Securing student loan funding is a pivotal step in higher education, but the question of when the money arrives often causes anxiety. Understanding the disbursement process, from application approval to funds hitting your account, is crucial for effective financial planning. This guide navigates the complexities of student loan disbursement, providing clarity on timelines, influencing factors, and troubleshooting potential delays.

This comprehensive overview covers various loan types, disbursement methods, and proactive steps to ensure a smooth process. We’ll explore strategies for tracking your application, addressing common issues, and ultimately, successfully managing your student loan funds.

Understanding Disbursement Schedules

Receiving your student loan funds involves understanding the disbursement process and the timelines involved. This process can vary depending on several factors, and knowing what to expect can help alleviate any anxieties about when the money will arrive.

The typical timeframe for receiving student loan funds after application approval depends heavily on the type of loan and the lender. Federal student loans generally have established disbursement schedules, while private loan disbursement times can be more variable. Processing times also account for factors such as the completeness of your application, verification of information, and the lender’s internal processing capacity.

Federal Student Loan Disbursement Schedules

Federal student loans, such as Direct Subsidized and Unsubsidized Loans, typically follow a set disbursement schedule tied to the academic term. Funds are often disbursed in installments, with the first disbursement arriving shortly before the start of classes. Subsequent disbursements may occur at the midpoint or end of the term, depending on the loan program and the institution’s policies. For example, a student enrolled in a fall semester might receive their first disbursement in late August or early September, with a second disbursement in November or December. These schedules are usually Artikeld in the loan award letter or on the lender’s website. Delays can occur if additional documentation is needed or if there are issues with the student’s financial aid application.

Private Student Loan Disbursement Schedules

Private student loans, offered by banks and other financial institutions, have more variable disbursement schedules. The disbursement timeline can range from a few days to several weeks after loan approval, depending on the lender’s processing speed and the complexity of the loan application. Factors such as credit checks, income verification, and co-signer requirements can influence the processing time. Some private lenders may disburse funds directly to the student, while others may send the funds directly to the educational institution. It’s crucial to check with the specific private lender for their anticipated disbursement timeline. For instance, one lender might process loans within a week, while another may take up to three weeks.

Factors Influencing Disbursement Timelines

Several factors can impact how quickly you receive your loan funds. These include the type of loan (federal or private), the lender’s processing time, the completeness of your application, and any required verification steps. A complete and accurate application will generally speed up the process, while missing information or discrepancies can lead to delays. Verification of income or employment information may also add time to the process.

| Loan Type | Typical Disbursement Time | Factors Affecting Timing | Contact Information |

|---|---|---|---|

| Federal Direct Subsidized/Unsubsidized Loans | A few weeks before the start of the semester, with potential additional disbursements during the term. | Application completeness, verification of enrollment, lender processing times. | StudentAid.gov or your school’s financial aid office. |

| Private Student Loans | A few days to several weeks after loan approval. | Lender processing times, credit checks, income verification, co-signer requirements, application completeness. | The specific private lender’s website or customer service department. |

Tracking Loan Progress

Staying informed about your student loan’s progress is crucial to ensure a smooth disbursement process. Regularly monitoring your application status allows you to proactively address any potential delays or issues, ultimately leading to a timely receipt of your funds. This involves utilizing various methods and resources provided by your lender.

Accessing and understanding the information available on your lender’s online portal is the most efficient way to track your loan. This typically involves logging in securely using your credentials and navigating to specific sections dedicated to loan status and disbursement information.

Accessing Online Student Loan Portals

A step-by-step guide to accessing your online student loan portal usually begins with locating the lender’s website. This is often found through a search engine or a link provided in your loan documents. Next, look for a section labeled “Login,” “Account Access,” or a similar phrase. You will then be prompted to enter your username and password. If you’ve forgotten your login details, most portals offer password reset options. Once logged in, navigate to the section related to your loan application, often labeled “My Loans,” “Loan Status,” or “Account Summary.” Finally, locate the specific loan you’re tracking and review the available information.

Information Found on Student Loan Portals

Student loan portals typically provide a comprehensive overview of your loan’s status. This usually includes the application date, the loan amount approved, the disbursement schedule (dates of payment), and the current status (e.g., “Application Received,” “Under Review,” “Approved,” “Disbursed”). Many portals also display the total amount disbursed to date, along with any remaining funds to be released. Some lenders even provide a visual progress bar or timeline to illustrate the stages of the disbursement process. Detailed transaction history, showing the exact dates and amounts of each disbursement, is also commonly available.

