Navigating the complex world of student loans often leaves borrowers questioning the average interest rates they’ll face. Understanding these rates is crucial for responsible financial planning, as they significantly impact the overall cost of higher education and long-term repayment. This exploration delves into the factors influencing these rates, highlighting the key differences between federal and private loans, and offering strategies for minimizing their impact.

From subsidized and unsubsidized federal loans to the variable and fixed rates offered by private lenders, the landscape of student loan interest is multifaceted. This guide aims to demystify this process, providing clear explanations and practical advice to empower students and borrowers to make informed decisions.

Understanding the Average Student Loan Interest Rate

The average student loan interest rate is a crucial factor for prospective borrowers, significantly impacting the total cost of their education. Understanding this average, however, requires considering several influencing factors and the distinctions between federal and private loans. This section will delve into these aspects, providing a clearer picture of student loan interest rate dynamics.

Factors Influencing the Average Student Loan Interest Rate

Several economic and legislative factors interplay to determine the average student loan interest rate. The prevailing market interest rates are a primary driver; when broader interest rates rise, so too do student loan rates, reflecting the increased cost of borrowing for lenders. Government policies, particularly those concerning federal student loan programs, also play a significant role. Changes in legislation, such as adjustments to the interest rate calculation methods or the introduction of new loan programs, directly affect the average rate. Furthermore, the creditworthiness of the borrower influences the interest rate, particularly for private loans. Borrowers with higher credit scores generally qualify for lower interest rates. Finally, the type of loan (e.g., subsidized vs. unsubsidized) also affects the interest rate.

Federal vs. Private Student Loan Interest Rates

Federal and private student loans differ substantially in their interest rate structures. Federal student loans typically offer fixed interest rates set by the government, providing predictability for borrowers. These rates are often lower than those offered by private lenders, reflecting the government’s role in supporting access to higher education. Private student loans, on the other hand, have variable interest rates that fluctuate based on market conditions. This variability can lead to unpredictable repayment costs. Furthermore, private loan interest rates are heavily influenced by the borrower’s credit history and creditworthiness, with those possessing better credit receiving lower rates. The eligibility criteria for federal loans are generally broader than those for private loans, making them more accessible to a wider range of students.

Historical Overview of Student Loan Interest Rate Fluctuations

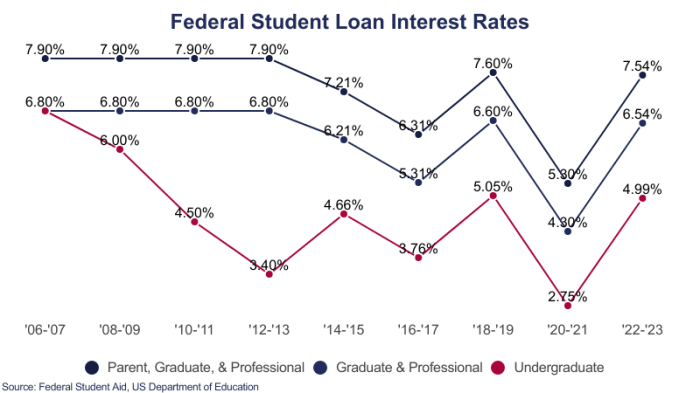

Student loan interest rates have not remained static; they’ve fluctuated significantly throughout history, influenced by broader economic trends and government policies. For instance, during periods of low inflation and economic stability, rates have generally been lower. Conversely, during times of economic uncertainty or high inflation, interest rates have tended to rise. Analyzing historical data reveals cyclical patterns, with rates increasing and decreasing in response to macroeconomic shifts. For example, the period following the 2008 financial crisis saw a period of relatively low interest rates on federal student loans, followed by a gradual increase in subsequent years. Tracking these historical trends can provide valuable insights into potential future fluctuations.

