Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the concept of interest capitalization. This process, where accrued interest is added to your principal loan balance, significantly impacts your total repayment amount and overall cost. Understanding when and how interest capitalization occurs is crucial for effectively managing your student debt and minimizing long-term financial burden. This guide will explore the intricacies of interest capitalization on federal and private student loans, providing clarity on its implications for various loan types, repayment plans, and deferment periods.

We’ll delve into the specifics of different loan programs, examining how subsidized and unsubsidized loans differ in their capitalization policies. We’ll also analyze the influence of deferment and forbearance periods on the capitalization process, showing how these periods can significantly increase your total debt. Furthermore, we’ll explore the impact of various repayment plans, from standard repayment to income-driven plans, and demonstrate how your chosen repayment strategy affects the timing and amount of capitalized interest. By the end, you’ll have a comprehensive understanding of interest capitalization and its implications for your financial future.

Understanding Capitalization

Interest capitalization on student loans is a crucial aspect of loan repayment that significantly impacts the total amount you’ll eventually pay. It’s essentially the process of adding unpaid interest to your principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger overall debt. Understanding how capitalization works is vital for effective loan management and minimizing long-term costs.

Interest capitalization on student loans isn’t a single, uniform process. The way it works depends on the specific loan type, your repayment plan, and your loan servicer’s policies. Different types of capitalization exist, each with its own implications for borrowers.

Types of Interest Capitalization

There are primarily two scenarios where interest capitalization occurs: during periods of deferment or forbearance, and at the end of the grace period. During deferment or forbearance, you are temporarily not required to make payments on your loans. However, interest typically continues to accrue during these periods. This accrued interest is then capitalized, added to your principal balance. At the end of your grace period (the period after graduation before repayment begins), any accrued interest may also be capitalized, depending on your loan terms.

Examples of Interest Capitalization

Let’s illustrate with a couple of scenarios. Imagine a student with a $10,000 federal student loan. If they enter a 6-month deferment period and the annual interest rate is 5%, approximately $250 in interest will accrue ($10,000 * 0.05 * 6/12). At the end of the deferment, this $250 is capitalized, increasing the principal to $10,250. Future interest calculations will now be based on this higher principal, leading to a larger overall repayment amount. Another example: if a borrower has accrued $500 in interest during their grace period, this $500 would be added to the principal balance once the grace period ends, if capitalization applies to that loan.

Comparison of Simple Interest and Capitalized Interest

The difference between simple interest and capitalized interest is substantial. Simple interest is calculated only on the original principal amount. Capitalized interest, on the other hand, is calculated on the principal plus any accumulated and capitalized interest. This compounding effect significantly increases the total amount owed over time.

| Feature | Simple Interest | Capitalized Interest | Example (5% interest, $10,000 principal, 1 year) |

|---|---|---|---|

| Interest Calculation | Based on original principal only | Based on original principal plus accumulated and capitalized interest | |

| Year 1 Interest | $500 ($10,000 x 0.05) | $500 ($10,000 x 0.05) | |

| Year 2 Interest (Simple) | $500 ($10,000 x 0.05) | $525 ($10,500 x 0.05) | Simple Interest total: $1000; Capitalized Interest total: $1025 |

| Total Interest After 2 Years | $1000 | $1025 |

Loan Types and Capitalization

Understanding how interest capitalization works is crucial for managing your student loan debt effectively. Different loan types and programs have varying capitalization policies, significantly impacting the total amount you ultimately repay. This section will clarify these differences for both federal and private student loans.

Interest capitalization, the process of adding accumulated unpaid interest to your principal loan balance, affects the total amount you owe. This added principal then accrues further interest, leading to a larger overall debt. The timing and application of capitalization vary considerably depending on the loan type and your repayment plan.

Federal Student Loan Capitalization Policies

Federal student loans, offered through programs like the Direct Loan program, generally have standardized capitalization rules. However, distinctions exist between subsidized and unsubsidized loans. Subsidized loans, typically awarded based on financial need, do not accrue interest while the borrower is in school at least half-time, during grace periods, or in certain deferment periods. Unsubsidized loans, on the other hand, accrue interest throughout these periods. Capitalization for both types usually occurs when repayment begins or when a deferment or forbearance period ends if interest has accrued. For example, if a borrower has an unsubsidized loan and enters a deferment period, the accrued interest will be capitalized at the end of that deferment period.

Private Student Loan Capitalization

Private student loans, offered by banks and other financial institutions, have much more variable capitalization policies. Unlike federal loans with standardized rules, the terms and conditions surrounding interest capitalization will be explicitly stated in the loan agreement. Some private loans might capitalize interest at the end of each billing cycle, while others might do so only when a repayment period ends or after a specific period of deferment. Factors like the loan’s interest rate, the repayment plan chosen, and the lender’s specific policies will determine the capitalization schedule. For instance, a private loan with a high interest rate and a short repayment period might see more frequent capitalization, resulting in faster debt growth.

