Navigating the world of student loans can feel overwhelming, especially when confronted with the crucial question: what constitutes a favorable interest rate? Understanding interest rates is paramount to responsible borrowing and long-term financial health. This guide will demystify the process, providing you with the knowledge to make informed decisions about your student loan financing.

We’ll explore the nuances of fixed versus variable rates, delve into the differences between federal and private loans, and examine the key factors influencing your interest rate, such as credit score and repayment plan. Ultimately, our aim is to equip you with the tools to secure the most advantageous terms possible for your educational funding.

Understanding Student Loan Interest Rates

Navigating the world of student loans requires a solid understanding of interest rates, as they significantly impact the total cost of your education. This section clarifies the different types of rates, the factors influencing them, and how they are calculated.

Fixed vs. Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate fluctuates based on an underlying index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could change over time.

Factors Influencing Student Loan Interest Rates

Several factors determine the interest rate you’ll receive on your student loans. Your credit score plays a significant role; a higher credit score often qualifies you for a lower interest rate. The type of loan also matters; federal student loans generally have lower rates than private student loans. Your chosen repayment plan can indirectly affect your interest rate; while the plan itself doesn’t directly change the rate, deferment or forbearance periods can lead to accumulating more interest over time, effectively increasing the overall cost.

Interest Rate Calculation and Application

Interest rates are typically expressed as an annual percentage rate (APR). The interest accrued depends on the principal balance, the interest rate, and the time period. For example, if you have a $10,000 loan with a 5% annual interest rate, the simple interest accrued in one year would be $500 ($10,000 x 0.05). However, most student loans use compound interest, meaning interest is calculated on both the principal and accumulated interest. This means that the interest accrued each year will increase as the loan balance grows. The calculation becomes more complex with monthly compounding, requiring a more sophisticated formula. Most loan servicers provide online tools or statements that clearly show the interest calculation for each billing cycle.

Comparison of Fixed and Variable Interest Rates

| Type | Rate | Advantages | Disadvantages |

|---|---|---|---|

| Fixed | Constant throughout the loan term | Predictable monthly payments; budget stability; less risk of unexpectedly higher payments. | May offer a slightly higher initial rate compared to a variable rate if market rates are low. |

| Variable | Fluctuates based on an index | Potentially lower initial rate if market rates are low. | Unpredictable monthly payments; risk of significantly higher payments if market rates rise; budgeting challenges. |

Federal vs. Private Student Loans

Choosing between federal and private student loans is a crucial decision for any student, significantly impacting their long-term financial well-being. Understanding the differences in interest rates and eligibility requirements is paramount to making an informed choice. This section will compare and contrast these loan types, focusing on how interest rates are determined and which option might be more advantageous in specific circumstances.

Federal and private student loans differ significantly in their interest rate structures, eligibility criteria, and overall repayment terms. These differences stem from the distinct roles of the federal government and private lenders in the student loan market. Federal loans are backed by the government, offering various protections and benefits not found in private loans. Private loans, on the other hand, are offered by banks, credit unions, and other financial institutions, and their terms are often more variable and less protective.