Communication Channels Used by Lenders

Lenders utilize various communication channels to keep borrowers updated on their loan progress. Email is a prevalent method for sending notifications about application updates, disbursement schedules, and important deadlines. Phone calls are sometimes used to address specific inquiries or to inform borrowers of critical changes. Finally, many lenders still send important documents and updates via postal mail, particularly for official loan agreements or confirmation of disbursement. It’s advisable to regularly check all these channels to ensure you don’t miss any crucial information.

Factors Affecting Disbursement

Receiving your student loan funds can sometimes be delayed, impacting your ability to cover educational expenses promptly. Several factors can contribute to these delays, ranging from incomplete paperwork to complex verification processes. Understanding these factors can help you proactively address potential issues and ensure a smoother disbursement process.

Reasons for Disbursement Delays

Delays in student loan disbursement are often caused by a combination of administrative processes and incomplete or inaccurate information. Common reasons include missing or incomplete application materials, such as transcripts or tax returns. Verification of student enrollment, financial need, and identity can also lead to delays. Furthermore, technical glitches within the lender’s systems or processing backlogs can contribute to extended wait times. In some cases, discrepancies between the information provided by the student and the information held by the institution or lender may trigger further investigation and delays.

Impact of Incomplete Application Materials

Incomplete application materials are a significant contributor to disbursement delays. Lenders require specific documentation to verify a student’s eligibility and identity before releasing funds. Missing transcripts, tax returns, or proof of enrollment can halt the process until the necessary information is provided. The impact is a direct delay in receiving funds, potentially leading to financial strain and difficulty covering immediate educational costs, such as tuition fees, housing, and books. The delay’s duration varies depending on the lender and the extent of missing information; it can range from a few days to several weeks.

Comparison of Verification Processes

Different lenders employ varying verification processes, impacting the speed of disbursement. Some lenders utilize automated systems to verify information quickly, while others may rely on manual review, leading to longer processing times. For instance, one lender might primarily use electronic verification of enrollment, while another might require physical copies of transcripts. The level of scrutiny also varies depending on factors such as the loan amount, the applicant’s credit history, and the type of loan (e.g., federal vs. private). A more stringent verification process might lead to a longer delay but also provides a higher level of assurance for both the lender and the borrower.

Potential Problems and Solutions

Understanding potential problems and their solutions is crucial for a timely disbursement.

- Problem: Missing or incorrect information on the application. Solution: Carefully review and double-check all application materials for accuracy and completeness before submission. Contact the lender immediately if any corrections are needed.

- Problem: Failure to meet the lender’s verification requirements. Solution: Promptly provide any requested documentation and actively follow up with the lender on the status of the verification process.

- Problem: Technical issues with the lender’s system. Solution: Contact the lender’s customer service department to report any technical problems and inquire about the status of your application.

- Problem: Delays in processing due to high volume. Solution: Apply for your loan well in advance of the required disbursement date to account for potential processing delays.

- Problem: Discrepancies between reported information and lender records. Solution: Immediately contact the lender to clarify any discrepancies and provide supporting documentation to resolve the issue.

Direct Deposit and Alternative Methods

Receiving your student loan funds efficiently and securely is crucial. Understanding the available disbursement methods and their associated processes will help ensure a smooth transition into your academic year. This section details the process of setting up direct deposit, compares it to alternative methods, and explains how to update your payment information if needed.

Direct deposit is the most common and often preferred method for receiving student loan funds. It involves having the money electronically transferred directly into your designated bank account. This eliminates the need to wait for a check in the mail and minimizes the risk of loss or theft.

Direct Deposit Setup

Setting up direct deposit typically involves providing your lender with your bank account information, including your account number and routing number. This information is usually collected through your student loan application or portal. It’s essential to double-check the accuracy of this information to prevent delays or incorrect deposits. Most lenders provide clear instructions and secure online forms to facilitate this process. After submitting your banking details, you’ll generally receive confirmation within a few business days.

Advantages and Disadvantages of Direct Deposit

Direct deposit offers several advantages over alternative methods. However, it’s important to weigh these benefits against potential drawbacks.

| Feature | Direct Deposit | Check |

|---|---|---|

| Speed | Funds are typically available within a few business days. | Can take several weeks to arrive by mail. |

| Convenience | Automatic deposit; no need to visit a bank or cash a check. | Requires a trip to the bank or the use of a check-cashing service. |

| Security | Reduces the risk of lost or stolen checks. | Increased risk of loss or theft during transit. |

| Fees | Generally no fees associated with direct deposit. | Potential fees from check-cashing services. |

| Accessibility | Requires a bank account. | Can be used without a bank account. |

Updating Payment Information

If you need to update your bank account information, you should contact your lender immediately. Most lenders provide a secure online portal where you can update your details. Alternatively, you may need to contact them via phone or mail, depending on their policies. It is crucial to update your information as soon as possible to ensure that your loan disbursement goes to the correct account. Failure to do so could result in delays or the funds being sent to an outdated account.

