The looming question for many graduates: when do student loan repayments begin? Navigating the complexities of student loan repayment can feel overwhelming, with various plans, interest calculations, and potential deferments impacting your timeline and overall cost. This guide provides a clear and concise overview of the repayment process, empowering you to make informed decisions about your financial future.

Understanding the different repayment plans available, the factors influencing repayment schedules, and strategies for effective debt management are crucial for minimizing long-term financial burdens. We’ll explore federal versus private loans, the impact of interest accrual, and the consequences of missed payments, providing you with the tools and resources to navigate this significant financial undertaking successfully.

Understanding Repayment Plans

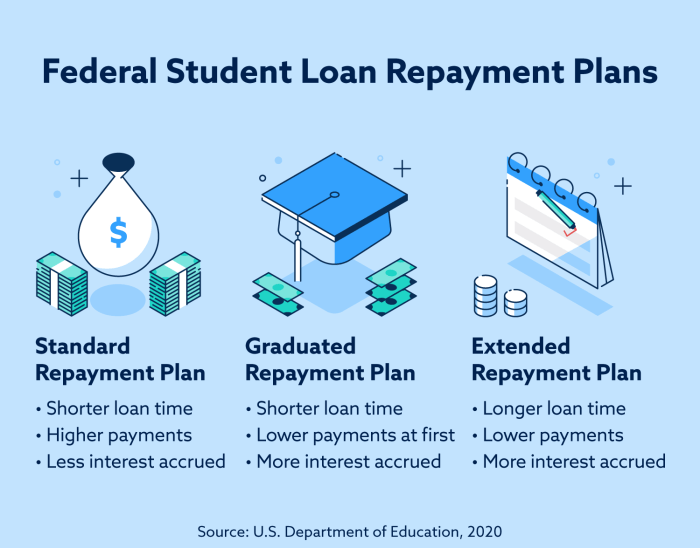

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term financial strain. Different plans offer varying payment amounts and schedules, impacting your monthly budget and the total interest you pay over the life of your loans. Understanding the nuances of each plan is key to making an informed decision.

Student Loan Repayment Plan Comparison

The following table compares three common student loan repayment plans: Standard, Graduated, and Income-Driven. The specifics of these plans can vary slightly depending on your lender and loan type (federal vs. private). This table provides a general overview.

| Plan Name | Payment Calculation | Minimum Payment | Eligibility Requirements |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over a 10-year period. | The amount needed to repay the loan within 10 years. | Available for most federal student loans. |

| Graduated Repayment Plan | Payments start low and gradually increase every two years for a 10-year period. | Lower than Standard initially, increasing over time. | Available for most federal student loans. |

| Income-Driven Repayment Plan (IDR) | Payment is calculated based on your discretionary income and family size. Several types of IDR plans exist (e.g., ICR, PAYE, REPAYE,IBR). | Varies significantly based on income and family size; generally lower than Standard and Graduated plans. | Available for most federal student loans; income verification required. |

Benefits and Drawbacks of Repayment Plans

Each repayment plan presents distinct advantages and disadvantages that significantly influence long-term financial outcomes.

Standard Repayment: This plan’s benefit is its speed; you pay off your loan quickly, minimizing total interest paid. However, the fixed high monthly payments can be challenging to manage, especially during periods of lower income.

Graduated Repayment: The lower initial payments are appealing for recent graduates with potentially lower incomes. However, the increasing payments can become burdensome later, and the total interest paid is higher than with the Standard plan.

Income-Driven Repayment: IDR plans offer significantly lower monthly payments, making them manageable for borrowers with limited income. However, this often results in a longer repayment period (potentially up to 20 or 25 years), leading to significantly higher total interest paid over the life of the loan. Forgiveness after 20 or 25 years (depending on the plan) is possible, but is subject to specific criteria and tax implications.

Applying for and Switching Repayment Plans

The process of applying for and switching between federal student loan repayment plans typically involves accessing your student loan servicer’s website. You will need your Federal Student Aid (FSA) ID and loan information. Switching plans usually requires completing an application and providing updated financial information (especially for IDR plans). There might be a short processing period before the change takes effect. Private loan repayment plan options and switching procedures vary greatly depending on the lender. It is important to carefully review your loan documents and contact your lender or servicer directly for specific guidance.

Managing Your Student Loan Debt

Successfully navigating student loan repayment requires a proactive approach to budgeting and financial planning. Understanding your income, expenses, and loan details is crucial for developing a manageable repayment strategy that minimizes stress and maximizes your financial well-being. This section will Artikel practical strategies to help you effectively manage your student loan debt.

Budgeting and Prioritizing Student Loan Payments

Creating a realistic budget is the cornerstone of effective student loan management. This involves meticulously tracking your income and expenses to identify areas where you can reduce spending and allocate more funds towards loan repayment. Prioritizing loan payments often involves considering factors such as interest rates, loan terms, and your overall financial goals. Higher-interest loans generally warrant more aggressive repayment strategies to minimize long-term interest accumulation. A well-structured budget will clearly show where your money is going, allowing you to identify areas for potential savings. For example, reducing discretionary spending on entertainment or dining out can free up significant funds for loan repayment.

