loans, potentially leading to a lower tax bill. However, the deduction isn’t unlimited; it’s subject to annual limits and adjusted gross income (AGI) phase-outs, making it essential to understand the specific rules and eligibility criteria.

This guide provides a comprehensive overview of the student loan interest deduction, clarifying the maximum deduction amount, eligibility requirements, and interaction with other tax benefits. We will explore the impact of filing status and offer practical advice on record-keeping and reporting the deduction accurately on your tax return. By understanding these key aspects, you can effectively leverage this valuable tax break and optimize your tax planning strategy.

Maximum Student Loan Interest Deduction Limits

The student loan interest deduction allows taxpayers to deduct the amount they paid in student loan interest during the tax year. However, there are limits on the amount of interest that can be deducted, and these limits are subject to changes based on your Adjusted Gross Income (AGI). Understanding these limits is crucial for accurately calculating your tax liability.

Annual Limit for Student Loan Interest Deduction

The maximum amount of student loan interest you can deduct annually is $2,500. This means regardless of how much interest you paid, your deduction cannot exceed this limit. This limit applies to all filing statuses.

Adjusted Gross Income (AGI) Phase-Out Ranges

The student loan interest deduction is subject to income limitations. This means that the deduction is gradually reduced or phased out as your AGI increases. The phase-out ranges are different depending on your filing status. For the 2023 tax year, the phase-out ranges are as follows:

For single filers, the deduction begins to phase out if your AGI is above $70,000 and is completely eliminated if your AGI is $85,000 or more. For married couples filing jointly, the phase-out begins at $140,000 and is eliminated at $165,000 or more. Married filing separately taxpayers have a phase-out starting at $70,000 and complete elimination at $85,000. For those filing as Head of Household, the phase-out begins at $105,000 and is eliminated at $130,000 or more.

Examples of Student Loan Interest Deduction Calculations

Let’s illustrate how the deduction works with a few examples:

Example 1: Single Filer with AGI of $60,000

A single filer paid $1,800 in student loan interest and has an AGI of $60,000. Since their AGI is below the phase-out range, they can deduct the full $1,800.

Example 2: Married Filing Jointly with AGI of $150,000

A married couple filing jointly paid $2,200 in student loan interest and has a combined AGI of $150,000. Their AGI falls within the phase-out range. The exact amount of the deduction would require a more complex calculation based on the specific phase-out formula used by the IRS, but it would be less than $2,200 and more than zero.

Example 3: Single Filer with AGI of $90,000

A single filer paid $2,500 in student loan interest and has an AGI of $90,000. Since their AGI exceeds the phase-out limit, they cannot deduct any student loan interest.

Maximum Deduction Amounts by Filing Status

| Filing Status | AGI Range | Maximum Deduction | Notes |

|---|---|---|---|

| Single | Below $70,000 | Up to $2,500 | Phased out between $70,000 and $85,000 |

| Married Filing Jointly | Below $140,000 | Up to $2,500 | Phased out between $140,000 and $165,000 |

| Married Filing Separately | Below $70,000 | Up to $2,500 | Phased out between $70,000 and $85,000 |

| Head of Household | Below $105,000 | Up to $2,500 | Phased out between $105,000 and $130,000 |