Interest Rate Comparison

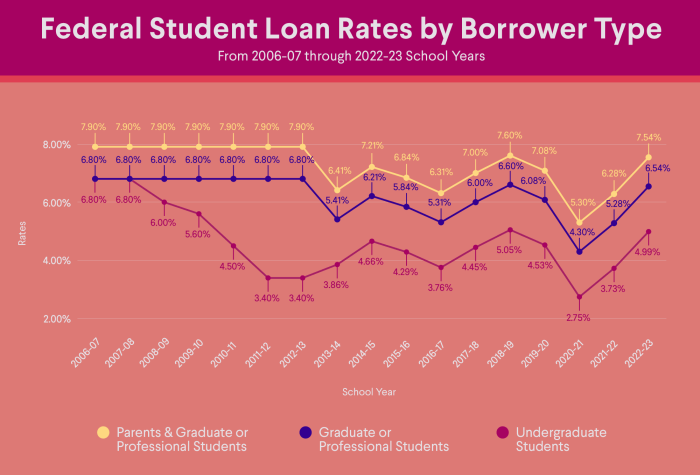

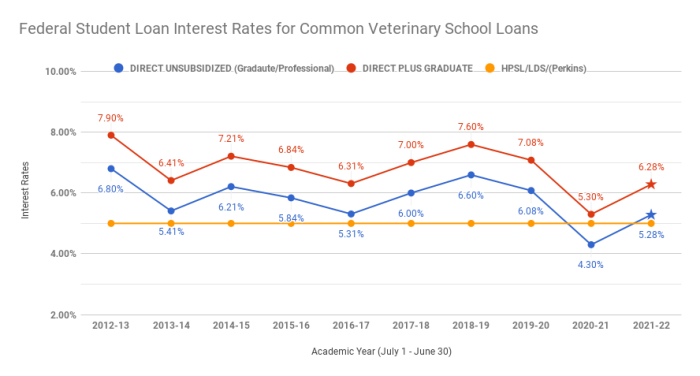

Federal student loan interest rates are generally lower than those offered by private lenders. This is because the federal government subsidizes these loans, aiming to make higher education more accessible. The specific interest rate for a federal loan depends on the loan type (e.g., subsidized vs. unsubsidized), the loan’s disbursement date, and the borrower’s credit history (though this is less of a factor than with private loans). In contrast, private student loan interest rates are variable and influenced by several factors, including the borrower’s credit score, credit history, income, and the co-signer’s creditworthiness (if applicable). A borrower with excellent credit might secure a lower interest rate on a private loan, while a borrower with limited or poor credit might face significantly higher rates.

Eligibility Requirements and Their Impact on Interest Rates

Eligibility for federal student loans is primarily determined by the student’s enrollment status and financial need (for subsidized loans). Credit history is not a major factor in determining eligibility or interest rates for federal loans. Conversely, private student loans require borrowers to meet specific creditworthiness standards. Lenders assess the applicant’s credit score, debt-to-income ratio, and overall financial stability. A strong credit history often results in a lower interest rate on a private loan, while a weak credit history can lead to higher rates or even loan denial. The availability of a creditworthy co-signer can significantly impact eligibility and interest rates for private loans.

Scenarios Favoring Federal or Private Loans Based on Interest Rates

Scenario 1: A student with a strong academic record and limited credit history is likely to secure a lower interest rate on a federal loan compared to a private loan, even if they qualify for a private loan. Federal loans are more accessible and less reliant on creditworthiness.

Scenario 2: A graduate student with excellent credit and a high income might find a competitive interest rate on a private loan, potentially lower than what’s available through federal loan programs. Their established creditworthiness makes them an attractive borrower for private lenders.

Scenario 3: A student with poor credit or limited credit history might find it extremely difficult or impossible to secure a private student loan. Federal loans provide a safety net in such situations, although the interest rates might be higher than what they could obtain with better credit.

Decision-Making Flowchart for Choosing Between Federal and Private Student Loans

This flowchart visually represents the decision-making process:

[Imagine a flowchart here. The flowchart would start with a question: “Do you meet the eligibility requirements for federal student loans?”. If yes, it branches to “Can you cover your educational costs with federal loans alone?”. If yes, it leads to “Choose federal loans”. If no, it branches to “Are you eligible for private loans and can you secure a lower interest rate than available through federal loans?”. If yes, it leads to “Consider a combination of federal and private loans”. If no, it leads to “Choose federal loans”. If the initial question is no, it leads directly to “Explore private loan options”.]

The flowchart illustrates the importance of exploring all available options and carefully comparing interest rates before making a final decision. Prioritizing federal loans due to their borrower protections is generally recommended unless a private loan offers demonstrably superior terms.

Factors Affecting Your Student Loan Interest Rate

Securing a student loan involves understanding the factors that influence the interest rate you’ll be charged. Several key elements contribute to the final interest rate, impacting your monthly payments and overall loan cost. Lenders carefully assess these factors to determine the level of risk associated with lending you money.

Several factors influence the interest rate a lender offers on a student loan. These factors are weighed differently depending on the type of loan (federal or private) and the lender’s specific policies. Understanding these factors empowers borrowers to make informed decisions and potentially secure more favorable terms.

Credit History

A strong credit history is a significant factor in determining your interest rate. Lenders view a history of responsible borrowing and timely repayments as a positive indicator of your ability to manage debt. Conversely, a poor credit history, including late payments, defaults, or high credit utilization, significantly increases your perceived risk to the lender, leading to higher interest rates or even loan denial. For example, a borrower with a FICO score above 750 might qualify for a significantly lower rate than someone with a score below 600. Building and maintaining a good credit score is crucial for obtaining favorable loan terms.

