Navigating the complexities of student loan debt can feel overwhelming, especially when facing the daunting prospect of missed payments. This guide offers a practical roadmap to help you understand your options, manage your debt effectively, and ultimately regain financial control. We’ll explore various strategies, from communicating with your loan servicer to exploring repayment plans and seeking professional guidance, ensuring you’re equipped to tackle this challenge head-on.

Understanding your financial situation is the first crucial step. This involves honestly assessing your income, expenses, and the total amount of your student loan debt. From there, we will examine various repayment options tailored to your specific circumstances, and explore avenues for seeking professional assistance if needed. The goal is to provide a clear, actionable path towards resolving your student loan debt and building a secure financial future.

Understanding Your Situation

Falling behind on student loan payments can stem from a complex interplay of factors, often leaving borrowers feeling overwhelmed and alone. Understanding these contributing elements is the crucial first step towards finding a solution. This section will explore the various reasons for delinquency, the emotional toll it takes, and provide a practical guide to assessing your financial standing.

Several factors can contribute to student loan delinquency. Unexpected job loss or a significant reduction in income are common culprits. Unexpected medical expenses, family emergencies, or even rising living costs can quickly strain a budget, making loan payments difficult to manage. Poor financial planning, such as failing to budget effectively for loan repayments, can also lead to delinquency. In some cases, borrowers may initially struggle with repayment due to a lack of understanding of their loan terms and available repayment options. Furthermore, the sheer weight of accumulated debt can be paralyzing, leading to avoidance and ultimately, delinquency.

The Emotional and Psychological Impact of Student Loan Debt

Struggling with student loan debt can have a profound impact on mental and emotional well-being. The constant pressure of looming payments and the fear of negative consequences, such as damage to credit scores, can cause significant stress and anxiety. This stress can manifest in various ways, including difficulty sleeping, changes in appetite, and feelings of hopelessness and depression. The weight of this debt can also strain personal relationships and affect overall life satisfaction. It’s important to acknowledge that these feelings are valid and to seek support if needed.

Assessing Your Current Financial Situation

Accurately assessing your financial situation is paramount to developing a manageable repayment plan. This involves a step-by-step process:

- Gather all relevant financial documents: This includes pay stubs, bank statements, tax returns, and a list of all your debts, including student loans, credit cards, and other loans. Note down the principal balance, interest rate, and minimum monthly payment for each loan.

- Calculate your monthly income: This includes your gross income (before taxes) from all sources, including employment, investments, and any other regular income streams.

- List all your monthly expenses: This includes housing (rent or mortgage), utilities, transportation, groceries, healthcare, debt payments, and other essential and non-essential expenses. Be as thorough as possible.

- Determine your net income: Subtract your total monthly expenses from your total monthly income. This will show you how much money you have left over each month after covering your expenses.

- Analyze your spending habits: Identify areas where you can potentially reduce spending. This might involve cutting back on non-essential expenses, such as entertainment or dining out.

Sample Budget Template

A clear budget is essential for visualizing income versus expenses. The following is a simple template:

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Salary | $XXXX | Housing | $XXXX |

| Other Income | $XXXX | Utilities | $XXXX |

| Total Income | $XXXX | Transportation | $XXXX |

| Groceries | $XXXX | ||

| Student Loan Payments | $XXXX | ||

| Other Debt Payments | $XXXX | ||

| Entertainment | $XXXX | ||

| Savings | $XXXX | ||

| Total Expenses | $XXXX | ||

| Net Income | $XXXX (Income – Expenses) |

Remember to be realistic when creating your budget. It’s better to slightly underestimate your income and overestimate your expenses to avoid unexpected shortfalls.

Contacting Your Loan Servicer

Open communication with your student loan servicer is crucial when facing financial hardship. Proactive and clear communication can significantly improve your chances of finding a manageable repayment solution. Understanding their processes and your rights will empower you to navigate this challenging situation effectively.