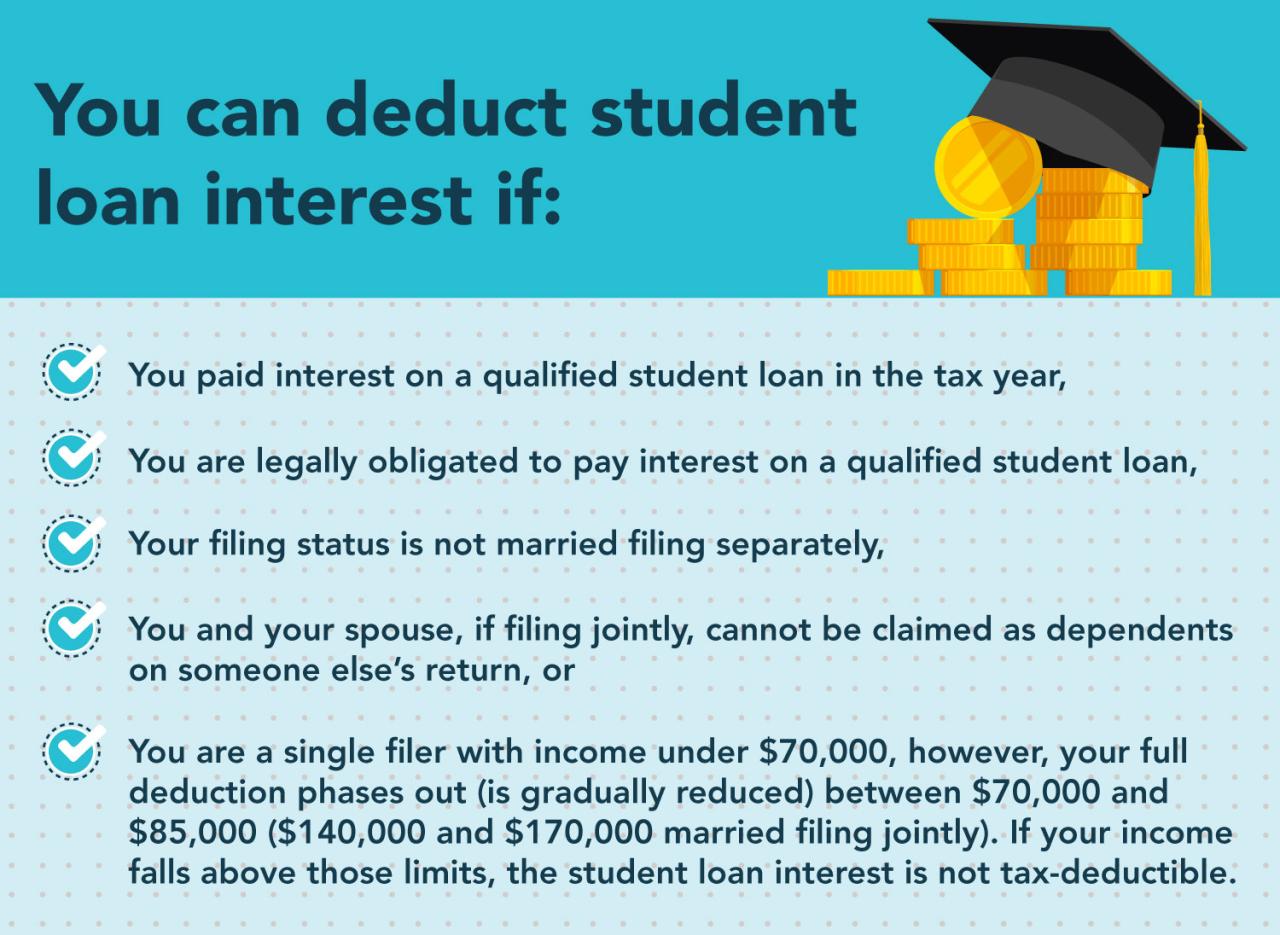

Eligibility Requirements for the Deduction

Claiming the student loan interest deduction hinges on meeting several key requirements. Understanding these stipulations is crucial to determine eligibility and accurately complete your tax return. Failure to meet even one criterion can disqualify you from this valuable tax benefit.

The student loan interest deduction isn’t universally applicable; specific types of loans, student statuses, and claimant relationships all play a role in determining eligibility. This section will clarify these often-confusing aspects.

