Navigating the complexities of student loan repayment can be daunting, especially when faced with unexpected financial hardship. This guide provides a comprehensive overview of strategies to explore when you find yourself unable to meet your monthly payments. From understanding your loan types and repayment options to seeking professional assistance, we’ll equip you with the knowledge and resources to navigate this challenging situation effectively and responsibly.

We’ll cover various avenues, including income-driven repayment plans, deferment and forbearance, loan consolidation and refinancing, and the importance of proactive communication with your loan servicer. Furthermore, we’ll address the potential consequences of default and highlight resources available to prevent future financial difficulties. The goal is to empower you to make informed decisions and regain control of your financial future.

Understanding Your Situation

Facing difficulty in paying your student loans can be incredibly stressful. The severity of your financial hardship depends on several factors, including the amount of your debt, your income, and your overall expenses. Understanding the specifics of your situation is the first crucial step towards finding a solution. This involves assessing the total debt, your monthly payments, and exploring potential options for managing your debt.

Understanding the types of loans you have is also essential. Federal student loans, offered by the U.S. government, generally offer more flexible repayment options and protections compared to private student loans, which are offered by banks and other private lenders. Federal loans often have income-driven repayment plans, deferment, and forbearance options unavailable with private loans. Private loans, while potentially offering higher interest rates and less flexibility, might have specific repayment terms or options that you should understand. The implications of these differences are significant, influencing your eligibility for various repayment assistance programs.

Federal and Private Student Loan Differences

Federal student loans are backed by the government, providing several benefits. These include income-driven repayment plans that adjust your monthly payment based on your income and family size, deferment options (temporarily postponing payments), and forbearance (reducing or suspending payments). Private student loans, on the other hand, are subject to the lender’s terms and conditions. They typically offer fewer repayment options and less protection in case of financial hardship. Understanding whether your loans are federal or private is crucial in determining your available options. For example, a borrower with solely federal loans might qualify for an income-driven repayment plan, while someone with private loans might only be able to negotiate directly with the lender for repayment assistance.

Calculating Total Student Loan Debt and Monthly Payments

Accurately calculating your total student loan debt and monthly payments is vital for assessing your financial situation. This involves gathering information from your loan servicer(s) about the principal balance, interest rate, and any accrued interest for each loan.

- Gather Loan Information: Contact each of your loan servicers (the company managing your loans) to obtain a statement detailing your loan balance, interest rate, and repayment terms for each loan.

- Calculate Total Debt: Sum the principal balance of all your loans to determine your total student loan debt.

- Calculate Monthly Payments: Use an online loan calculator or the amortization schedule provided by your loan servicer to determine your current monthly payment for each loan. Many online calculators allow you to input loan amount, interest rate, and loan term to calculate monthly payment.

- Calculate Total Monthly Payment: Add the monthly payments for each loan to find your total monthly student loan payment.

For example, let’s say you have two federal loans: Loan A with a $10,000 balance, 5% interest, and a 10-year repayment term, and Loan B with a $5,000 balance, 4% interest, and a 5-year repayment term. Using an online loan calculator, you’d find the monthly payment for Loan A and add it to the monthly payment for Loan B to arrive at your total monthly student loan payment. This total will give you a clear picture of your current financial obligation.

To calculate monthly payment, you can use the following formula (though loan calculators are generally recommended for accuracy): M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1], where M = Monthly Payment, P = Principal Loan Amount, i = Monthly Interest Rate (Annual Interest Rate/12), and n = Number of Months.

Contacting Your Loan Servicer

Facing difficulty in paying your student loans requires proactive communication with your loan servicer. Open and honest dialogue is crucial to exploring potential solutions and avoiding negative consequences. Delaying contact will only exacerbate the situation.

The process of contacting your loan servicer involves clearly explaining your financial hardship and exploring available options. This might include requesting forbearance, deferment, or an income-driven repayment plan. Remember to be prepared to provide documentation supporting your financial situation, such as pay stubs, tax returns, or bank statements. The more organized and prepared you are, the more productive the conversation will be.

