Securing student loan funds is a crucial step in pursuing higher education. The anticipation of receiving these funds can be both exciting and stressful, leaving many students wondering about the timeline and process. This guide aims to demystify the complexities of student loan disbursement, providing a clear understanding of what to expect, how to track your application, and how to address potential delays.

From understanding the various factors influencing disbursement speed—such as loan type and application completeness—to mastering the art of proactive monitoring and effectively managing your funds once received, we’ll cover all the essential aspects. We will also explore strategies for resolving common delays and offer practical advice on responsible financial planning to ensure a smooth and successful educational journey.

Understanding Student Loan Disbursement

Receiving your student loan funds involves a process that can vary depending on several factors. Understanding this process can help manage expectations and ensure a smoother transition into your academic journey. This section details the typical timeline, influencing factors, and step-by-step guide for student loan disbursement.

Typical Timeline for Student Loan Disbursement

The time it takes to receive your student loan funds typically ranges from a few weeks to several months, depending on several factors discussed below. A general estimate would be that the entire process, from application submission to funds hitting your account, can take anywhere between one and three months. However, this is a broad range, and significant variations are possible. For instance, some students might receive their funds within a few weeks, while others may experience delays extending to several months.

Factors Influencing Disbursement Speed

Several key factors can significantly impact how quickly your loan funds are disbursed. These factors include the type of loan, your school’s processing speed, and the completeness of your application.

- Loan Type: Federal student loans generally have a more established and streamlined disbursement process compared to private loans. Private loan providers often have varying internal procedures and may require additional verification steps, potentially leading to longer processing times.

- School Processing Time: Your school’s financial aid office plays a crucial role in verifying your eligibility and forwarding your loan information to the lender. Schools with efficient financial aid offices tend to process applications more quickly, leading to faster disbursement.

- Application Completeness: Incomplete or inaccurate applications can cause delays. Ensure you provide all required documentation and information accurately to avoid setbacks in the processing timeline. Missing information will often result in a request for further documentation from the lender or your school, delaying the process.

Step-by-Step Guide to Student Loan Disbursement

The process generally follows these steps:

- Application and Approval: You complete the Free Application for Federal Student Aid (FAFSA) for federal loans or a private loan application for private loans. The application is then reviewed and approved by the lender or your school.

- Loan Certification: Your school certifies your eligibility for the loan, verifying your enrollment and the amount you are eligible to borrow.

- Master Promissory Note (MPN): For federal loans, you will likely need to sign a Master Promissory Note, agreeing to the terms of the loan.

- Disbursement Scheduling: The lender schedules the disbursement of funds, typically in installments aligned with your academic terms.

- Funds Deposited: The funds are deposited into your designated bank account, usually directly from the lender or through your school.

Comparison of Disbursement Timelines for Various Loan Types

| Loan Type | Processing Time (Typical) | Typical Disbursement Delays | Notes |

|---|---|---|---|

| Federal Direct Subsidized Loan | 4-6 weeks | Minimal, usually within a week of processing | Faster due to established government processes |

| Federal Direct Unsubsidized Loan | 4-6 weeks | Minimal, usually within a week of processing | Similar processing time to subsidized loans |

| Federal PLUS Loan (Parent/Graduate) | 6-8 weeks | May experience slightly longer delays due to additional credit checks | Credit check required for parent borrowers |

| Private Student Loan | 6-8 weeks or longer | Can vary significantly depending on the lender and individual circumstances | More variable due to lender-specific processes and credit checks |

Tracking Loan Status

Staying informed about your student loan application’s progress is crucial for a smooth disbursement process. Regularly checking your loan status helps you identify and address potential issues promptly, ensuring you receive your funds on time. Proactive monitoring minimizes stress and allows you to focus on your studies.

Knowing how to track your loan status and understand the communication methods used by your lender is essential. This involves utilizing various tools and channels provided by your lender, as well as maintaining accurate personal and financial information.

Loan Status Tracking Methods

Most lenders offer multiple ways to track your loan application. These typically include online student loan portals, email updates, and phone support. Each method provides different levels of detail and accessibility. Utilizing a combination of these methods can offer the most comprehensive overview of your loan’s progress.

Communication Channels for Loan Status Updates

Lenders primarily communicate loan status updates through three main channels:

- Email: Regular email updates are common, providing notifications about application progress, required documentation, and disbursement dates. These emails often contain links to your online student loan portal for more detailed information.