Effective communication involves being organized, polite, and precise. Clearly articulate your financial difficulties, providing specific documentation whenever possible (like pay stubs or bank statements). Avoid emotional outbursts; instead, focus on presenting your situation objectively and respectfully. Keep detailed records of all communications, including dates, times, and the names of individuals you spoke with. This documentation will prove invaluable should any disputes arise.

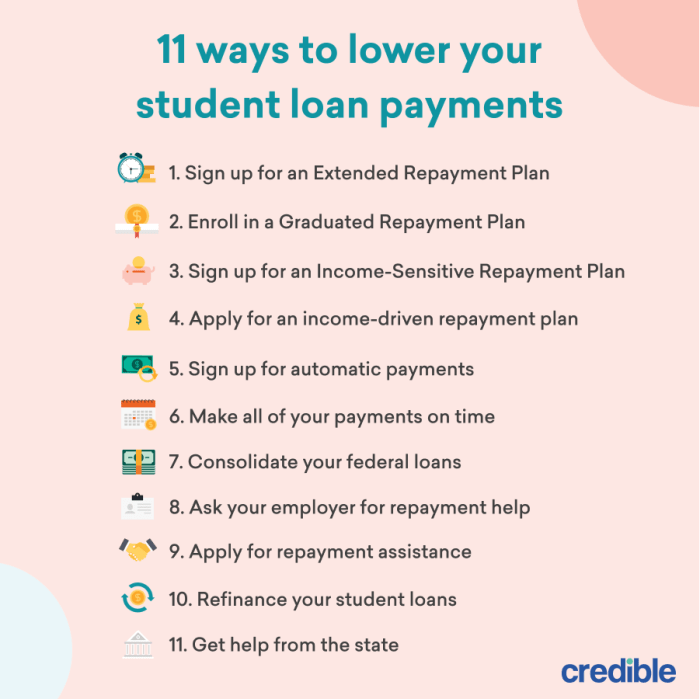

Repayment Plan Options

Several repayment plans are designed to help borrowers manage their student loan debt. Choosing the right plan depends on your individual financial circumstances and the type of loans you have. These plans often involve adjusting your monthly payment amount, extending the repayment period, or a combination of both. However, it’s important to understand that extending the repayment period will usually result in paying more interest overall.

- Standard Repayment Plan: This is the default plan, usually requiring fixed monthly payments over 10 years.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

- Extended Repayment Plan: Extends the repayment period to up to 25 years, reducing monthly payments but increasing total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. Several IDR plans exist (e.g., ICR, PAYE, REPAYE,IBR), each with specific eligibility requirements and calculation methods. These plans often lead to loan forgiveness after a certain number of qualifying payments.

Requesting Forbearance or Deferment

Forbearance and deferment are temporary pauses in your loan payments. A forbearance is granted when you experience temporary financial hardship, while a deferment is usually granted for specific reasons such as unemployment or enrollment in school. Both options can provide short-term relief, but interest may still accrue on unsubsidized loans during a forbearance period. It is important to understand that deferment or forbearance is not a long-term solution, and a repayment plan will eventually need to be established. Both require application and approval by your loan servicer.

Sample Email to Request Repayment Plan Modification

Subject: Request for Repayment Plan Modification – Account [Your Account Number]

Dear [Loan Servicer Name],

I am writing to request a modification to my student loan repayment plan due to unforeseen financial difficulties. [ Briefly explain your financial situation, e.g., job loss, medical expenses]. I have attached [list attached documents, e.g., pay stubs, bank statements].

I am interested in exploring options such as [mention specific plans you are interested in, e.g., an income-driven repayment plan, an extended repayment plan]. Please contact me at [Your Phone Number] or [Your Email Address] to discuss my options further.

Thank you for your time and consideration.