Co-Signer Impact

The inclusion of a co-signer can dramatically influence your interest rate. A co-signer is an individual with a strong credit history who agrees to share responsibility for repaying the loan. Their good credit history mitigates the lender’s risk, often resulting in a lower interest rate for the primary borrower. The co-signer essentially acts as a guarantor, reducing the likelihood of default. However, it’s important to remember that a co-signer remains financially liable for the loan if the primary borrower fails to repay.

Loan Type

Federal student loans generally offer lower, fixed interest rates compared to private loans. Federal loans are backed by the government, which reduces the lender’s risk. Private loans, on the other hand, carry higher interest rates, which can vary significantly based on the borrower’s creditworthiness and the lender’s assessment of risk. The interest rates on federal loans are often set by the government and can change annually.

Loan Amount and Term

The amount borrowed and the loan repayment term also affect the interest rate. Larger loan amounts may be associated with higher interest rates, reflecting a higher level of risk for the lender. Similarly, longer repayment terms can result in higher overall interest paid, although the monthly payments will be lower. Lenders might offer slightly different rates for different loan terms, incentivizing shorter repayment periods to mitigate risk.

Prioritized List of Factors Influencing Interest Rates

The following list prioritizes the factors influencing student loan interest rates, from most to least influential:

- Credit History: A strong credit history significantly lowers interest rates, while a poor history dramatically increases them.

- Co-signer: The presence of a co-signer with excellent credit can substantially reduce the interest rate.

- Loan Type: Federal loans generally offer lower rates than private loans.

- Loan Amount and Term: Larger loan amounts and longer repayment terms can lead to slightly higher interest rates.

Strategies for Securing a Lower Interest Rate

Improving your chances of securing a lower interest rate requires proactive steps:

- Build a strong credit history: Pay bills on time, keep credit utilization low, and monitor your credit report regularly.

- Secure a co-signer with excellent credit: A co-signer with a high credit score can significantly improve your chances of getting a lower rate.

- Explore federal loan options first: Federal student loans typically offer more favorable interest rates than private loans.

- Consider shorter repayment terms: While monthly payments will be higher, shorter repayment periods can lead to lower overall interest paid.

- Shop around for the best rates: Compare offers from multiple lenders to find the most competitive interest rate.

Repayment Plans and Interest Rates

Choosing the right student loan repayment plan significantly impacts the total cost of your education. The plan you select directly influences how much interest you accrue and the overall amount you repay. Understanding the nuances of different repayment options is crucial for long-term financial health.

Different repayment plans affect the total interest paid by altering the length of the repayment period and the monthly payment amount. Standard repayment plans typically involve fixed monthly payments over a 10-year period, while income-driven repayment plans adjust payments based on your income and family size, often extending the repayment period to 20 or even 25 years. This longer repayment period, while offering lower monthly payments, results in significantly higher total interest paid over the life of the loan.

Standard Repayment Plans and Interest Accrual

Standard repayment plans, often the default option, require fixed monthly payments over a 10-year period. This approach leads to quicker loan payoff but results in higher monthly payments. While the shorter repayment period minimizes total interest paid, the higher monthly payments can be challenging for recent graduates entering the workforce. For example, a $30,000 loan with a 5% interest rate under a standard 10-year plan would result in approximately $32,500 in total repayment, with roughly $2,500 being interest.

Income-Driven Repayment Plans and Interest Accrual

Income-driven repayment (IDR) plans offer lower monthly payments by adjusting payments based on your discretionary income and family size. These plans typically extend the repayment period to 20 or 25 years. The longer repayment term significantly increases the total interest paid. Using the same $30,000 loan example with a 5% interest rate, an IDR plan with a 20-year repayment period could result in total repayment exceeding $40,000, with more than $10,000 attributable to interest. This illustrates the significant cost of extended repayment. The lower monthly payments are appealing in the short term, but the substantial increase in total interest paid must be carefully considered.

Comparison of Standard and Income-Driven Repayment Plans

The following table summarizes the key differences between standard and income-driven repayment plans, highlighting their impact on total interest paid:

| Feature | Standard Repayment Plan | Income-Driven Repayment Plan |

|---|---|---|

| Repayment Period | 10 years | 20-25 years |

| Monthly Payment | Higher | Lower |

| Total Interest Paid | Lower | Higher |

| Financial Impact | Faster payoff, higher initial payments | Lower initial payments, higher total cost |

Choosing a repayment plan is a personal decision that requires careful consideration of your current financial situation and long-term goals. It’s crucial to weigh the benefits of lower monthly payments against the potential for significantly higher total interest costs.

