Navigating the complexities of student loan repayment can feel overwhelming. The sheer number of programs and plans available, each with its own eligibility criteria and repayment structures, often leaves borrowers unsure of the best path forward. This guide delves into the various federal and state programs designed to help students manage and, in some cases, eliminate their student loan debt, focusing on understanding the options available to find the most suitable solution for your individual circumstances.

We will explore income-driven repayment plans, loan forgiveness programs like Public Service Loan Forgiveness (PSLF) and the Teacher Loan Forgiveness Program, and other strategies such as loan consolidation and refinancing. Understanding these options empowers you to make informed decisions and develop a personalized repayment strategy that aligns with your financial goals and long-term aspirations.

Income-Driven Repayment Plans

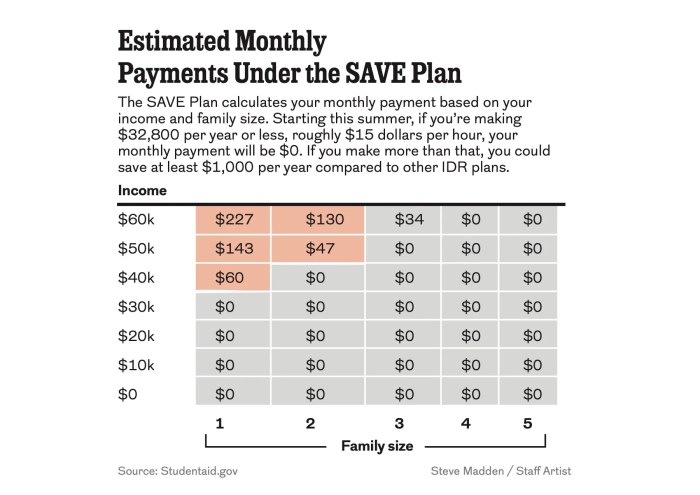

Income-driven repayment (IDR) plans offer a lifeline to student loan borrowers struggling to manage their monthly payments. These plans tie your monthly payment amount to your discretionary income, making them significantly more manageable than standard repayment plans for many individuals. However, it’s crucial to understand how they function and their long-term implications for your loan balance.

IDR plans adjust your monthly payment based on your income and family size. Because your payment is lower, you’ll likely pay more interest over the life of the loan and extend the repayment period, potentially resulting in a larger total amount repaid compared to standard repayment. The specific terms and conditions vary depending on the chosen plan.