Qualifying Student Loans

To be eligible for the deduction, the loan must be used to pay for qualified education expenses. This generally includes tuition, fees, room and board, and other necessary expenses for the student’s education at an eligible educational institution. Loans used for other purposes, such as personal expenses, do not qualify. Specifically, the loans must be: federal student loans, or private education loans. The interest paid on these loans, as long as they are for qualified education expenses, can potentially be deductible.

Student Status Requirements

The individual paying the interest must be considered a student to claim the deduction. This typically means they are enrolled at least half-time at an eligible educational institution for at least one academic period that began during the tax year. There are exceptions for students who are temporarily not enrolled due to illness or other circumstances, provided they intend to return to their studies. However, simply having previously attended college isn’t enough; active enrollment or a temporary absence with intent to return is required.

Who Can Claim the Deduction

The student loan interest deduction can be claimed by the individual who actually paid the interest, regardless of who borrowed the money. For instance, a student who took out a loan and is paying the interest directly can claim the deduction. Similarly, a parent who co-signed the loan and is making interest payments can claim the deduction, even if the student is also making payments. However, only one taxpayer can claim the deduction for a particular loan interest payment. The student and parent cannot both claim the deduction for the same interest payment.

Examples of Ineligibility

Several scenarios can lead to ineligibility for the student loan interest deduction. For example, if the loan was used for expenses unrelated to education, such as a new car or a vacation, the interest paid on that loan is not deductible. Furthermore, if the student is not enrolled at least half-time at an eligible educational institution, they would not qualify. Finally, if a taxpayer is claimed as a dependent on someone else’s tax return, they may not be able to claim the student loan interest deduction. They might need to file as independent to be eligible. Similarly, if the student is married filing jointly, the deduction’s availability depends on their spouse’s income and filing status. A high adjusted gross income (AGI) for the couple could eliminate their eligibility.

Interaction with Other Tax Deductions and Credits

The student loan interest deduction, while helpful, doesn’t exist in a vacuum. It interacts with other tax benefits, potentially impacting your overall tax liability in complex ways. Understanding these interactions is crucial for maximizing your tax savings. This section will explore the relationship between the student loan interest deduction and other relevant tax credits, highlighting potential scenarios and strategic planning considerations.

The student loan interest deduction and other education-related tax benefits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), often affect one another. Claiming one may limit or enhance the benefits of claiming the other. Careful consideration of individual circumstances is necessary to determine the most advantageous approach.

Interaction with the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit (LLC)

The AOTC and LLC are tax credits, not deductions, meaning they directly reduce your tax liability dollar-for-dollar (up to a certain limit), unlike the student loan interest deduction, which reduces your taxable income. A taxpayer can claim only one of these credits per student per year. Importantly, you can claim the student loan interest deduction *in addition* to either the AOTC or LLC, provided you meet the eligibility requirements for all. However, the AOTC is only available for the first four years of undergraduate education, while the LLC can be claimed for unlimited years of undergraduate or graduate education. This difference significantly impacts which credit is more beneficial depending on the student’s educational stage and financial situation. For example, a student in their first year of college might benefit more from the potentially larger AOTC, while a graduate student might find the LLC more useful.

Potential Scenarios Affecting Eligibility

Several scenarios illustrate how claiming one benefit might influence eligibility for another. For instance, a high-income taxpayer might find their AOTC phased out before they can fully benefit from it. In this case, the student loan interest deduction might offer a more substantial tax advantage. Conversely, a taxpayer with lower income might find the AOTC more valuable due to its larger potential reduction in tax liability. Another scenario involves students who attend multiple institutions. They must track their expenses and credits carefully to ensure they’re claiming the most advantageous credits and deductions. Finally, a taxpayer who has already used the AOTC for four years and is now pursuing graduate studies might exclusively benefit from the LLC and the student loan interest deduction.

Tax Planning Strategies Considering Deduction and Credit Interactions

Careful tax planning is essential to maximize the benefits of both the student loan interest deduction and education credits.

