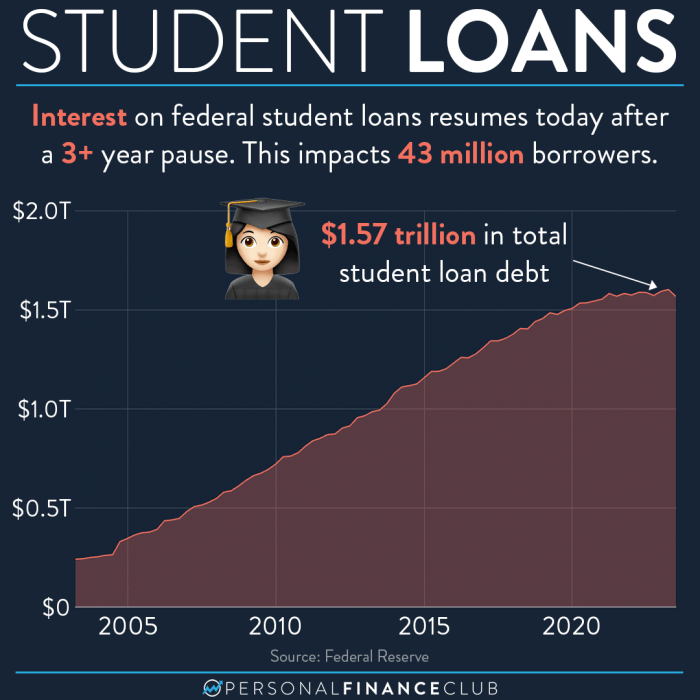

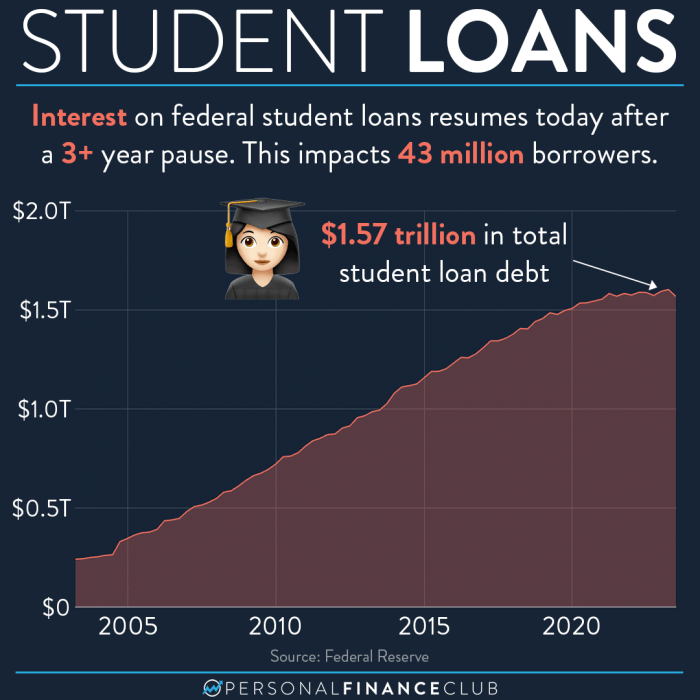

The pause on student loan interest payments has been a significant event, impacting millions of borrowers and the economy. This period of suspension, while offering temporary relief, has raised crucial questions about the future of student loan debt and the eventual resumption of interest accrual. Understanding the factors influencing this decision, from inflation and political pressures to the economic consequences for both borrowers and the nation, is vital for anyone affected by student loans.

This exploration delves into the history of student loan interest, examining past periods of suspension and resumption, and analyzing the various economic and political forces that have shaped these policies. We will also consider the potential impact of restarting interest payments, including the financial burden on borrowers and the potential ripple effects on the broader economy. Finally, we’ll explore available resources and repayment options to help borrowers navigate this complex landscape.

The History of Student Loan Interest Accrual

The accrual of interest on federal student loans in the United States has been a dynamic process, significantly influenced by economic conditions and government policy. Understanding this history requires examining periods of both consistent interest accrual and periods of suspension or modification, alongside the legislation and economic factors that shaped these shifts.

Timeline of Interest Accrual and Suspension

The history of student loan interest is marked by periods of consistent accrual interspersed with periods of temporary or partial suspension, primarily driven by economic downturns and policy decisions. Prior to the 2000s, interest consistently accrued on federal student loans, with rates fluctuating based on market conditions and the type of loan. However, the Great Recession and subsequent economic uncertainty led to significant changes. For example, the American Recovery and Reinvestment Act of 2009 included provisions impacting student loan interest rates. More recently, the COVID-19 pandemic prompted unprecedented actions, including a complete pause on interest accrual for many federal student loan programs. This pause, extended several times, represented a significant departure from historical practice. The resumption of interest accrual in 2023 marks a return to a more traditional model, though the long-term implications of these periods of suspension remain to be seen.