- Online Portal: A dedicated online portal is usually available, allowing you to log in and view the current status of your application, track submitted documents, and review important dates and deadlines. This portal typically offers the most comprehensive and up-to-date information.

- Phone Support: Contacting the lender’s customer service department by phone can provide answers to specific questions or address concerns not covered in email updates or the online portal. However, phone support may have longer wait times.

Importance of Accurate Information

Providing accurate personal and financial information during the application process is paramount to avoid delays. Inaccuracies can trigger verification processes, leading to delays in processing your application and the disbursement of your funds. This includes details such as your Social Security number, address, bank account information, and enrollment status. Double-checking all information before submitting your application is strongly recommended.

Proactive Monitoring Checklist

To ensure a timely disbursement, students should take the following actions:

- Create a checklist: List all required documents and deadlines. Mark off each step as you complete it.

- Regularly check your email: Check your email inbox frequently for updates from your lender.

- Access your online portal frequently: Log in to your online student loan portal at least once a week to review your application status.

- Keep your contact information updated: Ensure your contact information, including your email address and phone number, is current and accurate with your lender.

- Respond promptly to requests: If the lender requests additional documentation or information, respond promptly and completely.

- Contact customer support if needed: Don’t hesitate to contact your lender’s customer support if you have questions or concerns about your loan application.

Addressing Delays

Student loan disbursement can sometimes be delayed, causing understandable anxiety. Understanding the common reasons for these delays and the steps you can take to resolve them is crucial for a smooth transition into your studies. Proactive communication with your lender is key to preventing unnecessary stress and ensuring timely access to your funds.

Delays in receiving your student loan funds can stem from several sources. These range from administrative oversights to missing or incomplete documentation on your part. Knowing what to expect and how to address potential problems is the best way to ensure a quick resolution.

Common Reasons for Student Loan Disbursement Delays

Several factors can contribute to delays in receiving your student loan funds. These commonly include missing or incomplete documentation, such as verification of enrollment or dependency status. Processing errors within the lender’s system, discrepancies in your application information, and even unforeseen technical issues can also cause delays. Furthermore, delays can sometimes arise from the verification of your identity or financial information. Finally, a high volume of applications during peak periods can also lead to processing delays.

Resolving Issues Causing Delays

If you encounter a delay, the first step is to gather all relevant documentation. This includes your student loan application, acceptance letter from your institution, and any other forms or documents requested by your lender. Carefully review all documents for any discrepancies or missing information. Contact your institution’s financial aid office to confirm your enrollment status and ensure all necessary information has been sent to your lender. If you identify any missing information, submit it to your lender immediately. If you’ve already submitted all required documents, contacting your lender directly to inquire about the status of your loan is crucial.

Communication Templates for Contacting Your Lender

Effective communication is key to resolving delays. Here are some examples of email templates you can adapt:

Template 1 (General Inquiry):

Subject: Inquiry Regarding Student Loan Disbursement – [Your Name] – [Loan Application Number]

Dear [Lender Name],

I am writing to inquire about the status of my student loan disbursement. My application number is [Loan Application Number]. The expected disbursement date was [Date], and I have not yet received the funds. Could you please provide an update on the status of my application and let me know if any further information is required from my end?

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Template 2 (Missing Documentation):

Subject: Missing Documentation – Student Loan Disbursement – [Your Name] – [Loan Application Number]

Dear [Lender Name],

I am writing to follow up on my student loan disbursement application (number: [Loan Application Number]). I understand there may be a delay due to missing documentation. I have already [Action taken to resolve the issue, e.g., resubmitted the missing document]. Could you please confirm receipt and provide an estimated timeframe for disbursement?

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Flowchart for Addressing Delayed Loan Disbursement

The following flowchart Artikels the steps to take if your student loan disbursement is delayed:

[Imagine a flowchart here. It would begin with “Loan Disbursement Delayed?” A “Yes” branch would lead to “Gather all documentation.” This would branch to “Check for missing information?” A “Yes” branch would lead to “Resubmit missing information to lender.” A “No” branch would lead to “Contact lender for status update.” From “Contact lender for status update,” a branch would lead to “Issue resolved?” A “Yes” branch would lead to “Receive funds.” A “No” branch would lead to “Escalate issue to lender’s supervisor or relevant department.” From “Receive funds” and “Escalate issue…”, both would lead to “End.”]