Sincerely,

[Your Name]

[Your Account Number]

Exploring Repayment Options

Facing difficulty in paying your student loans necessitates exploring different repayment plans to find one that aligns with your financial capabilities. Choosing the right plan can significantly impact your monthly payments, overall repayment time, and long-term financial health. Understanding the differences between standard and income-driven repayment (IDR) plans is crucial for making an informed decision.

Income-driven repayment plans and standard repayment plans offer distinct approaches to managing student loan debt. Standard plans typically involve fixed monthly payments over a set period (usually 10 years), while IDR plans adjust payments based on your income and family size, potentially extending the repayment timeline. Both have advantages and disadvantages that should be carefully considered.

Income-Driven Repayment (IDR) Plans

IDR plans are designed to make student loan repayment more manageable for borrowers with lower incomes. These plans calculate your monthly payment based on a percentage of your discretionary income (income above a certain poverty guideline). Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility requirements vary slightly depending on the specific plan, but generally include having federal student loans and demonstrating financial need. While IDR plans offer lower monthly payments, this often comes at the cost of a longer repayment period, potentially leading to increased interest accrual over the life of the loan. For some borrowers, the lower monthly payments significantly improve their ability to manage their finances, while others may find the extended repayment period less desirable. For example, a borrower with a low income might choose an IDR plan to avoid default, while a borrower with a higher income might prefer a standard plan to pay off their loans faster.

Standard Repayment Plans

Standard repayment plans involve fixed monthly payments spread over a 10-year period. This approach provides a predictable payment schedule and allows for faster loan payoff, minimizing the total interest paid. Eligibility for standard repayment plans is relatively straightforward; you generally need to have federal student loans and be able to make the required monthly payments. However, the fixed monthly payments can be challenging for borrowers with limited income or fluctuating financial situations. For example, a recent graduate with a high loan balance and a lower starting salary might struggle to manage the payments of a standard repayment plan.

Comparison of Repayment Plans

The following table compares and contrasts income-driven repayment (IDR) plans and standard repayment plans:

| Feature | IDR Plans | Standard Repayment Plans |

|---|---|---|

| Monthly Payment | Based on discretionary income; lower payments | Fixed; higher payments |

| Repayment Period | Longer (up to 20-25 years) | Shorter (10 years) |

| Interest Accrual | Potentially higher due to longer repayment | Lower due to shorter repayment |

| Eligibility | Requires demonstrating financial need; specific plan eligibility criteria | Generally available to all federal student loan borrowers |

| Long-Term Consequences | Potential for loan forgiveness after 20-25 years (depending on the plan and income), but higher total interest paid. | Faster loan payoff, lower total interest paid, but higher monthly payments. |

Seeking Professional Help

Facing overwhelming student loan debt can be incredibly stressful, making it difficult to navigate the situation alone. Seeking professional guidance can provide crucial support and potentially lead to more effective solutions. Non-profit credit counseling agencies and financial advisors specializing in student loan debt offer valuable services to help you regain control of your finances.

Services Offered by Non-Profit Credit Counseling Agencies

Non-profit credit counseling agencies provide a range of services designed to help individuals manage their debt. These services typically include credit counseling, debt management plans (DMPs), and financial education workshops. A DMP, for example, involves consolidating multiple debts into a single monthly payment plan with lower interest rates. These agencies are typically staffed by certified credit counselors who can offer personalized guidance and support. They operate on a non-profit basis, ensuring that their primary focus is on helping clients improve their financial well-being, rather than maximizing profit. They also often offer budgeting and financial literacy resources to help prevent future debt accumulation.

Negotiating with Creditors to Reduce Debt

Negotiating with your creditors directly to reduce your student loan debt can be challenging but potentially rewarding. Success often depends on demonstrating your financial hardship and proposing a realistic repayment plan. Credit counseling agencies can assist in this process by acting as intermediaries, negotiating on your behalf and helping to structure a mutually agreeable plan. They can also help you gather necessary documentation to support your case, such as proof of income and expenses. Successful negotiations might result in reduced monthly payments, loan forgiveness programs, or even a settlement for a lower amount than the original debt. For instance, an individual facing job loss might successfully negotiate a temporary forbearance or deferment.