Factors Influencing Private Loan Capitalization

Several factors influence when interest capitalization begins on private student loans. These include the lender’s specific policies, the type of repayment plan selected (e.g., deferred, graduated, or standard), and whether the borrower has any periods of forbearance or deferment. It is imperative for borrowers to carefully review their loan agreements to understand the precise conditions under which interest capitalization will occur. Ignoring these details can lead to significant unforeseen increases in the total amount owed. For example, a loan agreement might specify capitalization after six months of non-payment, leading to a substantial increase in the loan principal.

Deferment and Forbearance

Deferment and forbearance are temporary pauses in student loan repayment, but they handle interest differently and significantly impact the total loan amount over time. Understanding how these periods affect interest capitalization is crucial for responsible loan management. Both deferment and forbearance can postpone your payments, but the consequences for your loan balance differ depending on the type of loan and the specific program.

Understanding the impact of deferment and forbearance on interest capitalization requires examining how interest accrues during these periods. During a deferment period, the government may or may not subsidize the interest, meaning that the government may pay the interest that accrues on your behalf. During a forbearance period, interest continues to accrue and is typically added to the principal balance of your loan at the end of the forbearance period, a process known as capitalization. This increased principal then accrues interest at a higher rate, resulting in a larger total loan amount over time.

Interest Capitalization During Deferment and Forbearance

The key difference lies in whether interest is subsidized during deferment. Unsubsidized loans accrue interest during deferment, which is then capitalized at the end of the deferment period. Subsidized loans, on the other hand, often have government-paid interest during deferment, preventing capitalization. Forbearance, however, almost always leads to interest capitalization, regardless of the loan type. The capitalized interest becomes part of the principal balance, increasing the total amount owed and future interest payments.

Examples of Deferment and Forbearance Impact

Let’s consider two scenarios. Scenario A involves a $20,000 unsubsidized loan with a 5% interest rate. A 12-month deferment period results in $1,000 of accrued interest ($20,000 * 0.05). This $1,000 is then capitalized, increasing the principal to $21,000. Scenario B is identical but involves a forbearance period. The outcome is the same; the $1,000 in accrued interest is capitalized, leading to a $21,000 principal balance. However, a subsidized loan in a similar deferment scenario would not see this increase in principal because the government would pay the accrued interest.

Scenario: Forbearance with and without Capitalization

Imagine a $15,000 unsubsidized loan with a 6% annual interest rate. A 24-month forbearance period is granted. Without interest capitalization, the interest accrued over two years would be $1,800 ($15,000 * 0.06 * 2). The total amount owed at the end of forbearance would remain $16,800. With capitalization, the $1,800 accrued interest is added to the principal, resulting in a new principal of $16,800. This new principal then accrues interest during repayment, leading to a higher total repayment amount compared to the scenario without capitalization. The longer the forbearance period, the more significant the difference becomes.

Comparison of Deferment and Forbearance Options

The impact of various deferment and forbearance options on interest capitalization can be summarized as follows:

- Subsidized Loan Deferment: Interest is usually paid by the government; therefore, capitalization is avoided.

- Unsubsidized Loan Deferment: Interest accrues and is capitalized at the end of the deferment period, increasing the loan principal.

- Forbearance (all loan types): Interest almost always accrues and is capitalized at the end of the forbearance period, significantly increasing the loan’s principal balance.

- Income-Driven Repayment Plans with Deferment: These plans may offer deferment options, but the impact on capitalization varies based on plan specifics and loan type.

Repayment Plans and Capitalization

Understanding how different repayment plans affect interest capitalization is crucial for minimizing your long-term student loan costs. The timing and amount of capitalization vary significantly depending on the repayment plan you choose, impacting your overall debt burden.

Capitalization, as previously discussed, is the process of adding accumulated interest to your principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger overall debt. The interaction between repayment plans and capitalization is complex, but understanding the basics can help borrowers make informed decisions.

Standard Repayment Plans and Capitalization

Standard repayment plans typically involve fixed monthly payments over a 10-year period. With this plan, interest accrues monthly, but capitalization generally only occurs during periods of deferment or forbearance, where payments are temporarily suspended. Therefore, strategic use of deferment or forbearance should be carefully considered, as it directly impacts the total interest capitalized. For example, if a borrower chooses to defer payments for a year, the accrued interest during that period would be capitalized, increasing the loan’s principal balance and extending the repayment period, leading to higher overall interest paid.