Average Interest Rates Across Different Loan Types

The table below presents a comparison of average interest rates across various student loan types. Note that these are averages and actual rates may vary based on individual circumstances and the year the loan was originated.

| Loan Type | Average Interest Rate (Example – Year 2023) | Interest Rate Type | Notes |

|---|---|---|---|

| Federal Subsidized Loan (Undergraduate) | 4.99% | Fixed | Interest does not accrue while the student is enrolled at least half-time. |

| Federal Unsubsidized Loan (Undergraduate) | 6.54% | Fixed | Interest accrues while the student is enrolled. |

| Federal Graduate PLUS Loan | 7.54% | Fixed | Higher interest rate due to graduate program length. |

| Private Student Loan | 7.00% – 15.00% | Variable or Fixed | Wide range due to individual creditworthiness and lender policies. |

Federal Student Loan Interest Rates

Understanding federal student loan interest rates is crucial for prospective borrowers, as these rates directly impact the total cost of a higher education. These rates are set by the government and fluctuate based on several factors, unlike private loans which are subject to market conditions and individual creditworthiness. This section will delve into the specifics of federal student loan interest rates.

Federal student loan interest rates are not static; they change periodically. The rates are typically set annually and depend on the type of loan (subsidized or unsubsidized), the loan’s disbursement date, and the prevailing market conditions. For example, the interest rate for a Direct Subsidized Loan might differ from that of a Direct Unsubsidized Loan, even if both are disbursed in the same year. The government uses a formula that incorporates Treasury note yields to determine these rates, ensuring they reflect the cost of borrowing for the federal government.

Determination of Federal Student Loan Interest Rates

The interest rates for federal student loans are determined by a complex formula that incorporates the 10-year Treasury note yield. This yield serves as a benchmark, reflecting the government’s cost of borrowing money. To this benchmark, a small fixed amount is added to account for administrative costs and other factors. This process ensures that the interest rates remain relatively low and reflect the current market conditions. For instance, if the 10-year Treasury note yield increases, the interest rate on federal student loans will also likely increase. Conversely, a decrease in the Treasury note yield will generally lead to lower interest rates. The exact formula and calculation are publicly available through the Department of Education.

Impact of Credit History on Federal Student Loan Interest Rates

Unlike private student loans, credit history does not directly affect the interest rate on federal student loans. Federal student loans are primarily based on need and eligibility, and are designed to be accessible to students regardless of their credit background. This makes federal student loans a more accessible option for students with limited or no credit history. This contrasts sharply with private student loans, where a strong credit history often leads to more favorable interest rates. Therefore, students with poor or no credit history can still obtain federal student loans without facing higher interest rates due to their credit score.

Federal Student Loan Process and Associated Interest Rate

The following flowchart illustrates the process of obtaining a federal student loan and the determination of its associated interest rate.

[Flowchart Description: The flowchart begins with the “Application for Federal Student Aid (FAFSA)”. This leads to “Eligibility Determination,” where the student’s financial need is assessed. Next is “Loan Approval/Disbursement,” followed by “Interest Rate Determination” which branches into “Type of Loan (Subsidized/Unsubsidized)” and “Current 10-Year Treasury Note Yield + Fixed Margin”. Finally, the process ends with “Loan Repayment”. The boxes are connected with arrows indicating the flow of the process. Each box clearly shows the stage in the loan process. The Treasury yield and fixed margin are explicitly mentioned as inputs to the interest rate calculation.]

Private Student Loan Interest Rates

Private student loans offer an alternative borrowing option for students, but understanding their interest rates is crucial before committing. Unlike federal loans, private loan interest rates are determined by the lender based on several factors, leading to a wider range of rates and potentially higher costs. This section will delve into the specifics of private student loan interest rates, highlighting key differences from federal loans and the factors influencing them.

Private student loan interest rates typically exceed those of federal student loans. This difference reflects the higher risk lenders perceive in extending credit to students without the government’s backing. Federal loans benefit from government subsidies and guarantee programs, resulting in lower interest rates for borrowers. The disparity can be significant, sometimes amounting to several percentage points, leading to a substantial difference in the total cost of borrowing over the life of the loan.

Factors Influencing Private Student Loan Interest Rates

Several factors influence the interest rate a private lender offers. These include the borrower’s credit history, credit score, income, debt-to-income ratio, the chosen repayment plan, and the loan’s terms (including the loan amount and repayment period). A strong credit history and high credit score generally qualify a borrower for a lower interest rate, reflecting a lower perceived risk for the lender. Conversely, a borrower with a weak credit history or a high debt-to-income ratio might receive a higher interest rate. The length of the repayment term also affects the interest rate; longer repayment periods typically come with higher rates. Finally, the type of loan (e.g., undergraduate vs. graduate) can also impact the interest rate offered.