Significant Legislation Impacting Student Loan Interest Rates and Repayment Plans

Several pieces of legislation have profoundly impacted student loan interest rates and repayment plans. The Higher Education Act of 1965 laid the foundation for the federal student loan program. Subsequent amendments and reauthorizations have continually adjusted interest rates, repayment options, and eligibility criteria. The Health Care and Education Reconciliation Act of 2010 made significant changes to the Stafford Loan program, including the introduction of income-driven repayment plans. The ongoing debate surrounding student loan forgiveness and reform further underscores the continuous evolution of federal student loan policy and its direct impact on interest accrual.

Economic Factors Influencing Decisions Regarding Interest Accrual

Economic conditions have played a crucial role in decisions regarding student loan interest accrual. Periods of economic expansion often see higher interest rates, reflecting a stronger economy and greater investor confidence. Conversely, during economic downturns or recessions, policymakers may opt to suspend or reduce interest rates to stimulate economic activity and alleviate financial burdens on borrowers. The decision to pause interest accrual during the COVID-19 pandemic, for instance, was partly driven by the recognition that widespread economic hardship could exacerbate the already significant burden of student loan debt. Inflationary pressures also influence these decisions; high inflation might necessitate adjustments to interest rates to maintain the program’s financial solvency.

Comparison of Interest Rates Across Federal Student Loan Programs (Past Decade)

The following table provides a simplified comparison of interest rates across different federal student loan programs over the past decade. Note that these are approximate figures, and actual rates varied based on loan type, year of disbursement, and other factors. Furthermore, the periods of interest suspension during the COVID-19 pandemic are not explicitly reflected in these average rates.

| Loan Program | Approximate Average Interest Rate (2013-2023) | Rate Type | Notes |

|---|---|---|---|

| Subsidized Stafford Loans | 3.5% – 6% | Fixed | Rates varied annually |

| Unsubsidized Stafford Loans | 4.5% – 7% | Fixed | Rates varied annually |

| PLUS Loans (Graduate/Parent) | 6% – 8% | Fixed/Variable (depending on year) | Higher rates than undergraduate loans |

| Direct Consolidation Loans | Variable, based on underlying loans | Weighted Average | Rate reflects average of consolidated loans |

Factors Influencing the Restart of Student Loan Interest

The resumption of student loan interest payments is a complex issue influenced by a multitude of economic and political factors. The decision isn’t simply a matter of turning a switch; it involves careful consideration of the potential impact on borrowers, the economy, and the government’s fiscal position. Several key elements play significant roles in shaping the timing and approach to this significant policy shift.

Inflation’s Role in the Decision-Making Process

Inflation significantly impacts the government’s decision regarding student loan interest resumption. High inflation erodes the real value of money, meaning the government’s outstanding debt, including the unpaid interest on student loans, becomes less burdensome in nominal terms. Conversely, restarting interest accrual generates revenue for the government, which can help offset inflationary pressures by reducing the need for additional borrowing or increasing taxes. However, restarting payments during high inflation could disproportionately impact borrowers struggling with increased living costs, potentially leading to increased defaults and exacerbating economic hardship. The government must carefully balance the economic benefits of increased revenue against the potential social and economic costs of imposing additional financial strain on borrowers. For example, if inflation is at 8%, the real cost of the debt is reduced, making the decision to resume payments more politically palatable. However, if this coincides with a rise in unemployment, the political pressure to extend the pause might outweigh the economic benefits of resuming interest.

Political Pressures Influencing the Timing of Interest Restart

The timing of student loan interest resumption is highly susceptible to political pressures. The student loan borrower base is a large and politically active demographic. Delaying the resumption of payments can be seen as a politically advantageous move, particularly during election cycles, potentially garnering support from a significant portion of the electorate. Conversely, promptly restarting payments might be favored by those who prioritize fiscal responsibility and reducing the national debt. The political party in power, along with the prevailing political climate and public opinion, significantly influence the timing of this decision. For instance, a government facing an upcoming election might choose to delay the restart to avoid alienating a large voting bloc, while a government with a strong mandate might prioritize fiscal stability and proceed with the resumption regardless of potential short-term political consequences.