Understanding Loan Funds

Student loan funds represent a significant financial resource for your education, and understanding how they are disbursed and managed is crucial for successful financial planning during your studies. This section details the typical disbursement process, various access methods, effective budgeting strategies, and provides a sample budget to guide your financial decisions.

Student loan funds are typically disbursed electronically via direct deposit into a designated bank account. Some lenders may offer the option of receiving a paper check, but direct deposit is overwhelmingly the preferred and most efficient method. Before your loan is disbursed, you’ll need to provide your lender with your banking information, ensuring accuracy to avoid delays or complications. The disbursement schedule varies depending on the lender and the specific loan program, but you’ll usually receive a notification informing you of the disbursement date and amount.

Loan Fund Access and Management

Once the funds are deposited, you have direct access to them through your bank account. Managing these funds responsibly is paramount. You can use online banking tools to track your balance, schedule payments for expenses, and set up automatic transfers to savings accounts if desired. Many banks offer budgeting apps or tools that can help you monitor your spending and track your progress toward your financial goals. It is strongly recommended to establish a separate bank account dedicated solely to your student loan funds to improve organization and avoid confusion with personal finances.

Budgeting and Allocating Student Loan Funds

Effective budgeting is essential to ensure your loan funds cover all your educational expenses. Creating a detailed budget allows you to track your spending, identify potential areas for savings, and avoid accumulating unnecessary debt. Start by listing all your expected expenses, including tuition, fees, books, accommodation, transportation, food, and other living costs. Then, allocate your loan funds accordingly, prioritizing essential expenses. Regularly review and adjust your budget as needed throughout the academic year. Consider using budgeting apps or spreadsheets to simplify this process.

Sample Student Loan Budget

The following table provides a sample budget. Remember that this is a template, and your actual expenses may vary. Adjust the amounts to reflect your individual circumstances and cost of living.

| Expense Category | Allocated Amount |

|---|---|

| Tuition | $10,000 |

| Fees | $1,500 |

| Books and Supplies | $500 |

| Rent/Accommodation | $6,000 |

| Food | $3,000 |

| Transportation | $500 |

| Other Expenses (e.g., entertainment, personal care) | $1,000 |

Financial Literacy and Planning

Securing student loan funds marks a significant step towards your education, but responsible financial management is equally crucial. Understanding your borrowing and developing sound financial habits will ensure you can navigate repayment effectively and build a strong financial foundation for your future. This section will provide guidance on responsible borrowing practices, the importance of understanding loan terms, and resources available to support your financial well-being.

Responsible Borrowing and Financial Planning for Students

Effective financial planning is paramount when managing student loan debt. It’s vital to borrow only the amount necessary to cover educational expenses, living costs, and other essential needs. Avoid unnecessary borrowing, as this will increase your debt burden and potentially prolong the repayment period. Creating a realistic budget that tracks income and expenses is key. This allows you to identify areas where you can reduce spending and prioritize essential needs. Consider exploring scholarships, grants, and part-time employment opportunities to supplement your funding and minimize your loan dependence.