Shopping for the Best Rates

Securing the most favorable student loan interest rate requires diligent research and comparison. Understanding the nuances of different lenders and loan terms is crucial to making an informed decision that minimizes your long-term borrowing costs. This involves more than simply looking at the advertised interest rate; it encompasses a comprehensive evaluation of the entire loan package.

Finding the best student loan interest rate isn’t a passive process; it’s an active pursuit demanding careful consideration and comparison shopping. Several strategies can significantly improve your chances of securing a competitive rate, from utilizing online comparison tools to directly contacting lenders. Remember, a lower interest rate translates to substantial savings over the life of the loan.

Comparison Shopping Strategies

To effectively compare student loan interest rates, begin by gathering information from multiple lenders. This should include both federal loan programs and private lenders. Avoid focusing solely on the advertised interest rate; instead, scrutinize the Annual Percentage Rate (APR), which incorporates fees and other charges into the overall cost of borrowing. Using online comparison tools, such as those offered by financial websites, can streamline this process by presenting various loan options side-by-side. These tools often allow you to filter results based on your specific financial situation and loan needs. Remember to check the lender’s reputation and read reviews before making any decisions.

Utilizing Online Resources and Tools

Many reputable websites offer free tools to compare student loan interest rates. These tools typically require you to input basic information, such as your credit score, desired loan amount, and educational goals. The results will then display a range of loan offers from various lenders, allowing for a direct comparison of interest rates, fees, and repayment terms. Some popular resources include government websites offering information on federal student loans and independent financial comparison sites. These sites often provide detailed explanations of the various loan options and highlight potential pitfalls to avoid. Always ensure the site you are using is reputable and secure.

Understanding Loan Terms and Fees

Beyond the interest rate itself, several other factors significantly influence the overall cost of your student loan. These include origination fees, late payment penalties, and prepayment penalties. Origination fees are upfront charges that are typically deducted from the loan amount. Late payment penalties can significantly increase your overall borrowing costs, so it’s essential to make on-time payments consistently. Prepayment penalties, while less common, can discourage early repayment of the loan. Carefully reviewing the loan terms and conditions is crucial to understanding these fees and avoiding unexpected charges. Consider the total cost of the loan, including all fees and interest, when making your decision.

Questions to Ask Lenders

Before committing to a student loan, it is vital to have a clear understanding of all aspects of the loan agreement. The following checklist of questions can guide your discussions with potential lenders:

- What is the APR (Annual Percentage Rate) for this loan?

- What are all the fees associated with this loan (origination, late payment, prepayment)?

- What is the repayment schedule, and what are the minimum monthly payments?

- What happens if I miss a payment?

- What are the options for deferment or forbearance if I experience financial hardship?

- What is the lender’s reputation and customer service record?

- Are there any prepayment penalties?

- What is the loan’s grace period?

By thoroughly investigating and comparing various loan offers, and by asking these crucial questions, students can significantly improve their chances of securing the most favorable student loan interest rate and minimizing their long-term financial burden.

Visual Representation of Interest Accrual

Understanding how interest accrues on student loans is crucial for effective financial planning. A visual representation can significantly clarify the complex interplay between loan amount, interest rate, repayment plan, and the total cost of borrowing. The following examples illustrate this using hypothetical scenarios.

The most effective way to visualize interest accrual is through a line graph. The x-axis represents time (in years), and the y-axis represents the total amount owed (principal plus accumulated interest). Multiple lines can be plotted on the same graph, each representing a different scenario. For example, one line could show the interest accrual on a $20,000 loan with a 5% interest rate under a standard repayment plan, while another line could show the same loan amount but with a 7% interest rate and an extended repayment plan.

Interest Accrual Under Different Interest Rates

Consider two scenarios: Scenario A involves a $10,000 loan with a 4% annual interest rate, and Scenario B involves the same loan amount but with a 7% annual interest rate. Both loans utilize a standard 10-year repayment plan. The graph would show two lines diverging over time. The line for Scenario B (7% interest) would rise more steeply than the line for Scenario A (4%), indicating a significantly higher total repayment amount due to the increased interest charges. After 10 years, the difference between the total amounts repaid under both scenarios would be substantial, highlighting the impact of even a seemingly small difference in interest rates.