Communication Methods and Their Effectiveness

Effective communication with your loan servicer is paramount. Different methods offer varying levels of efficiency and formality. Choosing the right method depends on your comfort level and the urgency of the situation.

Phone calls offer immediate interaction and allow for clarification of complex issues. A phone conversation allows for a more personal approach, providing the opportunity to directly address concerns and negotiate solutions. However, phone calls can be time-consuming and may require multiple attempts to reach a representative. For example, you might experience long hold times or difficulty scheduling a call at a convenient time.

Emails provide a written record of your communication, offering a more formal and documented approach. This method is useful for complex issues requiring detailed explanations or the submission of supporting documentation. However, email responses may be delayed, and crucial details may be missed or misinterpreted. For instance, a nuanced explanation of your financial difficulties might be misinterpreted without the benefit of verbal clarification.

Mail, while the least efficient method, provides a tangible record of your communication and is suitable for sending official documentation. Sending documents via mail offers a more formal record of your request, but the response time is significantly slower than phone calls or emails. For example, sending a formal hardship letter by mail could take several weeks to receive a response, delaying the process of finding a solution.

Documenting Communication

Maintaining meticulous records of all communication with your loan servicer is essential. This includes keeping copies of all emails, letters, and detailed notes of phone calls. This documentation serves as proof of your efforts to resolve the situation and can be crucial if disputes arise later. For example, if your loan servicer fails to follow through on a promised action, your documentation will help you to advocate for yourself. It’s advisable to keep a dedicated file or folder to store all communication, organized by date and subject matter. This organized approach ensures easy access to relevant information when needed.

Exploring Repayment Options

Facing difficulty in repaying your student loans doesn’t mean you’re without options. Several repayment plans can help manage your debt more effectively, aligning your monthly payments with your income and financial situation. Understanding these options is crucial to finding a sustainable solution. Careful consideration of your individual circumstances is key to selecting the most appropriate plan.

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payment on your income and family size. Several different IDR plans exist, each with its own eligibility requirements, payment calculation methods, and long-term consequences. Choosing the right plan depends on your current financial situation and long-term financial goals.

Income-Driven Repayment Plan Comparison

The following table compares four common IDR plans: Income-Driven Repayment (IDR), Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Remember that eligibility criteria and payment calculations can change, so it’s vital to check the official Department of Education website for the most up-to-date information.

| Plan Name | Eligibility | Payment Calculation | Benefits/Drawbacks |

|---|---|---|---|

| Income-Driven Repayment (IDR) | Generally available to federal student loan borrowers. Specific requirements may vary slightly depending on the specific IDR plan chosen. | Based on your discretionary income (income minus 150% of the poverty guideline for your family size) and loan balance. | Benefits: Lower monthly payments than standard plans. Drawbacks: May result in a longer repayment period and potentially higher total interest paid over the life of the loan. |

| Income-Based Repayment (IBR) | Generally available to federal student loan borrowers who received their first loan on or before June 30, 2014. | Payment is calculated based on your discretionary income and loan balance. The calculation differs slightly depending on whether you received your loans before or after July 1, 2014. | Benefits: Lower monthly payments than standard plans. Drawbacks: May result in a longer repayment period and potentially higher total interest paid over the life of the loan. May not be available to all borrowers. |

| Pay As You Earn (PAYE) | Generally available to federal student loan borrowers who received their first loan on or after October 1, 2007. | Payment is calculated as 10% of your discretionary income. | Benefits: Lower monthly payments than standard plans. Drawbacks: May result in a longer repayment period and potentially higher total interest paid over the life of the loan. May not be available to all borrowers. |

| Revised Pay As You Earn (REPAYE) | Generally available to most federal student loan borrowers. | Payment is calculated as 10% of your discretionary income. | Benefits: Lower monthly payments than standard plans, potentially lower interest accrual during periods of deferment. Drawbacks: May result in a longer repayment period and potentially higher total interest paid over the life of the loan. |

Applying for and Switching Repayment Plans

The process for applying for and switching between IDR plans typically involves completing an application through your student loan servicer’s website. You will need to provide documentation verifying your income and family size, such as tax returns or pay stubs. Switching plans may require re-certification of your income annually or every few years, depending on the specific plan. The application process can take several weeks to complete, so it’s important to start early.

