Navigating the complexities of student loan repayment can feel overwhelming, especially when trying to understand those crucial due dates. Knowing precisely when your payments are due is vital to avoiding late fees and maintaining a positive credit history. This guide provides a clear and concise overview of how to find your student loan due dates, manage your payments effectively, and understand your options if you encounter financial hardship.

From understanding different repayment plans and their associated schedules to mastering the art of online account access and proactive payment strategies, we’ll equip you with the knowledge and tools to confidently manage your student loan debt. We’ll also cover essential topics such as deferment and forbearance, helping you navigate potential challenges and stay on track toward financial freedom.

Understanding Loan Due Dates

Knowing when your student loan payments are due is crucial for avoiding late fees and maintaining a good credit history. Understanding the factors that determine your due date ensures you can budget effectively and manage your repayments responsibly. This information will clarify the different ways your payment schedule is established.

Student loan due dates are determined by several factors, primarily the type of loan you have and the repayment plan you’ve chosen. Federal student loans, for instance, often have a standard monthly payment due date, typically around the same day each month. Private student loans, however, may have varying due dates depending on the lender’s policies. Your repayment plan significantly influences the frequency and amount of your payments, thus impacting your due dates. Choosing a plan with longer repayment terms generally results in smaller monthly payments but extends the overall repayment period.

Loan Type and Repayment Plan Influence on Payment Schedules

The type of loan significantly impacts your payment schedule. Federal loans, such as Direct Subsidized and Unsubsidized Loans, Stafford Loans, and Perkins Loans, offer various repayment plans, each with its own payment schedule. Private loans, on the other hand, are offered by banks and credit unions, and their repayment terms and due dates are set by the lender. These terms can vary greatly, so understanding your loan agreement is essential.

Common Student Loan Repayment Plans and Due Dates

Several federal student loan repayment plans are available, each affecting the payment amount and frequency. The Standard Repayment Plan, for example, typically involves fixed monthly payments over 10 years. The Extended Repayment Plan stretches payments over a longer period, resulting in lower monthly payments but higher overall interest paid. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base your monthly payment on your income and family size. Due dates for these plans are usually consistent, often the same day each month. The exact due date is specified in your loan servicer’s communication.

Comparison of Repayment Plans and Payment Frequency

| Repayment Plan | Payment Frequency | Typical Payment Duration | Payment Amount |

|---|---|---|---|

| Standard Repayment Plan | Monthly | 10 years | Fixed, based on loan amount and interest rate |

| Extended Repayment Plan | Monthly | Up to 25 years | Lower than Standard Plan, but higher total interest |

| Income-Based Repayment (IBR) | Monthly | Up to 25 years | Variable, based on income and family size |

| Pay As You Earn (PAYE) | Monthly | 20 years | Variable, based on income and family size |

| Revised Pay As You Earn (REPAYE) | Monthly | 20 or 25 years | Variable, based on income and family size |

Locating Your Due Date Information

Knowing when your student loan payments are due is crucial for avoiding late fees and maintaining a positive credit history. This information is readily accessible through several channels provided by your loan servicer. Let’s explore the most common methods.

Accessing your due date information is straightforward, primarily through your loan servicer’s online portal and mobile application. These platforms offer a secure and convenient way to manage your student loan account, providing real-time updates on your payment schedule and account balance. Regularly reviewing this information is essential for proactive financial planning.

Accessing Due Date Information Through the Loan Servicer’s Website

Most loan servicers offer user-friendly websites designed to manage your student loan accounts. To find your due date, typically you will need to log in using your pre-registered username and password. Once logged in, navigate to the section displaying your account summary or payment information. This section usually clearly indicates your next payment due date, along with the amount due. The specific location of this information may vary slightly depending on your servicer, so consult their website’s help section if needed. For example, some websites prominently display this information on the dashboard upon login, while others might require navigating to a “Payments” or “Account Summary” tab.