Income-Driven Repayment Plan Mechanics and Loan Balance Impact

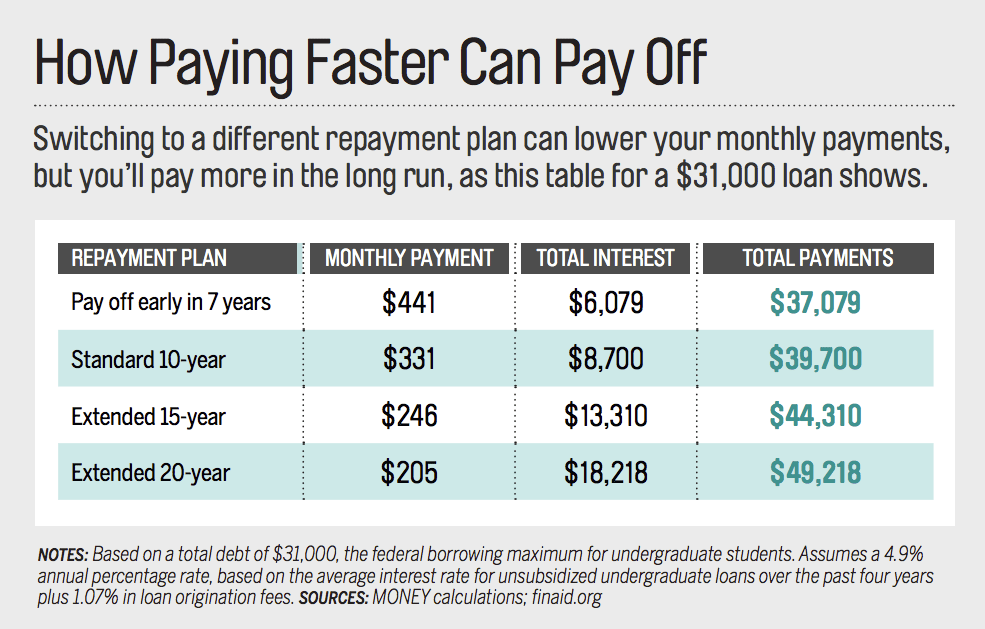

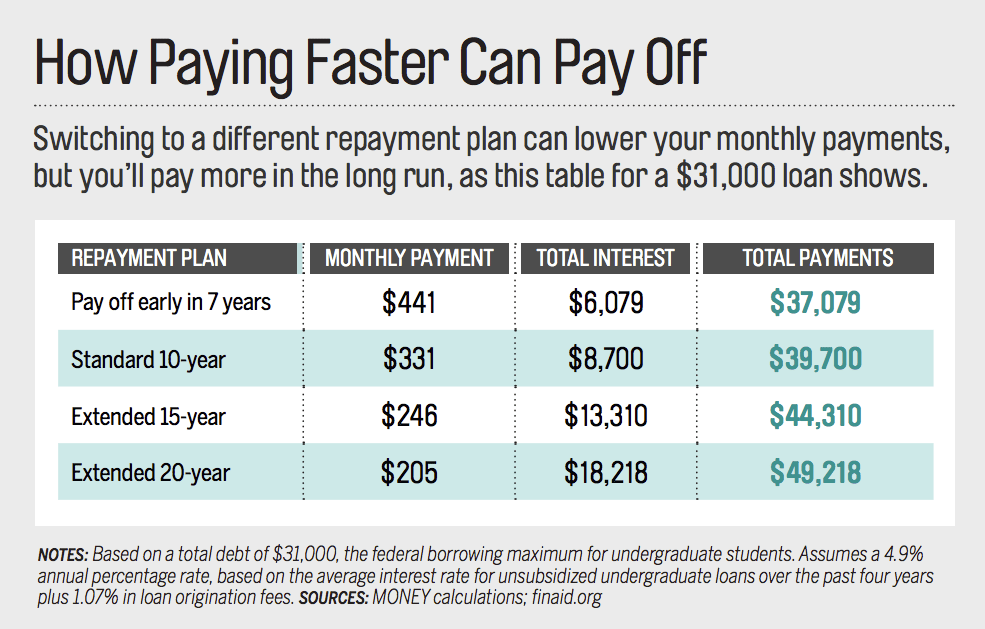

Income-driven repayment plans calculate your monthly payment based on a formula that considers your adjusted gross income (AGI), family size, and loan balance. The formula differs slightly between plans, but the core principle remains consistent: a lower income results in a lower monthly payment. However, because the payment is lower, it takes longer to repay the loan. This extended repayment period allows interest to accrue, potentially leading to a larger total repayment amount over the life of the loan than under a standard repayment plan. For example, a borrower with a $50,000 loan on a standard 10-year plan might pay significantly less in total interest compared to someone on an IDR plan that stretches the repayment over 20 or 25 years. The long-term impact on the loan balance is directly influenced by the interest accrued over this extended period.

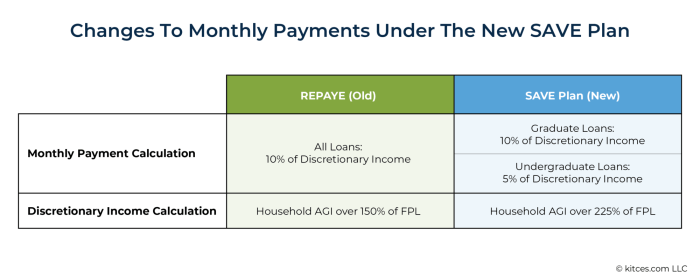

Differences Between ICR, PAYE, and REPAYE Plans

Several income-driven repayment plans exist, each with its own nuances. The Income-Contingent Repayment (ICR) plan, for instance, calculates payments based on a formula considering your AGI, family size, and loan balance. The Pay As You Earn (PAYE) plan typically caps monthly payments at 10% of discretionary income, while the Revised Pay As You Earn (REPAYE) plan offers a similar structure but also includes a broader range of federal student loans. Key differences lie in the payment calculation formulas, income thresholds, and loan types covered. The REPAYE plan, for example, might be more advantageous for borrowers with both undergraduate and graduate loans, while ICR might be suitable for those with older loans.