It’s crucial to understand that switching plans doesn’t erase existing debt; it simply alters the repayment schedule. Thoroughly review the terms and conditions of each plan before making a decision. Seeking guidance from a financial advisor specializing in student loan debt management can be invaluable in navigating this process and making informed choices.

Deferment and Forbearance

Navigating financial hardship while managing student loan debt can be challenging. Deferment and forbearance are two options that may provide temporary relief, but understanding their differences and potential consequences is crucial. Both offer a pause or reduction in your monthly payments, but they differ significantly in their eligibility criteria and long-term effects.

Deferment and forbearance are temporary pauses in your student loan payments. However, they differ in their eligibility requirements and how they impact your loans. Understanding these differences is critical for making informed decisions about your financial future.

Deferment Eligibility and Limitations

Deferment allows you to temporarily suspend your student loan payments. Eligibility typically hinges on specific circumstances, such as unemployment, enrollment in a qualifying graduate program, or experiencing economic hardship. The exact requirements and documentation needed vary depending on your loan type and lender. For instance, a deferment might be granted for up to three years for unemployment, but this period may not be renewable. Moreover, interest may or may not accrue depending on the type of loan. Federal subsidized loans generally do not accrue interest during deferment, while unsubsidized loans do. Private loans often have different rules, so it’s important to review your loan agreement.

Forbearance Eligibility and Limitations

Forbearance, unlike deferment, is generally granted at the discretion of your loan servicer. It’s typically used when you’re facing temporary financial difficulties that prevent you from making payments, even if you don’t meet the strict eligibility criteria for deferment. Forbearance can be granted for various reasons, such as illness or unexpected job loss. However, it’s crucial to understand that interest usually accrues during forbearance, leading to a larger overall loan balance when payments resume. The length of a forbearance period is also typically shorter than a deferment period, and repeated requests may be subject to stricter review.

Impact on Credit Score and Long-Term Repayment

Both deferment and forbearance can negatively impact your credit score, as they indicate that you are not making timely payments on your loans. The impact can vary depending on the length of the deferment or forbearance period, your overall credit history, and the reporting practices of your loan servicer. Furthermore, because interest usually accrues during forbearance (and sometimes during deferment), your total loan balance will likely be higher when payments resume, potentially extending your repayment period and increasing the total interest paid over the life of the loan. This could result in paying significantly more than the original loan amount.

Decision-Making Flowchart

[Imagine a flowchart here. The flowchart would begin with a diamond shape: “Facing difficulty making student loan payments?” A “yes” branch would lead to a rectangle: “Contact your loan servicer.” From there, two branches would emerge: one leading to a rectangle: “Meet deferment eligibility requirements?” and the other to a rectangle: “Request forbearance.” The “deferment eligibility requirements” rectangle would have a “yes” branch leading to a rectangle: “Deferment granted” and a “no” branch leading to the “request forbearance” rectangle. The “request forbearance” rectangle would lead to a rectangle: “Forbearance granted.” Both “Deferment granted” and “Forbearance granted” would lead to a final rectangle: “Monitor your loan status and plan for repayment.”]

The flowchart visually represents the decision process. First, contact your servicer to discuss your options. If you meet the criteria for deferment, this is generally the preferred option as interest may not accrue on subsidized federal loans. If not, forbearance is an alternative, but be aware of the accruing interest. Regardless of the chosen option, careful monitoring and planning for repayment are crucial.

Loan Consolidation and Refinancing

Managing multiple student loans can be overwhelming, leading to difficulties in tracking payments and understanding interest rates. Consolidation and refinancing offer potential solutions by simplifying your loan repayment process. However, it’s crucial to carefully weigh the advantages and disadvantages of each before making a decision.