- Track all education-related expenses: Maintain detailed records of student loan interest payments, tuition fees, and other qualifying education expenses to accurately claim all applicable deductions and credits.

- Compare the potential benefits of the AOTC and LLC: Carefully assess which credit offers the greater tax advantage based on the student’s educational status, income, and other relevant factors.

- Consider income limitations: Be aware of the income thresholds for both the AOTC and LLC, as exceeding these limits can reduce or eliminate the credit. The student loan interest deduction, while also having income limitations, generally has a higher threshold.

- Consult a tax professional: Seek professional advice to determine the optimal strategy for claiming education-related tax benefits based on your unique financial situation. This is especially important for complex scenarios involving multiple students or varying educational paths.

- Plan for future years: Consider the long-term implications of claiming specific credits, as claiming the AOTC now might limit your options in future years.

Record Keeping and Documentation

Proper record-keeping is crucial for successfully claiming the student loan interest deduction. The IRS requires sufficient documentation to verify your payments and ensure you meet all eligibility requirements. Failing to maintain accurate records could result in the denial of your deduction.

Maintaining accurate records of your student loan interest payments is essential for a smooth tax filing process. These records serve as irrefutable proof of your payments when you file your tax return. Having this documentation readily available simplifies the process and prevents potential delays or complications with the IRS. It also protects you from any discrepancies or challenges to your deduction claim.

Necessary Documentation for the Student Loan Interest Deduction

To claim the student loan interest deduction, you’ll need to gather several key documents. These documents provide concrete evidence to support your claim and help the IRS verify the accuracy of your deduction. Keep all these documents organized and readily accessible during tax season.

- Form 1098-E, Student Loan Interest Statement: This form is issued by your lender and reports the total amount of student loan interest you paid during the year. This is your primary piece of evidence.

- Student Loan Payment Records: Maintain records of all your student loan payments, including the date, amount, and the specific loan to which the payment was applied. Bank statements, online payment confirmations, and loan statements can serve as proof.

- Copy of your Tax Return from the Previous Year (if applicable): If you are amending a previous return due to a change in your student loan interest deduction, this will be necessary.

Sample Form for Tracking Student Loan Interest Payments

A well-organized record-keeping system is vital. A simple spreadsheet or a dedicated notebook can suffice, but a structured approach is recommended. The following example illustrates a straightforward method for tracking your student loan interest payments.

| Date of Payment | Payment Amount | Loan Number (if applicable) | Lender Name | Interest Paid (Specify if you can separate principal and interest) | Supporting Documentation (e.g., bank statement page number) |

|---|---|---|---|---|---|

| January 15, 2024 | $200 | 1234567 | Example Lender | $150 | Bank Statement, Page 2 |

| February 10, 2024 | $250 | 1234567 | Example Lender | $180 | Online Payment Confirmation |

Reporting the Student Loan Interest Deduction on Your Tax Form

Accurately reporting the deduction involves several steps. Follow these steps carefully to ensure your claim is processed correctly.

- Gather your documentation: Assemble all necessary documents, including Form 1098-E and your payment records.

- Complete Form 1040, Schedule 1 (Additional Income and Adjustments to Income): Enter the amount of student loan interest you paid during the year on line 21. This is where you report the deduction.

- Review your return: Carefully review your completed tax return before filing to ensure accuracy.

- File your return: File your tax return electronically or by mail, according to IRS instructions.

Impact of Filing Status on the Student Loan Interest Deduction

The maximum amount you can deduct for student loan interest isn’t a fixed number; it depends significantly on your filing status. This is because the adjusted gross income (AGI) thresholds that determine eligibility and the maximum deduction itself vary based on whether you’re single, married filing jointly, head of household, etc. Understanding these differences is crucial for accurately calculating your deduction and maximizing your tax savings.

The student loan interest deduction is a valuable tax break for those paying off student loans, but the amount you can deduct is capped and depends on your modified adjusted gross income (MAGI). The MAGI thresholds are different for each filing status, meaning the amount you can deduct, or even if you can deduct at all, will change depending on your filing status.