Applying for and Enrolling in an Income-Driven Repayment Plan

The process of applying for an IDR plan typically involves completing a form, providing documentation verifying your income and family size (such as tax returns), and submitting the completed application through the student loan servicer’s website. The specific requirements and procedures may vary slightly depending on the plan and your loan servicer. Once approved, you will be enrolled in the chosen plan, and your monthly payment will be adjusted accordingly. It’s important to recertify your income annually, or as required by the plan, to ensure your payment accurately reflects your current financial situation.

Calculating Monthly Payments Under Different Income-Driven Repayment Plans

Calculating the exact monthly payment under each IDR plan requires using the specific formula for that plan, which often involves complex calculations factoring in AGI, family size, and loan balance. While precise calculation requires using the official government resources or a loan servicer’s calculator, a simplified understanding can be gained by realizing that the payment is a percentage of discretionary income (the amount remaining after deducting certain expenses from your AGI). This percentage varies by plan. For example, under PAYE, it might be 10%, while under ICR, it could be a higher or lower percentage depending on your loan amount and income. To get an accurate estimate, it is best to use the online calculators provided by the Department of Education or your loan servicer. These calculators take into account all relevant factors to provide a personalized payment estimate.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program is a federal initiative designed to incentivize individuals pursuing careers in public service by offering loan forgiveness after 120 qualifying monthly payments. This program can significantly reduce the burden of student loan debt for eligible borrowers, but it’s crucial to understand the specific requirements to avoid disappointment.

PSLF Program Requirements

To qualify for PSLF, borrowers must meet several stringent criteria. They must have federal Direct Loans (not FFEL or Perkins loans), be employed by a qualifying government or non-profit organization, and be enrolled in an income-driven repayment plan. Crucially, all 120 qualifying payments must be made on time under an income-driven repayment plan while working full-time for a qualifying employer. Any payment made before consolidation into a Direct Consolidation Loan will not count towards the 120 payment requirement. The program’s complexity highlights the importance of careful planning and consistent monitoring of loan status.

Comparison of PSLF with Other Loan Forgiveness Programs

PSLF differs significantly from other loan forgiveness programs, such as the Teacher Loan Forgiveness program or the Income-Driven Repayment (IDR) plans which offer forgiveness based on factors like income or years of teaching. While IDR plans offer lower monthly payments based on income, PSLF provides complete loan forgiveness after 120 qualifying payments, regardless of the remaining loan balance. The Teacher Loan Forgiveness program, on the other hand, forgives a smaller amount of debt, requiring specific teaching roles and a limited time frame. PSLF’s unique feature is its focus on public service and the potential for complete debt elimination.

Examples of Qualifying Occupations

A wide range of professions qualify for PSLF. Examples include teachers at public schools, social workers employed by government agencies, nurses in public hospitals, and lawyers working for non-profit legal aid organizations. Government employees at all levels (federal, state, local) are generally eligible, as are employees of qualifying non-profit organizations. The key is that the employer must be a government organization or a non-profit organization that qualifies under IRS section 501(c)(3). It’s important to verify your employer’s eligibility directly with the PSLF program.

Steps to Apply for and Receive PSLF

Careful adherence to these steps is crucial for successful PSLF application.

- Consolidate Loans (if necessary): If you have FFEL or Perkins loans, consolidate them into a Direct Consolidation Loan. This is a prerequisite for PSLF eligibility.

- Choose an Income-Driven Repayment Plan: Enroll in an income-driven repayment plan (IDR) such as ICR, PAYE, REPAYE, or IBR.

- Verify Employment: Ensure your employer is a qualifying public service or non-profit organization. Use the PSLF Help Tool to verify.

- Make 120 Qualifying Payments: Make 120 timely monthly payments while employed full-time by a qualifying employer.