Consolidating multiple student loans into a single loan streamlines your payments into one monthly bill, making budgeting easier. Refinancing, on the other hand, involves replacing your existing loans with a new loan from a private lender, often at a lower interest rate. Both options can simplify your financial life, but they differ significantly in terms of eligibility, interest rates, and potential benefits.

Federal Loan Consolidation versus Private Loan Refinancing

Federal loan consolidation combines your eligible federal student loans into a single, new federal loan. This process simplifies repayment, but it typically doesn’t lower your interest rate; instead, it calculates a weighted average of your existing rates. In contrast, private loan refinancing involves securing a new loan from a private lender to pay off your existing federal and/or private student loans. This option *can* potentially lower your interest rate, but it comes with the loss of federal student loan benefits, such as income-driven repayment plans and deferment/forbearance options. Choosing between these options depends on your individual circumstances and financial goals. For example, borrowers with a strong credit history and stable income may benefit from refinancing to secure a lower interest rate, while those prioritizing federal loan benefits might prefer consolidation.

Factors to Consider When Choosing a Loan Consolidation or Refinancing Program

Several factors influence the decision of whether to consolidate or refinance your student loans. First, consider your credit score. A higher credit score typically qualifies you for better interest rates on private refinancing loans. Second, evaluate your current interest rates. Refinancing is most beneficial when your current rates are higher than what’s offered by private lenders. Third, assess the terms and conditions of different loan programs. Pay close attention to fees, repayment periods, and any penalties for early repayment. Fourth, understand the potential loss of federal student loan benefits. Refinancing with a private lender often means losing access to income-driven repayment plans and other federal protections. Finally, carefully compare the total cost of each option, factoring in interest rates, fees, and the length of the repayment period. For instance, a lower interest rate with a longer repayment term might ultimately cost more in total interest paid.

Seeking Professional Help

Navigating the complexities of student loan debt can be overwhelming, and seeking professional guidance is often a crucial step towards finding a manageable solution. Fortunately, several resources are available to provide support and assistance to individuals struggling with student loan repayment. These resources offer a range of services, from financial counseling and debt management plans to legal representation.

Many individuals find it beneficial to seek professional help when facing significant student loan debt. Understanding the available resources and how to access them can significantly improve the chances of successfully managing and resolving the financial challenges involved. This section will explore the different avenues for obtaining professional assistance.

Non-profit Credit Counseling Agencies

Non-profit credit counseling agencies offer valuable services to individuals struggling with debt, including student loans. These agencies are typically staffed with certified credit counselors who provide unbiased advice and guidance. Their services are often offered at a low cost or on a sliding scale based on income.

The services offered by credit counseling agencies include debt management plans (DMPs), which consolidate multiple debts into a single monthly payment with a lower interest rate. They also provide valuable financial education resources, teaching budgeting techniques, debt management strategies, and long-term financial planning. These agencies can help individuals create a realistic budget, identify areas where they can reduce spending, and develop a comprehensive plan for managing their finances. A DMP, however, will appear on your credit report. It’s important to weigh the benefits of a DMP against the potential negative impact on your credit score.

Government Programs

The federal government offers several programs designed to assist individuals with student loan repayment. These programs often provide options for income-driven repayment plans, which adjust monthly payments based on income and family size. Some programs also offer loan forgiveness or cancellation for individuals working in public service or certain professions. The specific eligibility criteria and benefits vary depending on the program. Researching and understanding the available government programs is essential for determining which options might be suitable for an individual’s specific circumstances. Examples include the Public Service Loan Forgiveness (PSLF) program and Income-Driven Repayment (IDR) plans. These programs require specific criteria to be met for loan forgiveness or reduced monthly payments.