Extended Repayment Plans and Capitalization

Extended repayment plans offer longer repayment terms, typically up to 25 years. While this lowers monthly payments, it allows interest to accrue for a much longer period. Similar to standard plans, capitalization primarily happens during deferment or forbearance. However, the extended repayment period means that more interest accrues before repayment begins or resumes, resulting in potentially higher capitalization amounts compared to standard plans. The longer timeframe increases the total interest paid over the life of the loan.

Income-Driven Repayment Plans and Capitalization

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base monthly payments on your income and family size. A key feature of IDR plans is that they often result in lower monthly payments, but this frequently means a longer repayment period (potentially 20-25 years). While capitalization still occurs during deferment or forbearance, the extended repayment period under IDR plans can lead to substantial interest capitalization over time. This is because the low monthly payments may not cover the accruing interest, leading to a larger portion of the interest being added to the principal.

Hypothetical Scenario: Long-Term Cost Implications

Let’s consider a hypothetical scenario: Sarah borrows $50,000 in student loans.

| Repayment Plan | Monthly Payment (Estimate) | Repayment Period | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard (10-year) | $550 | 10 years | $16,000 (without capitalization during deferment/forbearance) |

| Extended (25-year) | $275 | 25 years | $45,000 (without capitalization during deferment/forbearance) |

| Income-Driven (20-year) | $200 – $400 (variable based on income) | 20 years | $35,000 – $55,000 (without capitalization during deferment/forbearance) |

This table illustrates the significant difference in total interest paid across different repayment plans. Note that these figures are estimates and do not account for potential interest capitalization during deferment or forbearance. In reality, the total cost with capitalization during deferment/forbearance could be significantly higher for all plans, especially for IDR plans where lower payments might lead to more frequent periods where interest exceeds the payment amount. The actual figures will vary based on the specific loan terms, interest rates, and the length of any deferment or forbearance periods.

Grace Periods and Capitalization

Grace periods represent a crucial timeframe after your student loan repayment period ends or before it begins, during which interest may or may not accrue depending on the loan type. Understanding how grace periods interact with capitalization is vital for minimizing your overall loan costs. The length of the grace period directly affects the amount of interest that will be added to your principal balance.

Grace periods and their impact on capitalization vary significantly between subsidized and unsubsidized federal student loans. This difference stems from the government’s role in covering interest during the grace period for subsidized loans. Understanding this distinction is key to effectively managing your student loan debt.

Subsidized and Unsubsidized Loan Differences During Grace Periods

Subsidized federal student loans offer a grace period where the government pays the accruing interest. This means that no interest is added to the principal balance during this period. Consequently, the principal amount remains unchanged when the grace period ends, and repayment begins on the original loan amount. For example, imagine a $10,000 subsidized loan with a six-month grace period. Even if interest accrues during this time, the government covers it, so the borrower begins repayment with a $10,000 principal. The total amount owed remains consistent throughout the grace period, leading to a lower overall repayment cost.

Unsubsidized federal student loans, however, behave differently. Interest continues to accrue during the grace period, and this interest is added to the principal balance at the end of the grace period—this is capitalization. Using the same example, a $10,000 unsubsidized loan with a six-month grace period will accumulate interest. Let’s assume $300 in interest accrued during this six months. At the end of the grace period, this $300 is added to the principal, resulting in a new principal balance of $10,300. Repayment then begins on this higher amount, leading to increased total repayment costs. The longer the grace period, the more interest accrues and the higher the capitalized amount.

The Accumulation and Capitalization of Interest During the Grace Period

Let’s illustrate the capitalization process with a concrete example. Consider a $20,000 unsubsidized federal student loan with a six-month grace period and a 5% annual interest rate. During the grace period, interest is calculated monthly. In the first month, the interest accrued is ($20,000 * 0.05)/12 ≈ $83.33. This interest is added to the principal at the end of each month, resulting in a slightly higher interest calculation for the following month. This compounding effect continues throughout the six-month grace period. At the end of the six months, the total accumulated interest (approximately $250, depending on the precise calculation method) is added to the principal balance of $20,000, resulting in a new principal of $20,250. This capitalized amount then becomes the basis for future interest calculations and monthly payments. This process highlights how even seemingly small amounts of interest can significantly impact the overall loan repayment cost when compounded over time.

Grace Period Length and Capitalized Interest

The length of the grace period directly influences the amount of capitalized interest. A longer grace period allows for more interest to accrue, leading to a larger amount added to the principal at the end of the grace period. For instance, an 18-month grace period would result in substantially more capitalized interest compared to a six-month grace period, all other factors being equal. This difference can be significant, potentially adding hundreds or even thousands of dollars to the total loan amount. Borrowers should be aware of the length of their grace period and understand its implications for their overall repayment costs.