Economic Impacts of Resuming Interest Payments Versus Extending the Pause

Resuming interest payments generates revenue for the government, reducing the overall national debt and potentially freeing up funds for other government programs. However, it simultaneously increases the financial burden on borrowers, potentially leading to reduced consumer spending and slower economic growth. Conversely, extending the pause provides short-term relief to borrowers, potentially stimulating consumer spending, but it increases the overall national debt and delays the government’s recovery of the loan principal and interest. The economic impact depends on a variety of factors including the overall health of the economy, the level of inflation, and the specific characteristics of the borrower population. A strong economy might be better able to absorb the impact of resumed payments, while a weak economy might benefit more from an extended pause. Models predicting the impact often differ depending on the assumptions made about borrower behavior and the overall economic environment.

Potential Consequences for Borrowers if Interest Resumes Unexpectedly

An unexpected resumption of interest payments could significantly impact borrowers. Many may be unprepared for the sudden increase in their monthly payments, potentially leading to increased financial stress, delinquencies, and defaults. This could have ripple effects throughout the economy, impacting housing markets, consumer spending, and overall economic growth. Borrowers might experience difficulty budgeting and managing their finances, potentially leading to reduced credit scores and limited access to future credit. The severity of the impact will vary depending on individual circumstances, but the potential for widespread financial hardship is significant, particularly for those with low incomes or high debt burdens. A phased-in approach, with adequate notice and potential support mechanisms, could help mitigate these risks.

Impact on Borrowers and the Economy

The resumption of student loan interest accrual will significantly impact both individual borrowers and the broader economy. The added financial burden on borrowers could lead to decreased consumer spending and potentially trigger a ripple effect throughout various economic sectors. Understanding the potential consequences is crucial for policymakers and individuals alike.

The restart of interest accrual will immediately increase the monthly payments for many borrowers. For those already struggling to make ends meet, this added expense could be overwhelming, potentially leading to financial hardship. The magnitude of this impact will vary depending on factors such as loan amount, interest rate, repayment plan, and individual financial circumstances. The added financial strain could force some borrowers to make difficult choices, potentially impacting their ability to save, invest, or even meet other essential financial obligations.

Financial Burden on Borrowers

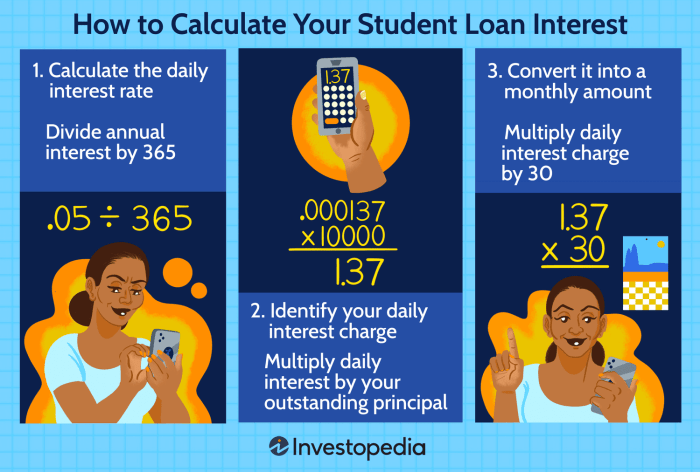

The following hypothetical scenario illustrates the potential impact of restarting interest accrual on borrowers with varying loan amounts and repayment plans. Assume a 5% annual interest rate for simplicity.

| Borrower | Loan Amount | Repayment Plan (Monthly Payment before Interest) | Monthly Payment (with Interest) | Annual Increase in Payment |

|---|---|---|---|---|

| A | $20,000 | $300 | $325 | $300 |

| B | $50,000 | $750 | $875 | $1500 |

| C | $100,000 | $1500 | $1750 | $3000 |

Note: These are simplified examples and actual increases will vary based on the specific loan terms and repayment plan. The calculations assume a simple interest model for illustrative purposes. In reality, the calculation of interest on student loans is more complex.

Potential Defaults and Delinquencies

The increased financial burden could lead to a rise in student loan defaults and delinquencies. Borrowers facing financial hardship may struggle to meet their increased monthly payments, potentially resulting in negative credit impacts and further financial instability. Historical data from previous periods of student loan interest accrual can offer insights into potential default rates. For example, data from the period following the 2008 financial crisis could provide a relevant comparison point, though economic conditions were vastly different then. Analyzing trends in default rates across different demographic groups and loan types could also offer valuable predictive insights. Predicting the precise increase in defaults and delinquencies requires sophisticated modeling incorporating various macroeconomic and microeconomic factors.