Legal Assistance

In some cases, individuals may require legal assistance to navigate complex issues related to student loan debt. Legal professionals specializing in consumer law or bankruptcy can provide advice on legal options, such as negotiating with lenders, challenging unfair practices, or exploring bankruptcy as a last resort. Seeking legal counsel can be particularly helpful if facing aggressive collection tactics, loan modification disputes, or complex legal issues related to student loans. It’s important to note that bankruptcy is a significant financial decision with long-term consequences and should be considered carefully after exploring all other available options.

Preventing Future Financial Difficulties

Successfully navigating student loan debt requires not only addressing current challenges but also proactively preventing future financial difficulties. This involves developing sound financial habits, improving financial literacy, and creating a sustainable plan for managing your finances. By implementing these strategies, you can build a stronger financial foundation and avoid similar struggles in the future.

A crucial first step is creating a realistic budget. This allows you to visualize your income and expenses, identify areas for potential savings, and develop a manageable repayment plan for your student loans. Understanding your spending habits is key to making informed financial decisions.

Budget Template and Repayment Planning

A simple budget template can be created using a spreadsheet or budgeting app. It should include all sources of income (salary, part-time jobs, etc.) and all expenses (rent, utilities, groceries, transportation, entertainment, loan repayments). Categorizing expenses helps identify areas where you can potentially reduce spending. Once you have a clear picture of your income and expenses, you can create a realistic repayment plan for your student loans. This plan should incorporate your budget constraints and allow for comfortable loan repayment without jeopardizing your essential living expenses. For example, if your monthly income is $3000 and your essential expenses are $2000, you have $1000 left for loan repayment and other expenses. Allocate a specific amount each month towards your student loans, ensuring it’s a manageable amount within your budget.

Improving Financial Literacy and Informed Borrowing

Improving financial literacy is essential for making informed decisions about borrowing money for education and managing your finances overall. This includes understanding concepts such as interest rates, credit scores, and different types of loans. Before taking out any loan, carefully compare interest rates, repayment terms, and fees from different lenders. Consider the total cost of borrowing and whether the potential return on your education justifies the debt you’re taking on. Seek advice from financial advisors or utilize free online resources to enhance your understanding of personal finance. For instance, understanding the difference between simple and compound interest can significantly impact your long-term financial health. Compound interest, where interest is calculated on both the principal and accumulated interest, can lead to a larger debt burden over time if not carefully managed.

Resources for Financial Education and Budgeting Tools

Numerous resources are available to assist with financial education and budgeting. Many non-profit organizations offer free financial counseling and workshops. Online budgeting tools and apps can help you track your spending, create a budget, and set financial goals. Government websites often provide information on financial aid and loan repayment programs. For example, the Consumer Financial Protection Bureau (CFPB) offers valuable resources and educational materials on various aspects of personal finance, including student loan management. Similarly, many universities and colleges have financial aid offices that can provide guidance and support to students and alumni regarding student loan repayment. Utilizing these resources can significantly improve your financial literacy and empower you to make informed decisions about your financial future.

Understanding the Implications of Default

Defaulting on your student loans has serious and long-lasting consequences that can significantly impact your financial well-being. It’s crucial to understand these implications before reaching that point. Failing to make payments can lead to a cascade of negative effects, making it harder to recover financially.

Defaulting on federal student loans triggers a series of actions by the government to recover the debt. These actions can severely impact your credit score, making it difficult to obtain loans, rent an apartment, or even secure certain jobs. The consequences can be financially devastating and far-reaching, extending beyond the immediate debt itself.

Wage Garnishment

Wage garnishment is a legal process where a portion of your paycheck is automatically withheld to pay your defaulted student loans. The amount withheld can be substantial, leaving you with limited funds to cover your essential living expenses. The process typically begins after the Department of Education has exhausted other collection methods. For example, a borrower might find 15% of their paycheck garnished until the debt is settled. This can create significant hardship and make budgeting extremely challenging.

Tax Refund Offset

The government can also seize a portion or all of your federal tax refund to apply towards your defaulted student loans. This means that the money you were expecting to receive back as a refund will instead be used to pay down your debt. This can be particularly frustrating, especially for those who rely on their tax refund for essential expenses or debt repayment. The IRS will intercept the refund directly, and the borrower will not receive the money.