Examples of Private Student Loan Interest Rate Structures

Private lenders offer various interest rate structures. Some offer fixed interest rates, meaning the rate remains constant throughout the loan’s life. Others offer variable interest rates, which fluctuate based on an underlying index, such as the prime rate or LIBOR (although LIBOR is being phased out). A lender might offer a fixed rate of 7% for a 10-year loan or a variable rate that starts at 6% but could increase or decrease over time, depending on market conditions. The specific rates offered will vary depending on the lender and the borrower’s creditworthiness.

Fixed vs. Variable Interest Rates: Key Differences

Understanding the difference between fixed and variable interest rates is essential when choosing a private student loan. The implications of each choice can significantly impact the total cost of borrowing.

- Fixed Interest Rate: The interest rate remains constant throughout the loan’s repayment period. This provides predictability and allows borrowers to accurately budget for their monthly payments. The total interest paid will be known from the start.

- Variable Interest Rate: The interest rate fluctuates based on an index. This can lead to lower payments initially if the index is low, but payments could increase significantly if the index rises. The total interest paid is uncertain and depends on market conditions throughout the loan term.

Impact of Interest Rates on Repayment

Understanding the impact of interest rates on student loan repayment is crucial for effective financial planning. Higher interest rates significantly increase the total amount you’ll pay back over the life of the loan, while lower rates lead to considerable savings. This section explores how interest rates affect repayment, examines various repayment plans, and offers strategies for minimizing the long-term financial burden.

The interest rate directly influences the total cost of borrowing. A higher interest rate means you’ll pay more in interest charges over the loan’s lifespan, leading to a larger overall repayment amount. Conversely, a lower interest rate results in lower interest charges and a smaller total repayment. This difference can amount to thousands of dollars, depending on the loan amount, interest rate, and repayment period. For example, a 1% increase in the interest rate on a $30,000 loan could add thousands of dollars to the total repayment amount over 10 years.

Repayment Plan Options and Their Relationship to Interest Rates

The choice of repayment plan can significantly affect how interest accrues and the overall repayment cost. Different plans offer varying monthly payments and repayment timelines. Understanding these options is crucial for managing your debt effectively.

Standard repayment plans typically involve fixed monthly payments over a 10-year period. Interest continues to accrue throughout the repayment period. Income-driven repayment plans, on the other hand, adjust your monthly payments based on your income and family size. While these plans typically extend the repayment period, resulting in higher total interest paid, they offer lower monthly payments that can be more manageable during periods of lower income. Extended repayment plans offer longer repayment periods, leading to lower monthly payments but higher total interest paid. For borrowers struggling with repayment, consolidation can lower monthly payments by combining multiple loans into a single loan with a potentially lower interest rate.

Strategies for Minimizing Interest Rate Impact

Several strategies can help minimize the long-term impact of interest rates on student loan repayment.

Prioritizing early repayment is key. Making extra payments towards the principal amount reduces the total interest accrued over time. Even small extra payments can significantly reduce the overall cost and shorten the repayment period. Refinancing your student loans with a lower interest rate is another effective strategy, especially if interest rates have fallen since you initially borrowed. It’s important to shop around and compare offers from different lenders before refinancing. Careful budgeting and financial planning are crucial to ensure you can make timely payments and avoid late fees, which can further increase the overall cost of borrowing.

Illustrative Repayment Costs

The following table illustrates the total repayment cost for a $10,000 loan with varying interest rates over different repayment periods. These figures are for illustrative purposes and do not account for fees or other charges.

| Interest Rate | 10-Year Repayment | 15-Year Repayment | 20-Year Repayment |

|---|---|---|---|

| 3% | $11,160 | $11,770 | $12,390 |

| 5% | $12,570 | $13,660 | $14,780 |

| 7% | $14,180 | $15,830 | $17,510 |

| 9% | $15,990 | $18,320 | $20,660 |

Resources for Finding Interest Rate Information

Securing accurate and up-to-date information on student loan interest rates is crucial for informed decision-making. Understanding where to find this information and how to interpret it effectively can significantly impact your borrowing choices and long-term financial health. Reliable sources provide the necessary data to compare loan options and make sound financial decisions.