Sample Budget Allocation

The following is a sample budget demonstrating how to allocate funds for loan repayment alongside other essential expenses. Remember, this is a template; your specific budget will need to reflect your individual income and expenses.

| Category | Monthly Allocation |

|---|---|

| Housing (Rent/Mortgage) | $1000 |

| Utilities (Electricity, Water, Gas) | $200 |

| Transportation (Car Payment, Gas, Public Transport) | $300 |

| Groceries | $400 |

| Student Loan Payment | $500 |

| Healthcare | $100 |

| Savings (Emergency Fund, Retirement) | $200 |

| Other Expenses (Entertainment, Clothing) | $300 |

| Total Monthly Expenses | $3000 |

This example assumes a monthly income sufficient to cover these expenses. Adjust the amounts to reflect your personal circumstances. The key is to ensure your student loan payment is a consistent and prioritized expense within your budget.

Creating a Personalized Student Loan Repayment Plan

Developing a personalized repayment plan involves a step-by-step process.

- List all your student loans: Include lender, loan amount, interest rate, and minimum monthly payment for each loan.

- Calculate your total monthly loan payments: Sum the minimum monthly payments for all your loans.

- Assess your monthly income and expenses: Create a detailed budget to understand your available funds.

- Determine your affordable monthly payment: This should be a realistic amount you can consistently afford without jeopardizing other essential expenses.

- Choose a repayment strategy: Consider options like the standard repayment plan, extended repayment plan, or income-driven repayment plan. Research which best suits your financial situation.

- Prioritize loan payments: Focus on paying off higher-interest loans first to minimize overall interest costs.

- Regularly review and adjust your plan: Your financial situation may change over time, so regular review and adjustments are essential.

Consequences of Missing Loan Payments

Missing student loan payments can have severe repercussions. Late payments negatively impact your credit score, making it harder to obtain loans, credit cards, or even rent an apartment in the future. Repeated missed payments can lead to loan default, resulting in wage garnishment, tax refund offset, and damage to your credit history. In some cases, it could even result in legal action by the lender. For example, a significant drop in your credit score can increase interest rates on future loans, costing you substantially more money over time. The consequences of defaulting on student loans are severe and long-lasting.

Resources and Support

Navigating the complexities of student loan repayment can feel overwhelming, but numerous resources and support systems are available to help borrowers manage their debt effectively. Understanding these resources and how to access them is crucial for successful repayment. This section details the various avenues of assistance available, from government agencies to non-profit organizations and online tools.

Government Agencies and Non-Profit Organizations

Several government agencies and non-profit organizations provide valuable assistance to student loan borrowers. These entities offer guidance on repayment plans, debt management strategies, and potential hardship programs. Contacting these organizations can provide personalized support and access to resources tailored to individual circumstances.

- Federal Student Aid (FSA): The FSA website (studentaid.gov) is a comprehensive resource offering information on federal student loan programs, repayment plans, and available assistance programs. They provide tools and resources to help borrowers understand their loan terms and manage their debt. Contact information is readily available on their website.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services, including assistance with student loan debt management. They can help borrowers create a budget, explore repayment options, and negotiate with lenders. Their website provides a directory of certified credit counselors.

- The United States Department of Education: The Department of Education oversees federal student aid programs and provides resources for borrowers experiencing difficulties. Their website offers information on various repayment plans, forgiveness programs, and other assistance options.

Student Loan Servicers and Their Services

Your student loan servicer is the company responsible for managing your student loans. They handle billing, payment processing, and provide information about your loans. Many servicers offer additional services to assist borrowers.

- Repayment Plan Options: Servicers offer various repayment plans, including income-driven repayment (IDR) plans, which adjust your monthly payments based on your income and family size. They can help you determine which plan best suits your financial situation.

- Deferment and Forbearance: In times of financial hardship, servicers may offer temporary deferment or forbearance, which allows you to postpone or reduce your payments for a limited time. However, interest may still accrue during these periods.

- Debt Counseling and Consolidation: Some servicers offer debt counseling services, providing guidance on managing your student loans. They may also facilitate loan consolidation, combining multiple loans into a single loan with a potentially lower monthly payment.

Government Programs and Initiatives

The government offers various programs and initiatives to assist with student loan repayment. These programs are designed to make repayment more manageable and accessible to borrowers facing financial challenges.

- Income-Driven Repayment (IDR) Plans: These plans calculate your monthly payment based on your income and family size, making repayment more affordable for low-income borrowers. Several IDR plans exist, each with different eligibility requirements and repayment periods.

- Public Service Loan Forgiveness (PSLF): This program forgives the remaining balance of your federal student loans after you’ve made 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization.

- Teacher Loan Forgiveness: This program provides forgiveness for a portion of your federal student loans if you teach full-time for five consecutive academic years in a low-income school or educational service agency.