Damage to Credit Score

Defaulting on student loans significantly damages your credit score. This negative mark remains on your credit report for seven years, making it difficult to obtain loans, credit cards, or even rent an apartment. A lower credit score can lead to higher interest rates on future loans, making it more expensive to borrow money. Landlords and employers often check credit reports, so a poor credit score can also limit your housing and employment options. For example, a credit score impacted by a default could drop significantly, increasing interest rates on a mortgage by several percentage points.

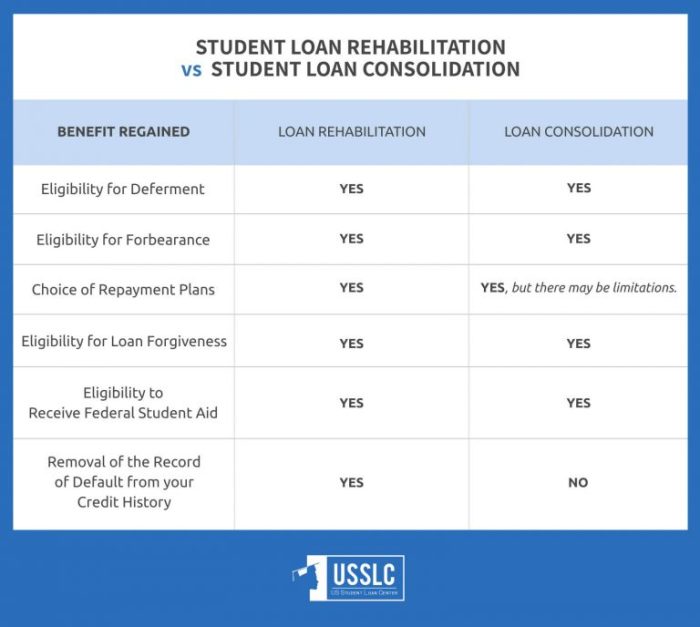

Loan Rehabilitation

Loan rehabilitation is a process that allows you to restore your defaulted federal student loans to good standing. It involves making nine on-time payments over a 10-month period. Once completed, the default is removed from your credit report, and you may be eligible for various repayment plans. However, it’s important to note that interest continues to accrue during the rehabilitation period. While rehabilitation can improve your credit standing, it doesn’t erase the fact that you defaulted; it merely mitigates the long-term impact.

Steps to Avoid Defaulting on Student Loans

It’s essential to proactively manage your student loans to avoid default. Creating a budget, exploring repayment options, and communicating with your loan servicer are crucial steps. Consider these actions to prevent default:

- Create a realistic budget that includes your student loan payments.

- Contact your loan servicer immediately if you anticipate difficulties making payments.

- Explore available repayment plans, such as income-driven repayment, to lower your monthly payments.

- Consider loan consolidation or refinancing to simplify payments and potentially lower interest rates.

- Seek professional financial counseling to create a personalized debt management plan.

Concluding Remarks

Facing the inability to pay student loans can be stressful, but understanding your options and taking proactive steps is crucial. Remember, effective communication with your loan servicer, exploring available repayment plans, and seeking professional guidance when needed are vital components of successfully managing your student loan debt. By proactively addressing your financial situation and utilizing the resources available, you can work towards a path that leads to financial stability and long-term well-being.

FAQs

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score and lead to late fees. Contact your loan servicer immediately to discuss options to avoid further penalties.

Can I negotiate a lower monthly payment?

Depending on your circumstances and loan type, you may be able to negotiate a lower payment or explore alternative repayment plans. Contact your loan servicer to discuss possibilities.

What is the difference between default and delinquency?

Delinquency refers to being late on payments, while default occurs after a prolonged period of non-payment, leading to more severe consequences.

Are there government programs to help with student loan debt?

Yes, several government programs offer assistance, including income-driven repayment plans and loan forgiveness programs for specific professions.