Accessing Due Date Information Through the Loan Servicer’s Mobile App

Many loan servicers also provide mobile applications for convenient account management. The process for locating your due date is similar to the website method. After logging into the app using your credentials, look for sections labeled “Account Summary,” “Payments,” or similar designations. The app’s layout will be intuitive, often with clear visual indicators pointing to your next payment due date and amount. For instance, a typical app might display this information on the main screen, possibly accompanied by a calendar icon or a prominent “Next Payment Due” heading. If you are having trouble, refer to the app’s help section or frequently asked questions (FAQs).

The Importance of Regularly Checking Your Loan Account

Regularly checking your loan account for updates is vital for several reasons. It allows you to stay informed about any changes to your payment schedule, potential issues with your payments, and ensures you remain on track with your repayment plan. Ignoring your account could lead to missed payments and potentially negative consequences. Ideally, you should check your account at least once a month, or even more frequently if you anticipate any changes in your financial situation.

Potential Issues That May Delay or Alter Your Payment Due Date

Several factors could potentially influence your student loan payment due date. These may include changes to your repayment plan (e.g., deferment, forbearance), administrative errors on the part of your loan servicer, or even unforeseen circumstances affecting your ability to make timely payments. If you notice any discrepancies or unexpected changes to your due date, immediately contact your loan servicer to clarify the situation and avoid any negative impact on your credit report. For example, a change in your repayment plan might result in a new due date, and it’s crucial to understand these changes promptly. Similarly, a processing error by the servicer might lead to a delay, necessitating immediate communication to rectify the situation.

Managing Your Payments

Successfully managing your student loan payments is crucial to avoiding late fees and maintaining a positive credit history. Consistent and timely payments demonstrate financial responsibility and can positively impact your future borrowing opportunities. This section Artikels strategies for simplifying the payment process and budgeting effectively.

Effective payment management involves understanding your options and choosing a method that best suits your needs and lifestyle. Automating payments, updating your information promptly, and adopting a sound budgeting strategy are key components of responsible loan repayment.

Automatic Payments

Setting up automatic payments is a highly recommended strategy for ensuring on-time payments. This eliminates the risk of forgetting due dates and the associated late fees. Most lenders offer this option through their online portals, allowing you to schedule recurring payments from your checking or savings account. You can typically specify the payment amount and frequency (e.g., monthly, bi-monthly). Be sure to check your account balance regularly to ensure sufficient funds are available for each scheduled payment.

Updating Payment Information

It’s essential to keep your lender informed of any changes to your contact information, including your address, phone number, and email address. Failing to do so could result in missed payment notices or difficulties in communicating with your lender. Most lenders provide online portals where you can easily update your details. It is good practice to update your information immediately upon any change to avoid potential complications.

Payment Method Comparison

Several payment methods are available for student loan repayment. Online payments are generally the most convenient and efficient, offering confirmation and tracking capabilities. Mail payments, while still accepted by many lenders, carry the risk of delays and lost payments. Phone payments might be available but are less common and often less efficient. Online payments offer the greatest convenience and security, while mail payments present a higher risk of delays and loss. Phone payments are generally less efficient and may not be widely available.

Budgeting and Repayment Management Tips

Effective budgeting is crucial for successful student loan repayment. Consider these tips:

- Create a detailed monthly budget that includes all income and expenses, allocating a specific amount for your student loan payment.

- Prioritize your loan payments and ensure they are included in your essential expenses.

- Explore options for income maximization, such as taking on a part-time job or freelance work, to supplement your repayment capacity.

- Track your loan payments diligently and reconcile your account statements regularly.

- Consider using budgeting apps or spreadsheets to monitor your spending and track your progress towards loan repayment goals.

- If facing financial hardship, contact your lender promptly to explore options like deferment or forbearance. Early communication can help prevent delinquency.

Dealing with Missed Payments

Missing a student loan payment can have significant consequences, impacting your credit score and potentially leading to further financial difficulties. Understanding the potential ramifications and available resources is crucial for proactive management of your student loan debt.

Missing even a single student loan payment can negatively affect your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Late payments are reported to credit bureaus, and this negative mark can remain on your credit report for seven years. Furthermore, your loan servicer may charge late fees, which can quickly add up and increase your overall debt. In more serious cases, repeated missed payments can lead to loan default, resulting in wage garnishment, tax refund offset, and even legal action.