Using Online Tools and Calculators

Numerous online tools and calculators can help you estimate your monthly payments and total repayment costs. These tools provide valuable insights into different repayment scenarios and help you plan effectively.

Many websites, including the Federal Student Aid website (studentaid.gov), offer free loan calculators. These calculators typically require you to input information about your loan amount, interest rate, and repayment plan to estimate your monthly payments and total repayment cost. Using these tools allows for a more informed decision-making process when selecting a repayment plan.

For example, inputting a $50,000 loan amount at a 5% interest rate over a 10-year repayment period might yield an estimated monthly payment of approximately $530 and a total repayment cost of approximately $63,600. Changing the repayment period to 15 years would lower the monthly payment but increase the total cost.

Long-Term Financial Planning

Student loan debt can significantly impact your long-term financial well-being, extending far beyond the repayment period. Understanding the potential consequences and proactively planning for them is crucial for securing a stable and prosperous future. Careful consideration of your repayment strategy and its implications on major life milestones is essential.

Student loan debt can substantially influence major life decisions, particularly homeownership and retirement planning. High monthly payments can reduce disposable income, limiting the amount available for a down payment on a house or for regular contributions to retirement savings accounts. The longer it takes to pay off student loans, the less time you have to build wealth through investments and savings, potentially delaying retirement or reducing its comfort level. This is especially true if high-interest debt is preventing you from making more aggressive investments.

Impact on Homeownership

The size of your mortgage and the type of home you can afford are directly affected by your student loan payments. A larger student loan debt burden may necessitate a smaller mortgage, a longer repayment term, or even postponing homeownership altogether. For example, someone with $50,000 in student loan debt at a 7% interest rate might find their monthly payments significantly reduce their ability to qualify for a mortgage, compared to someone with no student loan debt. This could mean opting for a smaller home or a longer mortgage term, both of which can have long-term financial consequences.

Impact on Retirement Planning

Student loan debt can severely hinder retirement savings. The money allocated to monthly loan payments could have been invested in retirement accounts, earning compound interest over time. Delaying retirement savings even for a few years can significantly reduce the final retirement nest egg due to the lost potential for growth. Consider this example: If someone starts saving $500 per month at age 25 with a 7% annual return, they will have considerably more at retirement than someone who starts at age 35, even if they contribute the same amount monthly. The impact of student loan debt is the deferral of that initial $500 monthly contribution, directly impacting the overall savings growth.

Strategies for Minimizing Long-Term Burden

Several strategies can help mitigate the long-term effects of student loan debt. Prioritizing high-interest loans for early repayment, exploring income-driven repayment plans, and consistently making extra payments whenever possible can significantly shorten the repayment period and reduce the total interest paid. Furthermore, building a strong credit score is vital, as it improves access to lower-interest refinancing options.

Refinancing Student Loans

Refinancing student loans involves consolidating multiple loans into a single loan with a potentially lower interest rate. This can lead to significant savings over the life of the loan, accelerating the repayment process. However, before refinancing, borrowers should carefully compare interest rates from different lenders, consider the terms and conditions of the new loan, and ensure that it aligns with their long-term financial goals. Factors to consider include the credit score, loan amount, and the length of the repayment term. It’s crucial to understand the potential benefits and drawbacks before making a decision. For example, refinancing federal loans into private loans might mean losing access to federal protections and repayment programs.

Hypothetical Scenario: Repayment Strategies and Long-Term Outcomes

Let’s consider two individuals, both graduating with $50,000 in student loan debt at a 7% interest rate. Individual A aggressively pays off the debt within 5 years through extra payments and potentially a higher monthly payment. Individual B opts for a standard 10-year repayment plan. While Individual B’s monthly payments are lower, they will pay significantly more in interest over the life of the loan. This difference in interest paid will substantially impact their long-term savings potential and ability to reach financial milestones like homeownership and retirement. Individual A, having paid off their loans early, will have significantly more disposable income in the long run and a greater capacity for investments.

Final Thoughts

Successfully managing student loan debt requires careful planning, proactive engagement with your loan servicer, and a realistic understanding of your financial capabilities. By understanding the various repayment options, factors affecting your repayment timeline, and available resources, you can create a personalized repayment strategy that aligns with your financial goals. Remember, seeking guidance from financial professionals and utilizing available resources can significantly ease the process and contribute to long-term financial well-being.

FAQ Compilation

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score, potentially leading to higher interest rates on future loans. Late fees may also apply, increasing your overall debt.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, carefully consider the terms and conditions before refinancing, as it may impact your eligibility for certain government programs.

What is loan consolidation?

Loan consolidation combines multiple student loans into a single loan, often simplifying repayment. It may also result in a lower monthly payment, but the total interest paid over the life of the loan could be higher.

Where can I find a student loan calculator?

Many websites, including those of federal student loan servicers and financial institutions, offer free student loan calculators to estimate monthly payments and total repayment costs.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payment on your income and family size. They often result in lower monthly payments but may extend your repayment period.