Calculating Capitalized Interest

Understanding how capitalized interest is calculated is crucial for accurately predicting your future loan balance. Capitalization adds accumulated interest to your principal loan amount, increasing the total amount you owe and potentially lengthening your repayment period. This section details the methods and provides a practical example.

The calculation of capitalized interest is straightforward, though the specific details may vary slightly depending on your loan servicer and loan terms. Generally, the process involves determining the unpaid interest accrued during a specific period (often a deferment or forbearance period), and then adding that accumulated interest to the principal balance. This new, larger principal balance then accrues interest at the loan’s stated interest rate.

Capitalized Interest Calculation Method

The fundamental formula for calculating capitalized interest is relatively simple: Capitalized Interest = Total Accrued Interest. The complexity lies in determining the “Total Accrued Interest.” This is calculated by multiplying the outstanding principal balance by the daily or monthly interest rate and summing this across the period of deferment or forbearance.

Capitalized Interest = Principal Balance x (Daily/Monthly Interest Rate) x Number of Days/Months

Let’s illustrate with a step-by-step example:

Example Calculation of Capitalized Interest

Assume a student loan with a principal balance of $10,000 and an annual interest rate of 6%. The borrower enters a six-month deferment period.

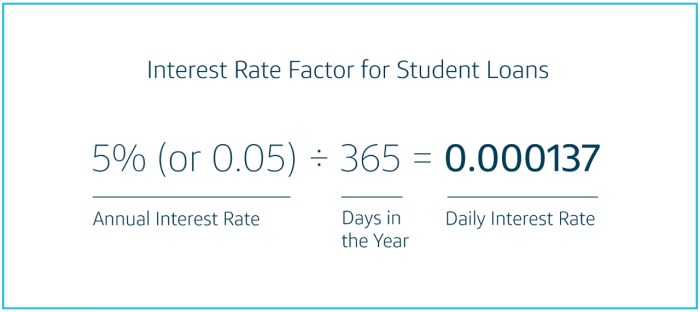

- Calculate the daily interest rate: The annual interest rate is 6%, so the daily rate is 6%/365 = 0.0164%.

- Calculate the interest accrued each day: Each day, the interest accrued is $10,000 * 0.000164 = $1.64.

- Calculate the total interest accrued during the deferment: Over six months (180 days), the total interest accrued is $1.64/day * 180 days = $295.20.

- Capitalize the interest: The $295.20 in accrued interest is added to the principal balance. The new principal balance becomes $10,000 + $295.20 = $10,295.20.

Impact of Capitalization on Total Amount Owed

Following the capitalization, the borrower will now owe interest on the increased principal balance of $10,295.20. This means that future interest payments will be higher than they would have been had the interest not been capitalized. The longer the deferment or forbearance period, the more significant the impact of capitalization on the total amount owed. For example, if the borrower continued to make no payments for another six months, the amount of interest capitalized would be substantially larger, leading to a larger increase in the principal balance. This illustrates the importance of understanding capitalization and making timely payments to avoid this compounding effect.

Step-by-Step Guide to Calculating Capitalization’s Impact

To understand the full impact, follow these steps:

- Determine the capitalization period: Identify the length of the deferment or forbearance period in days or months.

- Calculate the daily or monthly interest rate: Divide the annual interest rate by 365 (for daily) or 12 (for monthly).

- Calculate daily/monthly interest accrued: Multiply the principal balance by the daily/monthly interest rate.

- Calculate total interest accrued during the period: Multiply the daily/monthly interest accrued by the number of days/months in the period.

- Add capitalized interest to the principal: Add the total accrued interest to the original principal balance to get the new principal balance.

- Project future payments: Use the new principal balance to project future interest and principal payments to see the overall impact on the total amount owed.

Last Recap

Successfully managing student loan debt requires a proactive approach and a thorough understanding of all its aspects. Interest capitalization, while a complex topic, is a crucial element in determining your total repayment cost. By carefully considering the information presented – encompassing loan types, repayment plans, deferment options, and grace periods – you can make informed decisions to minimize the impact of capitalized interest and achieve efficient repayment. Remember, understanding the intricacies of interest capitalization empowers you to take control of your financial future and navigate the student loan repayment process with greater confidence and clarity.

FAQ

What happens if I don’t make payments during my grace period?

Interest will accrue and may capitalize at the end of the grace period, increasing your principal balance.

Can I prevent interest capitalization?

Making payments while interest is accruing, even small ones, can help minimize the amount of interest that capitalizes.

How often does interest capitalize?

This depends on your loan servicer and loan type; it’s often annually but can vary.

Does capitalization affect my credit score?

While capitalization itself doesn’t directly impact your credit score, the resulting higher loan balance can affect your debt-to-income ratio, which is a factor in credit scoring.