- Submit the PSLF Form: Complete and submit the PSLF form annually to track your progress and ensure your payments are counted correctly.

- Monitor Your Progress: Regularly check your loan servicer’s website to monitor your progress towards loan forgiveness.

- Apply for Forgiveness: Once you’ve made 120 qualifying payments, submit your application for loan forgiveness.

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program offers partial loan forgiveness to eligible teachers who have completed five years of full-time teaching in low-income schools or educational service agencies. This program can significantly reduce the burden of student loan debt for individuals dedicated to serving in under-resourced educational settings.

Eligibility Criteria for Teacher Loan Forgiveness

To qualify for the Teacher Loan Forgiveness Program, teachers must meet specific requirements related to their teaching position, the type of school or agency they work for, and their loan type. These criteria ensure the program targets its benefits to those serving in high-need areas.

Qualifying Teaching Positions and Required Service Periods

Eligible teachers must work full-time for at least five consecutive academic years in a qualifying school or educational service agency. A qualifying school is generally defined as a public elementary school, secondary school, or educational service agency that serves a low-income student population. Examples of qualifying teaching positions include elementary school teachers, secondary school teachers (such as high school math teachers or middle school science teachers), and special education teachers working in these low-income settings. The five years of service must be consecutive; breaks in service will not count towards loan forgiveness.

Application Process and Required Documentation

The application process for Teacher Loan Forgiveness involves submitting a completed application form along with supporting documentation. Crucial documents include proof of employment (such as employment contracts or pay stubs) demonstrating five consecutive years of full-time teaching at a qualifying school or agency, and verification of the school’s low-income status. Applicants must also provide documentation of their federal student loans, such as loan promissory notes or statements from their loan servicers. Accurate and complete documentation is essential for a successful application.

Visual Representation of the Application Process

Imagine a flowchart. The first box represents the initial eligibility check, confirming if the applicant meets the criteria for teaching position and school type. The next box shows the gathering of required documentation: employment verification, school designation verification, and student loan information. This leads to the submission of the completed application form and supporting documents. A subsequent box shows the Department of Education’s review of the application. Finally, the last box depicts the outcome: either loan forgiveness is granted, or a notification is sent explaining any deficiencies or reasons for denial. This flowchart visually summarizes the step-by-step procedure involved in applying for the Teacher Loan Forgiveness Program.

Other Federal Student Loan Repayment Options

Beyond loan forgiveness programs, several other federal student loan repayment strategies can help borrowers manage their debt. These options focus on altering repayment terms or consolidating loans to potentially lower monthly payments or reduce the overall cost of borrowing. Understanding these options is crucial for developing a personalized repayment plan that aligns with individual financial circumstances.

Loan Consolidation

Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. This simplifies repayment by reducing the number of monthly payments and potentially lowering the monthly payment amount. However, it’s important to note that the new interest rate is typically a weighted average of the interest rates on the original loans, so it may not always result in a lower overall interest rate. Consolidation may also extend the repayment period, leading to a higher total interest paid over the life of the loan. For example, a borrower with several loans at varying interest rates might find consolidation beneficial if it leads to a manageable monthly payment, even if the total interest paid increases slightly. This is particularly helpful for borrowers struggling to keep track of multiple loans and payments.

Refinancing Student Loans

Refinancing involves replacing your existing federal student loans with a new private loan from a bank or credit union. This can offer advantages such as lower interest rates, shorter repayment terms, or different repayment options. However, refinancing federal student loans means losing access to federal repayment plans like income-driven repayment or forgiveness programs. This can be a significant disadvantage, particularly for borrowers who might qualify for these programs. For example, a borrower with excellent credit and a high income might find refinancing attractive due to lower interest rates, but a borrower who anticipates needing an income-driven repayment plan should avoid refinancing their federal loans.

Choosing a Repayment Strategy: A Decision-Making Flowchart

This flowchart Artikels the steps to choose the best repayment strategy.

Start: Assess your current financial situation (income, expenses, debt).

1. Do you qualify for any loan forgiveness programs (PSLF, Teacher Loan Forgiveness, etc.)?

Yes: Explore eligibility and requirements. Proceed to step 4.