Resources for Finding Reputable Financial Advisors

Finding a trustworthy financial advisor specializing in student loan debt requires careful research. Several resources can help you locate qualified professionals. Professional organizations, such as the National Association of Personal Financial Advisors (NAPFA) and the Certified Financial Planner Board of Standards, maintain directories of certified advisors. Online review platforms, while requiring careful scrutiny, can provide insights into the experiences of other clients. Referrals from trusted sources, such as friends, family, or your credit counseling agency, can also be invaluable. It’s crucial to verify the advisor’s credentials and experience before engaging their services.

Evaluating the Legitimacy and Trustworthiness of Financial Advice Sources

Before relying on any financial advice, it’s essential to evaluate the source’s legitimacy and trustworthiness. Look for advisors with appropriate certifications and licenses. Check their professional affiliations and look for evidence of a strong track record and positive client reviews. Be wary of sources promising unrealistic returns or quick fixes. Legitimate financial advisors will generally provide transparent and detailed information about their fees and services. Avoid advisors who pressure you into making immediate decisions or who seem overly focused on selling specific products rather than providing personalized guidance. Researching the advisor’s background through online resources and professional organizations is a crucial step in ensuring their credibility.

Understanding the Legal Implications

Falling behind on your student loan payments can have serious legal consequences. Understanding these implications is crucial to making informed decisions about your financial situation. The severity of these consequences depends on several factors, including the type of loan, the amount owed, and your individual circumstances.

Types of Student Loan Default and Their Consequences

Student loan default occurs when you fail to make payments for a specific period (typically 90 days). Different types of federal student loans have slightly different default processes, but the consequences are generally similar. Defaulting on a federal student loan can lead to wage garnishment (a portion of your paycheck is seized to repay the debt), tax refund offset (your tax refund is used to pay the debt), and the inability to obtain federal financial aid in the future. Furthermore, it can negatively impact your credit score, making it difficult to secure loans, rent an apartment, or even get certain jobs. Private student loans have their own default procedures, often involving collection agencies and potentially legal action. The specific consequences vary based on the lender’s policies and the terms of your loan agreement.

Legal Ramifications of Failing to Make Student Loan Payments

The legal ramifications of failing to make student loan payments extend beyond the immediate consequences of default. The government can take legal action to recover the debt, which might involve lawsuits, wage garnishment, and even the seizure of assets. The Department of Education, or its contracted collection agencies, has significant legal power to pursue repayment. This legal action can significantly impact your financial stability and overall well-being. Ignoring collection notices or failing to engage in repayment negotiations can worsen the situation and potentially lead to more aggressive legal action. It is important to understand that student loan debt is not easily discharged through bankruptcy.

Bankruptcy and Student Loan Debt

Bankruptcy is a legal process that can help individuals manage overwhelming debt. However, student loan debt is notoriously difficult to discharge through bankruptcy. While it’s not impossible, it requires demonstrating undue hardship, a high legal bar that involves proving your current financial situation and future prospects are severely compromised by the debt. The court will consider factors such as your income, expenses, and ability to repay the loan. Successfully proving undue hardship requires extensive documentation and legal representation, making it a complex and challenging process. The vast majority of bankruptcy filings do not result in the discharge of student loan debt.

Common Misconceptions About Student Loan Debt and Bankruptcy

It’s essential to dispel some common misconceptions surrounding student loan debt and bankruptcy:

- Misconception: All student loan debt is easily discharged in bankruptcy. Reality: Discharging student loan debt through bankruptcy is exceptionally difficult and requires demonstrating undue hardship, a very high legal standard.

- Misconception: Ignoring student loan debt will make it go away. Reality: Ignoring the debt will likely lead to default, resulting in serious legal and financial consequences, including wage garnishment and damage to your credit score.