Consequences of Missed Payments

The consequences of missing student loan payments are far-reaching and can significantly impact your financial well-being. A missed payment triggers a series of events that can escalate quickly if not addressed promptly. These consequences include a drop in credit score, late payment fees imposed by your loan servicer, and the potential for your loan to go into default. Defaulting on your student loans can have severe repercussions, including wage garnishment, the seizure of tax refunds, and potential legal action. It is therefore imperative to understand the severity of these consequences and take immediate action to avoid them.

Steps to Take After a Missed Payment

If you miss a student loan payment, the first step is to contact your loan servicer immediately. Do not ignore the missed payment notice. Explain your situation honestly and explore available options. Many servicers offer forbearance or deferment programs that can temporarily suspend or reduce your payments during periods of financial hardship. These programs provide temporary relief, but it’s crucial to develop a repayment plan to avoid accumulating further debt. It is also important to keep detailed records of all communication with your loan servicer, including dates, times, and the names of individuals you spoke with.

Resources for Borrowers Facing Financial Hardship

Several resources are available to help borrowers facing financial hardship manage their student loans. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping borrowers create budgets and negotiate with creditors. The U.S. Department of Education’s website provides comprehensive information on student loan repayment plans and hardship programs, including income-driven repayment plans that adjust your monthly payments based on your income and family size. Your loan servicer may also offer internal hardship programs and resources; it’s advisable to explore these options directly. Remember, seeking help early is key to preventing more serious financial problems.

Creating a Repayment Plan After a Missed Payment

After a missed payment, creating a comprehensive repayment plan is essential to get back on track. This plan should involve carefully reviewing your budget, identifying areas where expenses can be reduced, and exploring options to increase income. Consider using budgeting tools and apps to track your spending and create a realistic budget. If you have multiple loans, prioritize repayment based on interest rates, aiming to pay off higher-interest loans first. Regular communication with your loan servicer is critical; work with them to establish a payment plan that fits your financial situation. This proactive approach demonstrates responsibility and can help prevent further negative consequences.

Understanding Deferment and Forbearance

Navigating the complexities of student loan repayment can be challenging, and sometimes unforeseen circumstances necessitate temporary pauses in payments. Deferment and forbearance are two such options, offering temporary relief from loan payments, but with key differences. Understanding these differences is crucial for making informed decisions about your financial well-being.

Deferment and forbearance both allow you to temporarily postpone your student loan payments, but they differ significantly in their eligibility requirements, the impact on your loan, and the application process. Deferment is generally preferred because it often doesn’t accrue interest on subsidized loans, while forbearance typically does.

Deferment Eligibility and Application

Deferment is a temporary postponement of your student loan payments granted by your loan servicer. Eligibility criteria vary depending on the type of loan and your circumstances. Common reasons for deferment include returning to school at least half-time, experiencing unemployment, or facing economic hardship. The application process typically involves completing a form provided by your loan servicer, providing supporting documentation to verify your eligibility (such as proof of enrollment or unemployment), and submitting the completed application. The length of a deferment period varies but is typically limited to a certain number of months.

Forbearance Eligibility and Application

Forbearance, unlike deferment, is a temporary suspension of your loan payments granted at the discretion of your loan servicer. While it’s often used for similar reasons as deferment (financial hardship, unemployment, etc.), the criteria are less stringent and eligibility is more broadly applied. The application process is generally similar to that of deferment; you’ll need to contact your servicer, explain your circumstances, and request forbearance. The length of forbearance is also typically limited and often determined on a case-by-case basis.

Requirements and Limitations of Deferment and Forbearance

Understanding the requirements and limitations of each option is vital. Both deferment and forbearance can impact your credit score and potentially lead to increased overall loan costs due to accrued interest (except for subsidized loans in deferment).

- Deferment:

- Requires specific qualifying circumstances (e.g., unemployment, return to school).

- May not accrue interest on subsidized loans, but interest usually accrues on unsubsidized loans.