No: Proceed to step 2.

2. Are you struggling to make your current loan payments?

Yes: Consider an income-driven repayment plan (IDR). Proceed to step 4.

No: Proceed to step 3.

3. Do you want to simplify your payments or potentially lower your monthly payment?

Yes: Consider loan consolidation. If you have excellent credit and are confident you won’t need federal repayment programs, consider refinancing. Proceed to step 4.

No: Continue with your current repayment plan.

4. Evaluate the long-term costs and benefits of each option, considering total interest paid and potential access to forgiveness programs. Select the option that best suits your financial situation and long-term goals. End.

State-Specific Student Loan Repayment Assistance Programs

Many states offer programs designed to help residents manage their student loan debt. These programs vary significantly in their eligibility requirements, the types of assistance offered, and the amount of financial support provided. Understanding the specifics of your state’s program is crucial for maximizing your repayment options.

Types of State-Level Student Loan Repayment Assistance

State programs generally fall into a few categories. Some offer direct loan repayment assistance, providing a certain amount of money annually to help borrowers pay down their principal. Others offer tax benefits, such as deductions or credits, that reduce the amount of taxes owed, effectively freeing up money for loan repayment. Still others provide matching contributions to those who are participating in income-driven repayment plans. The specifics depend heavily on the state and its budget priorities.

Examples of State Programs and Their Requirements

While specific programs and requirements change frequently, it’s important to check directly with your state’s higher education authority for the most up-to-date information. The following table offers examples of the types of programs that may exist, but should not be considered an exhaustive list and should not be considered current policy without independent verification.

| State | Program Name (Example) | Type of Assistance | Eligibility Requirements (Example) |

|---|---|---|---|

| Indiana | Indiana Student Loan Repayment Program (Example) | Direct Loan Repayment | Must be employed in a high-demand occupation within the state; specific income limits may apply. |

| Pennsylvania | PA Loan Forgiveness Program (Example) | Loan Forgiveness | Must work in a public service role within the state for a specified number of years; specific income limits may apply. |

| Maryland | Maryland Student Loan Debt Relief Tax Credit (Example) | Tax Credit | Must meet certain income requirements; credit amount may be capped. |

| California | California Student Loan Repayment Assistance (Example) | Matching Contributions | Must be enrolled in an income-driven repayment plan; specific income limits may apply. |

Comparing Benefits and Limitations of State Programs

The benefits of state programs are clear: reduced student loan debt and improved financial stability. However, limitations exist. Eligibility requirements can be stringent, often restricting access to specific professions or income levels. Funding for these programs is often limited, leading to competitive application processes and potential waiting lists. Furthermore, the amount of assistance offered may not be sufficient to make a significant impact on a large loan balance. The specific benefits and limitations will vary greatly by state and program.

Ultimate Conclusion

Successfully managing student loan debt requires careful planning and a thorough understanding of the available resources. From income-driven repayment plans that adjust payments based on your income to loan forgiveness programs that offer complete debt cancellation under specific circumstances, numerous options exist to alleviate the burden of student loans. By carefully considering your individual circumstances and exploring the programs Artikeld in this guide, you can develop a repayment strategy that minimizes financial stress and paves the way for a secure financial future.

FAQ Section

What is the difference between PSLF and Teacher Loan Forgiveness?

PSLF forgives remaining federal student loan debt after 120 qualifying monthly payments under an income-driven repayment plan for those working full-time in public service. Teacher Loan Forgiveness forgives up to $17,500 of eligible loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency.

Can I refinance my federal student loans?

Yes, you can refinance federal student loans with a private lender. However, be aware that refinancing typically means losing federal protections, such as income-driven repayment plans and loan forgiveness programs.

What if I don’t qualify for any forgiveness programs?

Even if you don’t qualify for forgiveness, income-driven repayment plans can significantly lower your monthly payments, making them more manageable. Exploring options like loan consolidation to simplify your payments is also beneficial.

Where can I find more information about state-specific programs?

Your state’s higher education agency or department of education website is a good starting point. You can also search online for “[Your State] student loan repayment assistance.”