Contacting Your Lender

Knowing how to effectively contact your student loan lender is crucial for resolving any disbursement issues or simply staying informed about your loan status. Direct and efficient communication can save you time and frustration. This section provides guidance on contacting common lenders and strategies for successful communication.

Contact Information for Common Student Loan Lenders

Finding the right contact information can be the first step in resolving a problem. Below are some examples, but it’s vital to check the official website of your specific lender for the most up-to-date contact details. Contact information is subject to change, so always verify it before reaching out.

| Lender | Website (Example) | Phone Number (Example – Always verify) | Email Address (Example – Always verify) |

|---|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | 1-800-4-FED-AID | (Check website for specific contact email addresses based on your needs) |

| Sallie Mae | salliemae.com | (Check website for phone numbers based on your account type) | (Check website for specific contact email addresses based on your needs) |

| Navient | navient.com | (Check website for phone numbers based on your account type) | (Check website for specific contact email addresses based on your needs) |

Effective Strategies for Communicating with Student Loan Servicers

When contacting your lender, clear and concise communication is key. Prepare all necessary information beforehand, such as your loan ID number, social security number (only if required by the lender), and a brief description of your issue. Be patient and polite, even if you are frustrated. Remember to keep records of all communication, including dates, times, and the names of the representatives you speak with.

Sample Email Template for Inquiring About Disbursement Status

Subject: Inquiry Regarding Disbursement of Student Loan – [Your Name] – [Loan ID Number]

Dear [Lender Name],

I am writing to inquire about the disbursement status of my student loan, loan ID number [Your Loan ID Number]. My expected disbursement date was [Expected Disbursement Date]. I have not yet received the funds.

Could you please provide an update on the status of my disbursement? If there are any delays, I would appreciate an explanation and an estimated timeframe for when I can expect to receive the funds.

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Flowchart for Addressing Disbursement Issues

A flowchart can help visualize the steps to take if you encounter problems with your disbursement.

*(Note: The above is placeholder text for an image. A real flowchart would show boxes and arrows depicting the process described.)*

Understanding Loan Terms and Conditions

Before you can begin repaying your student loan, you need to understand the terms and conditions governing its disbursement. This section clarifies the distinctions between disbursement and repayment, Artikels key terms and conditions, and addresses common misunderstandings. Understanding these aspects is crucial for responsible financial management.

Disbursement refers to the process of releasing your student loan funds to you, while loan repayment is the subsequent process of paying back the borrowed amount, typically with interest, according to a predetermined schedule. Disbursement is a one-time or series of events, while repayment is an ongoing process spanning several years or even decades.

Disbursement Terms and Conditions, Including Fees

Student loan disbursement is governed by specific terms and conditions set by your lender. These terms may vary depending on the type of loan (federal, private, etc.), the lender, and your specific loan agreement. Common conditions include the timing of disbursement (often tied to academic progress), the method of disbursement (direct deposit or check), and any applicable fees. For instance, some lenders might charge a fee for processing the loan or for specific disbursement methods. It’s crucial to review your loan agreement carefully to understand all associated costs. Failure to meet the terms and conditions can lead to delays or even denial of funds.

Common Misunderstandings Regarding Loan Disbursement

A frequent misunderstanding is that the entire loan amount will be disbursed at once. In many cases, disbursement is phased, with funds released in installments corresponding to academic terms or semesters. Another common misconception is that the disbursement process is instantaneous. There’s often a processing period, sometimes several weeks, between loan approval and the actual release of funds. Finally, some students incorrectly believe that all fees are included in the loan amount. This is not always the case; some fees might be charged separately. Understanding these distinctions is crucial to avoid financial surprises.

Key Terms Related to Student Loan Disbursement

Understanding the terminology associated with student loan disbursement is essential for navigating the process effectively. Below is a list of key terms and their definitions:

- Disbursement: The release of loan funds to the student.

- Disbursement Date: The date the loan funds are released.

- Grace Period: The period after graduation or leaving school before loan repayment begins.

- Interest Rate: The percentage charged on the outstanding loan balance.

- Principal: The original amount of the loan, excluding interest.

- Loan Agreement: The legal contract outlining the terms and conditions of the loan.

- Origination Fee: A fee charged by the lender for processing the loan application.

Financial Planning After Disbursement

Receiving your student loan funds marks a significant step, but responsible financial planning is crucial to ensure you make the most of this resource and avoid future debt burdens. Effective budgeting and mindful spending are key to navigating your finances successfully throughout your studies.