- Typically has a limited duration, often tied to the qualifying event.

- May require documentation to prove eligibility.

- Forbearance:

- Generally has less stringent eligibility requirements than deferment.

- Interest typically accrues on both subsidized and unsubsidized loans during the forbearance period.

- Duration is often determined by the servicer based on individual circumstances.

- May require regular contact with the servicer to maintain the forbearance.

Examples of situations where deferment or forbearance might be appropriate include: a recent graduate facing unemployment, a parent returning to school to enhance their career prospects, or someone experiencing a temporary reduction in income due to an unforeseen event such as illness or injury. Always carefully weigh the potential benefits and drawbacks before applying for either option, considering the long-term impact on your loan repayment and overall financial health. Remember to contact your loan servicer to discuss your specific circumstances and determine the best course of action.

Visual Representation of Payment Schedules

A clear visual representation of your student loan payment schedule is invaluable for understanding and managing your repayment journey. A well-designed chart can transform complex financial data into an easily digestible format, allowing you to track your progress and make informed decisions.

A sample payment schedule could be represented as a table or a line graph. A table would list each payment, its due date, the amount paid, the interest accrued for that period, and the remaining principal balance. A line graph would visually depict the decline in your principal balance over time, with the x-axis representing time (months or years) and the y-axis representing the remaining loan balance. Key dates, such as the start and end of the repayment period, could be highlighted. The graph could also show a separate line representing the total interest paid cumulatively, illustrating how interest accrual decreases as the principal balance reduces. For example, a table might show that in month one, $200 was paid, with $10 accruing as interest, leaving a principal balance of $10,000. Month 12 might show a $200 payment, $5 of interest, and a principal balance of $8000. This clearly illustrates the decreasing interest over time.

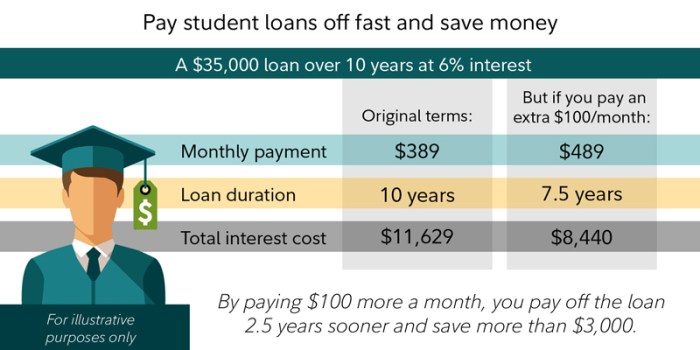

Benefits of Visual Aids in Loan Repayment

Visual representations significantly enhance understanding of loan repayment. A simple table or graph makes it easy to see the impact of each payment on the principal balance and the total interest paid. This clarity empowers borrowers to make more informed decisions about their repayment strategy. For instance, a visual representation might show that making extra payments significantly shortens the repayment period and reduces the overall interest paid, making the long-term financial benefits readily apparent. This visual confirmation can motivate borrowers to stay on track and make consistent payments.

Final Conclusion

Successfully managing your student loans requires proactive planning and a clear understanding of your repayment obligations. By utilizing the resources and strategies Artikeld in this guide, you can confidently navigate the repayment process, avoid potential pitfalls, and ultimately achieve financial stability. Remember, staying organized, utilizing available online tools, and proactively addressing any challenges will significantly contribute to your success in repaying your student loans. Take control of your financial future today!

FAQ Insights

What happens if I miss a student loan payment?

Missing a payment can result in late fees, damage to your credit score, and potential collection actions. Contact your loan servicer immediately if you anticipate difficulty making a payment.

Can I change my repayment plan?

Yes, you can often switch to a different repayment plan based on your income and circumstances. Check with your loan servicer for available options.

How can I estimate my total repayment cost?

Your loan servicer’s website or account portal typically provides an amortization schedule showing the total cost of your loan over the repayment period.

Where can I find my loan servicer’s contact information?

Your loan servicer’s contact information should be on your loan documents or accessible through the National Student Loan Data System (NSLDS).