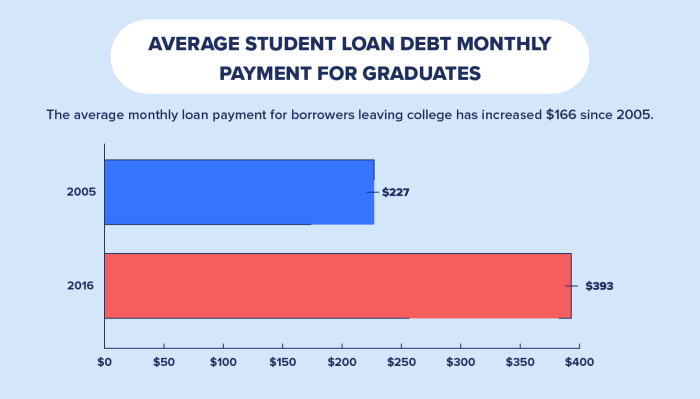

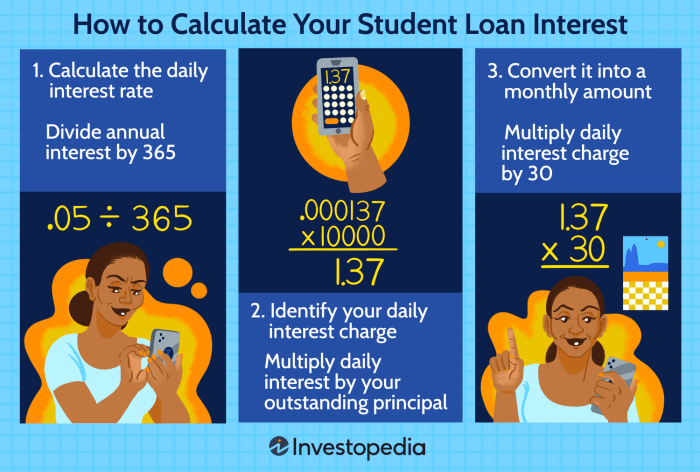

Understanding Loan Repayment Terms and Interest Rates

Understanding your loan repayment terms and interest rates is crucial for responsible debt management. Your loan agreement will specify the repayment period (typically 10-20 years), the monthly payment amount, and the annual interest rate. Interest accrues on the outstanding loan balance, increasing the total amount you owe. Higher interest rates result in larger overall costs. Carefully review your loan documents to fully understand these terms and explore options for different repayment plans that might affect your monthly payments and total interest paid. For example, a longer repayment period lowers your monthly payment but increases the total interest paid over the life of the loan. Conversely, a shorter repayment period increases your monthly payment but reduces the total interest paid.

Resources for Financial Guidance and Budgeting Assistance

Numerous resources are available to provide students with financial guidance and budgeting assistance. Many colleges and universities offer free financial aid workshops and counseling services. These services can help you create a budget, understand your loan terms, and develop strategies for responsible debt management. Furthermore, several non-profit organizations and government agencies provide free financial literacy programs and resources. These resources often include online tools, budgeting apps, and educational materials to help you manage your finances effectively. For example, the National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, including debt management plans. The Consumer Financial Protection Bureau (CFPB) website provides a wealth of information on student loans, budgeting, and financial planning.

Student Loan Repayment: An Infographic Overview

This infographic uses a combination of charts and visuals to illustrate key aspects of student loan repayment.

The infographic begins with a title: “Understanding Your Student Loan Repayment.”

Section 1: Interest Accrual: A simple line graph visually depicts how interest accumulates over time on a sample loan amount ($20,000) with a 5% interest rate. The x-axis represents time (in years), and the y-axis represents the total amount owed, showing the steady increase due to accumulated interest.

Section 2: Repayment Plans: A table compares three common repayment plans (Standard, Graduated, and Income-Driven) showing the monthly payment amount, total repayment period, and total interest paid for a sample loan. This visually demonstrates how different plans impact monthly expenses and long-term costs.

Section 3: Consequences of Default: A pie chart illustrates the potential consequences of defaulting on student loans, such as wage garnishment, tax refund offset, and damage to credit score. Each segment represents a percentage of borrowers experiencing a specific consequence, using realistic percentages based on available data from reputable sources. The visual impact emphasizes the severity of defaulting.

Section 4: Key Terms Glossary: A visually appealing list defines key terms like “principal,” “interest,” “amortization,” “deferment,” and “forbearance.” Each term is briefly defined using simple, accessible language.

The overall infographic uses a clear and concise design with minimal text, relying on visual elements to communicate information effectively. A color-coded scheme makes it easy to follow, and the use of icons enhances understanding. The infographic uses a consistent font and layout to maintain a professional and visually appealing presentation. The data presented is sourced from reliable government and educational institutions to ensure accuracy and credibility.

Outcome Summary

Successfully navigating the student loan disbursement process requires proactive engagement and a clear understanding of the involved steps. By utilizing the tracking methods Artikeld, addressing potential delays promptly, and implementing sound financial planning strategies, students can confidently manage their funds and focus on their academic pursuits. Remember, responsible borrowing and effective budgeting are key to a successful educational experience and a financially secure future.

Questions and Answers

What happens if my loan application is incomplete?

An incomplete application will likely cause delays. The lender will contact you to request the missing information. Responding promptly is crucial to expedite the process.

Can I change my disbursement method after applying?

This depends on your lender and how far along in the process you are. Contact your lender directly to inquire about changing your disbursement method.

What if I don’t receive my loan funds by the expected date?

Contact your lender immediately. They can investigate the reason for the delay and provide an updated timeline.

Are there penalties for withdrawing from classes after receiving loan funds?

Yes, there may be return of funds requirements depending on your institution and the loan type. Contact your financial aid office for clarification.