Interest Accrual Under Different Repayment Plans

This graph would illustrate the impact of repayment plan choice on the total interest paid. Imagine a $20,000 loan with a 6% interest rate. One line would represent a standard 10-year repayment plan, and another would represent an extended 20-year repayment plan. While the 20-year plan results in lower monthly payments, the graph would clearly show that the total interest paid over the life of the loan is considerably higher compared to the 10-year plan. The line for the 20-year plan would remain elevated for a longer period, showcasing the cumulative effect of interest accumulation over an extended timeframe. This visual clearly demonstrates the trade-off between lower monthly payments and a higher overall cost.

Illustrative Graph Description

Imagine a graph with a clearly labeled x-axis (Years) and y-axis (Total Amount Owed). Three lines are plotted: Line A represents a $10,000 loan at 5% interest with a 10-year repayment plan; Line B represents the same loan but with a 7% interest rate and a 10-year repayment plan; and Line C represents a $10,000 loan at 5% interest with a 15-year repayment plan. Line B would show a steeper incline than Line A, indicating faster interest accumulation due to the higher interest rate. Line C would show a gentler incline than Line A initially, but it would extend further along the x-axis, demonstrating the longer repayment period and higher total interest paid over time, despite the lower interest rate.

Final Wrap-Up

Securing a favorable student loan interest rate requires careful research, understanding of your financial situation, and proactive planning. By comparing loan offers, understanding the impact of different repayment plans, and leveraging strategies to improve your creditworthiness, you can significantly reduce the overall cost of your education. Remember, a lower interest rate translates to substantial long-term savings, allowing you to focus on your studies and future career prospects without the burden of excessive debt.

FAQ Summary

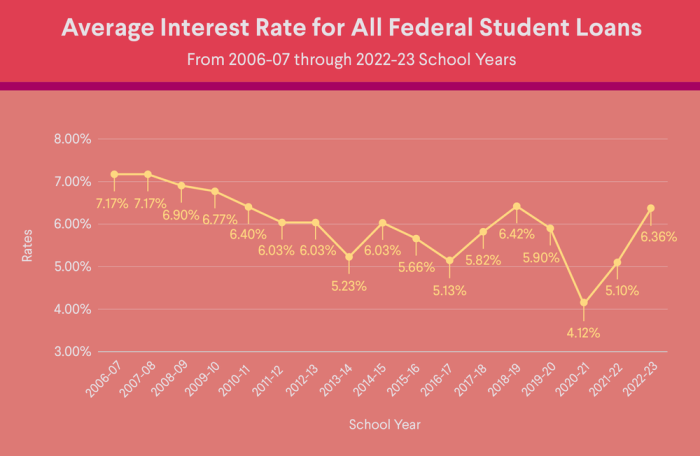

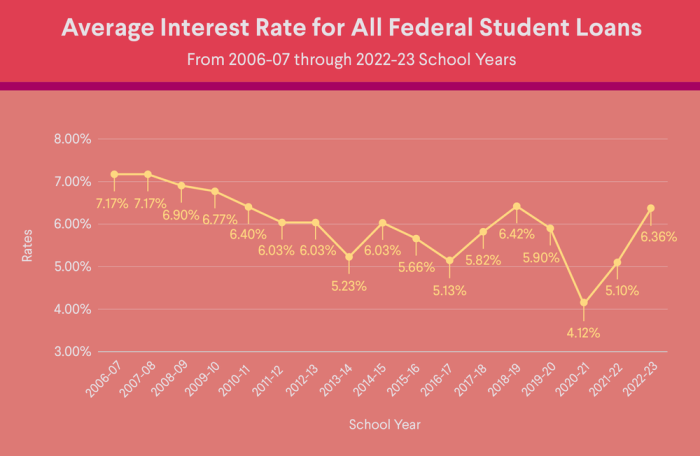

What is the average student loan interest rate?

The average interest rate varies depending on the loan type (federal or private), the borrower’s creditworthiness, and the prevailing market conditions. There’s no single “average” rate; it fluctuates considerably.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it’s crucial to compare offers carefully and consider the terms and fees involved. Refinancing typically involves private lenders and may affect your eligibility for federal loan benefits.

How does my credit score affect my student loan interest rate?

A higher credit score generally leads to a lower interest rate. Lenders view borrowers with strong credit history as less risky, thus offering more favorable terms.

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans do. This can significantly impact the total amount you owe.