Finding reliable sources for student loan interest rate information requires careful consideration. Many organizations provide this data, but not all are equally trustworthy or up-to-date. It’s essential to prioritize official government websites and established financial institutions. Misinterpreting information can lead to costly mistakes, highlighting the importance of understanding the nuances of interest rate reporting.

Reliable Sources of Student Loan Interest Rate Information

Several sources offer dependable information on student loan interest rates. These sources vary in the types of loans they cover (federal versus private) and the level of detail provided. It’s beneficial to consult multiple sources to get a comprehensive picture.

- Federal Student Aid (FSA): The official U.S. Department of Education website, studentaid.gov, provides detailed information on federal student loan interest rates. This site offers current rates for various federal loan programs, including subsidized and unsubsidized loans, PLUS loans, and Grad PLUS loans. The information is regularly updated to reflect current market conditions.

- National Education Association (NEA): The NEA, a significant teachers’ union, often publishes articles and resources related to student loans, including information on current interest rates and repayment options. While not a primary source for interest rates in the same way as FSA, their analysis can be insightful.

- Individual Lenders’ Websites: Private student loan lenders, such as Sallie Mae, Discover, and others, publish their current interest rates directly on their websites. However, it’s crucial to remember that these rates are subject to change and are often based on individual creditworthiness.

- Financial News Outlets: Reputable financial news sources, such as the Wall Street Journal, Bloomberg, and Reuters, frequently report on trends in student loan interest rates. While not providing the exact rates themselves, they offer valuable context and analysis of market fluctuations.

Interpreting Interest Rate Information

Understanding the nuances of interest rate reporting is critical. Official sources typically provide the annual percentage rate (APR), which represents the total cost of borrowing, including fees. This differs from the stated interest rate, which doesn’t include fees. It’s crucial to understand the difference to accurately compare loan offers.

The APR is a more comprehensive indicator of the true cost of borrowing than the stated interest rate alone.

Fixed versus variable interest rates should also be carefully considered. Fixed rates remain constant throughout the loan term, while variable rates fluctuate with market conditions. While variable rates might initially be lower, they can increase significantly over time, leading to unpredictable repayment amounts.

Understanding Loan Terms and Conditions

Beyond the interest rate itself, understanding the associated terms and conditions is paramount. These terms significantly influence the overall cost and repayment schedule of the loan. Key aspects include:

- Repayment plans: Different repayment plans offer varying monthly payments and total interest paid. Understanding the implications of each plan is essential.

- Fees: Origination fees, late payment fees, and other charges can significantly increase the total cost of the loan. These fees should be factored into the overall cost comparison.

- Deferment and forbearance options: These options provide temporary pauses in repayment, but they often accrue interest, increasing the total loan amount.

Comparing Interest Rates from Different Lenders

Comparing interest rates effectively requires a systematic approach. A simple comparison of numbers isn’t sufficient; a holistic assessment considering all loan terms is essential.

- Gather information: Collect the APR, loan term, repayment plan details, and any associated fees from each lender.

- Use a loan calculator: Online loan calculators help estimate the total cost of each loan, including interest and fees, based on the provided information.

- Compare total cost: Focus on the total amount repaid, rather than solely on the interest rate, to accurately assess the best option.

- Consider creditworthiness: Your credit score significantly influences the interest rate offered. Improving your credit score can lead to better loan terms.

Conclusive Thoughts

Securing a higher education shouldn’t come at the cost of crippling debt. By understanding the intricacies of student loan interest rates—from the factors that influence them to the available repayment options—borrowers can proactively manage their finances and plan for a financially secure future. Remember to always explore all available resources and compare offers carefully before committing to a loan.

Commonly Asked Questions

What factors affect my student loan interest rate?

Several factors influence your interest rate, including your credit history (for private loans), the type of loan (federal vs. private, subsidized vs. unsubsidized), and the prevailing market interest rates.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but carefully compare offers and consider the terms and conditions before refinancing.

What is the difference between a fixed and variable interest rate?

A fixed interest rate remains constant throughout the loan term, while a variable rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may initially be lower but could increase over time.

Where can I find reliable information on current interest rates?

Government websites (like studentaid.gov for federal loans) and reputable financial institutions are excellent resources for up-to-date information.