AGI Thresholds and Maximum Deductions by Filing Status

The Internal Revenue Service (IRS) sets annual AGI limits that determine both your eligibility for the deduction and the maximum amount you can deduct. These limits are adjusted annually for inflation. For example, in a given tax year, the single filer might have a maximum deduction of $2,500 but only if their AGI is below a specified threshold (let’s say $70,000 for this example). If their AGI exceeds that threshold, the deduction may be reduced or eliminated. Married filing jointly taxpayers will have a higher AGI threshold, but the maximum deduction amount might also be higher, perhaps $5,000 in this hypothetical scenario, although this would be subject to their MAGI being below the threshold for married filing jointly filers. Head of household filers would have their own specific AGI threshold and maximum deduction amount, falling somewhere between the single and married filing jointly amounts. Qualifying surviving spouses have the same AGI thresholds and maximum deduction amounts as married filing jointly.

Examples of Deduction Calculation for Different Filing Statuses

Let’s consider a simplified example using hypothetical figures for a given tax year:

| Filing Status | AGI Threshold | Maximum Deduction | Taxpayer’s Actual Student Loan Interest Paid | Deduction Amount |

|---|---|---|---|---|

| Single | $70,000 | $2,500 | $1,800 | $1,800 |

| Married Filing Jointly | $140,000 | $5,000 | $4,000 | $4,000 |

| Head of Household | $90,000 | $3,750 | $3,000 | $3,000 |

| Single | $70,000 | $2,500 | $3,000 | $2,500 |

| Married Filing Jointly | $140,000 | $5,000 | $6,000 | $5,000 |

Note: These are hypothetical numbers for illustrative purposes only. Actual AGI thresholds and maximum deduction amounts vary yearly and are subject to change by the IRS. Always consult the most current IRS guidelines.

Visual Representation of Maximum Deduction Across Filing Statuses

Imagine a bar chart. The horizontal axis lists the filing statuses (Single, Married Filing Jointly, Head of Household, Qualifying Surviving Spouse). The vertical axis represents the maximum student loan interest deduction amount in dollars. Each bar’s height corresponds to the maximum deduction allowed for that filing status. The bar representing “Married Filing Jointly” would generally be the tallest, followed by “Head of Household,” then “Single,” with “Qualifying Surviving Spouse” being the same height as “Married Filing Jointly.” The exact heights of the bars would reflect the current year’s IRS-specified limits. This visual representation clearly demonstrates how the maximum deduction varies significantly depending on the taxpayer’s filing status. Remember that these maximum amounts only apply if the taxpayer’s AGI is below the applicable threshold for their filing status.

Summary

Successfully claiming the student loan interest deduction requires careful attention to detail and a thorough understanding of the applicable rules and regulations. While the potential tax savings can be substantial, it’s crucial to accurately track your payments and maintain proper documentation to support your claim. By familiarizing yourself with the maximum deduction limits, eligibility requirements, and interactions with other tax benefits, you can confidently navigate the process and maximize your tax advantages. Remember to consult with a qualified tax professional if you have any questions or complex situations.

Expert Answers

Can I deduct interest paid on loans for graduate school?

Yes, as long as the loans are qualified education loans used to pay for higher education expenses.

What if my AGI is just above the phase-out range? Can I still deduct anything?

Possibly, a partial deduction may still be allowed depending on how much your AGI exceeds the limit. The amount will be reduced proportionally.

If I’m married filing jointly, can my spouse claim the deduction if they paid the interest?

Only one spouse can claim the deduction, even if both contributed to the interest payments. You’ll need to decide who will claim it on your joint return.

My loan servicer didn’t send me a 1098-E form. What should I do?

Contact your loan servicer immediately to request a copy of the 1098-E form. You may still be able to claim the deduction if you have other documentation proving the interest payments.