Successful financial management requires a proactive approach. Understanding your income (loan funds) and expenses allows for informed decision-making, preventing overspending and promoting financial stability. This section will Artikel practical strategies for budgeting, responsible spending, expense tracking, and accessing helpful financial resources.

Budgeting Student Loan Funds

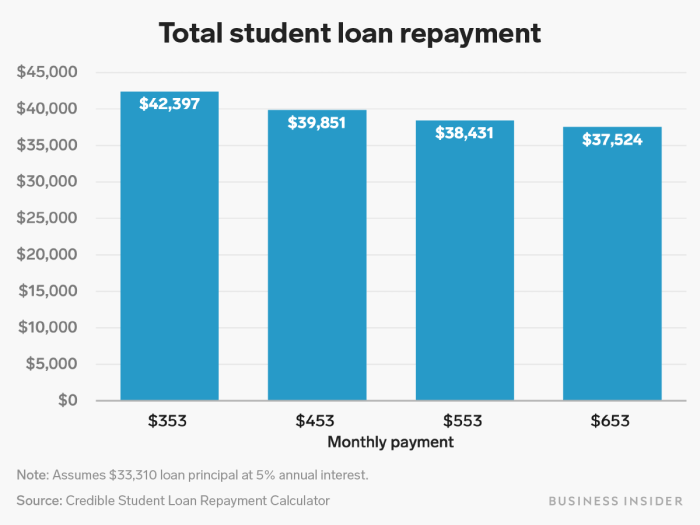

Creating a realistic budget is paramount. Start by listing all your expected expenses, including tuition, housing, food, books, transportation, and personal expenses. Then, compare this to the total amount of your loan disbursement. Consider using budgeting apps or spreadsheets to track income and expenses. A simple 50/30/20 rule can be helpful: allocate 50% of your income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Adjust these percentages based on your individual circumstances. For example, a student living at home might allocate a smaller percentage to housing and a larger percentage to savings. A student with significant existing debt might prioritize debt repayment over savings initially.

Examples of Responsible Spending Habits

Responsible spending involves prioritizing needs over wants and making conscious purchasing decisions. This includes comparing prices before making purchases, looking for discounts and sales, and avoiding impulsive buys. For instance, buying used textbooks instead of new ones can significantly reduce costs. Cooking at home more often than eating out will also save money. Utilizing public transportation or cycling instead of owning a car can substantially lower transportation expenses. Tracking your spending can highlight areas where you might be overspending, allowing you to make adjustments. For example, if you realize you are spending too much on coffee, you could switch to brewing your own coffee at home.

Tracking Expenses After Disbursement

Regularly tracking your expenses provides valuable insights into your spending patterns and helps identify areas for improvement. This can be done manually using a notebook or spreadsheet, or through budgeting apps that automatically categorize transactions. Tracking expenses allows you to monitor your progress against your budget and make necessary adjustments to avoid overspending and ensure your loan funds last throughout your studies. For example, if you notice you are consistently exceeding your budget for entertainment, you can reduce your spending in that area by choosing less expensive activities.

Available Financial Resources for Students

Numerous resources are available to help students manage their finances. These include:

- University Financial Aid Offices: These offices provide guidance on financial aid, budgeting, and managing student loans.

- Student Loan Servicers: These organizations offer resources and support for managing student loan repayment.

- Online Budgeting Tools and Apps: Many free and paid apps are available to help track expenses and create budgets.

- Credit Counseling Agencies: These agencies provide free or low-cost credit counseling and debt management services.

- Government Websites: Websites like the Federal Student Aid website offer valuable information on student loans and financial aid.

Conclusive Thoughts

Successfully navigating the student loan disbursement process requires preparation, proactive monitoring, and clear communication with your lender. By understanding the typical timelines, potential delays, and available resources, you can confidently manage your finances and focus on your academic pursuits. Remember to utilize the available online portals and contact your lender promptly if you encounter any issues. Proactive planning and communication are key to a smooth and successful experience.

Helpful Answers

What happens if my application is incomplete?

Incomplete applications often lead to delays. Lenders will typically contact you to request the missing information. Responding promptly is crucial to expedite the process.

Can I change my disbursement method after I’ve applied?

Generally, yes, but you should contact your lender as soon as possible to make the necessary changes. The ability to change methods may depend on the lender and the stage of processing your application.

What if I don’t receive my loan money by the expected date?

Contact your lender immediately. They can investigate the reason for the delay and provide an updated timeline. Keep records of all communication.

Are there fees associated with student loan disbursement?

Some lenders may charge fees, but this is not always the case. Review your loan agreement carefully for details regarding any applicable fees.