- Misconception: Filing for bankruptcy automatically discharges all student loan debt. Reality: Bankruptcy rarely results in the discharge of student loans. A successful discharge requires proving undue hardship, a difficult legal process.

- Misconception: Student loan debt disappears after a certain number of years. Reality: Federal student loans generally do not have a statute of limitations, meaning they can be pursued indefinitely. Private loans may have statutes of limitations, but these are often long and vary by state.

Long-Term Financial Planning

Resolving your student loan debt is a significant achievement, but it’s only the first step towards long-term financial security. A comprehensive plan is crucial to ensure you don’t fall back into debt and can build a stable financial future. This involves carefully managing your finances, rebuilding your credit, and fostering strong financial habits.

Developing a robust post-debt financial strategy requires a multifaceted approach. This includes creating a realistic budget, setting financial goals, and actively working towards achieving them. It also involves understanding and utilizing various financial tools and resources to your advantage. Ignoring this crucial phase could lead to future financial instability, negating the hard work put into resolving the student loan issue.

Strategies for Credit Score Improvement

Improving your credit score after a default or delinquency requires consistent effort and patience. Strategies include paying all bills on time, maintaining low credit utilization (keeping your credit card balances low compared to your credit limit), and monitoring your credit report regularly for errors. Consider using credit-building tools like secured credit cards, which require a security deposit, to help establish a positive credit history. Consistent, responsible credit management will gradually improve your credit score, unlocking better financial opportunities in the future. For example, someone with a credit score in the low 500s who consistently pays their bills on time and keeps their credit utilization below 30% for a year might see their score increase by 50-100 points.

The Importance of Financial Literacy and Budgeting

Financial literacy is the foundation of sound financial management. It involves understanding concepts like budgeting, saving, investing, and debt management. Creating a realistic budget – a detailed plan for how you will spend your money each month – is essential for tracking your income and expenses. This allows you to identify areas where you can cut back and save more. Regularly reviewing and adjusting your budget is key to adapting to changing circumstances. For instance, using budgeting apps or spreadsheets can provide a clear picture of your spending habits, helping you identify areas for improvement. Moreover, understanding basic investing principles can help you grow your wealth over time.

A Sample Financial Roadmap

Imagine a roadmap divided into three phases. Phase 1 (Years 1-3): Focus is on debt elimination and emergency fund building. This involves aggressively paying down any remaining debts (beyond student loans), building an emergency fund of 3-6 months’ worth of living expenses, and establishing a positive credit history. Phase 2 (Years 4-7): This phase emphasizes saving for major goals, such as a down payment on a house or investing for retirement. It involves increasing contributions to retirement accounts and exploring different investment options. Phase 3 (Years 8+): This long-term phase involves maintaining financial stability, potentially paying off your mortgage, and continuing to invest for retirement and other long-term goals. This phase also includes regularly reviewing and adjusting your financial plan to adapt to life changes and economic shifts. This visual representation, while simplified, highlights the importance of a phased approach to long-term financial security. Each phase builds upon the previous one, leading to a more secure financial future.

Conclusion

Facing student loan debt doesn’t have to define your financial future. By proactively addressing the situation, exploring available resources, and implementing a strategic plan, you can regain control of your finances. Remember, seeking professional help and open communication with your loan servicer are vital steps in navigating this challenging journey. With careful planning and informed decision-making, you can work towards a debt-free future and achieve long-term financial stability.

FAQ Compilation

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and eventually default, resulting in wage garnishment or tax refund offset.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan with a new interest rate and repayment plan. This can simplify repayment but may not always lower your overall cost.

What is a forbearance?

A forbearance temporarily suspends or reduces your monthly payments. Interest may still accrue during this period, increasing your total debt.

Are there programs to help with student loan debt forgiveness?

Yes, several programs exist, such as Public Service Loan Forgiveness (PSLF) and income-driven repayment plans (IDRs), offering potential forgiveness after meeting specific criteria. Eligibility requirements vary.