Ripple Effect on the Economy

The increased financial strain on borrowers could lead to reduced consumer spending. With less disposable income, borrowers may cut back on non-essential purchases, impacting businesses across various sectors. This decreased consumer demand could potentially lead to slower economic growth and job losses. The magnitude of this ripple effect will depend on factors such as the overall health of the economy, the proportion of borrowers affected, and the extent to which they reduce their spending. A reduction in consumer spending could lead to a decrease in aggregate demand, potentially causing a contractionary effect on the economy. This could further exacerbate the financial difficulties faced by borrowers and lead to a vicious cycle of economic downturn.

Government Communication and Public Awareness

Effective communication regarding the resumption of student loan interest accrual is crucial for ensuring borrowers understand their obligations and can plan accordingly. The government’s approach to disseminating this information significantly impacts borrower preparedness and overall economic stability.

The government has employed various channels to inform borrowers about the reinstatement of student loan interest. Official statements from the Department of Education, typically released through press releases and updates on their website, provide the most direct information. These statements usually Artikel the timeline for the restart, potential impacts on repayment plans, and resources available to borrowers. Further communication often takes place through email notifications sent directly to loan holders, informing them of changes to their repayment schedules and interest rates.

Official Government Statements on Student Loan Interest

Official government statements regarding the resumption of student loan interest have emphasized the importance of borrowers understanding their loan terms and preparing for the upcoming changes. These statements typically include specific dates for the restart of interest accrual, details about how the interest will be calculated, and resources for borrowers seeking assistance or clarification. While the exact wording and details vary depending on the specific statement and its release date, the overarching message consistently centers on the need for borrowers to proactively manage their loans. For example, a press release might detail the exact date interest will resume and include a link to a frequently asked questions (FAQ) page on the Department of Education’s website.

Government Communication Methods

The government utilizes a multi-pronged approach to reach student loan borrowers. Direct email notifications to borrowers are a key method, ensuring personalized communication about upcoming changes to individual loan accounts. The Department of Education’s website serves as a central hub for information, offering FAQs, videos, and downloadable resources. Social media platforms are also used to disseminate updates and announcements, although this method may not reach all borrowers effectively. Finally, the government may collaborate with media outlets to publish articles and conduct interviews to reach a wider audience. However, relying solely on social media or the news media is insufficient to ensure everyone receives the necessary information.

Strategies for Improving Communication and Transparency

Several strategies could enhance communication and transparency around student loan interest. A more proactive and personalized communication strategy, perhaps using text message alerts in addition to emails, would improve outreach. Simplifying complex information through easily digestible infographics and videos would aid understanding. Furthermore, increased collaboration with student advocacy groups and financial literacy organizations could help disseminate information more effectively to vulnerable populations. Finally, establishing a centralized, easily accessible online resource with FAQs, calculators, and repayment plan comparison tools would empower borrowers to make informed decisions.

Public Service Announcement on Student Loan Repayment

Understanding your student loan terms is crucial for your financial future. Knowing your interest rate, repayment plan, and total loan amount empowers you to make informed decisions and avoid unnecessary debt. Explore different repayment options and contact your loan servicer if you need assistance. Don’t hesitate to seek help; resources are available to guide you through the process. Take control of your student loan debt today!

Alternative Repayment Options and Resources

Navigating student loan repayment can feel overwhelming, but understanding the available options and resources is crucial for managing your debt effectively. Several repayment plans cater to different financial situations, offering flexibility and potentially reducing your monthly payments. This section will explore these options, the application process, and helpful resources to guide you.

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing your monthly payment on your income and family size. These plans offer lower monthly payments than standard repayment plans, and some even lead to loan forgiveness after a specific period of qualifying payments. The application process involves completing a form, providing income documentation, and selecting a plan that best suits your needs. Failure to recertify your income annually could result in increased payments.

Income-Driven Repayment Plans

Several IDR plans exist, each with its own eligibility criteria and payment calculation method. These include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). The specific plan offering the lowest monthly payment will vary depending on individual circumstances, such as income, loan amount, and family size. For example, a borrower with a high debt load and low income might find REPAYE more beneficial than IBR, while someone with a lower debt load and stable income might prefer IBR.

Applying for Income-Driven Repayment and Loan Forgiveness Programs

The application process typically involves completing a form (often online) through the Federal Student Aid website (studentaid.gov). You’ll need to provide documentation verifying your income and family size, such as tax returns or pay stubs. Once approved, your payments will be adjusted according to your chosen IDR plan. For loan forgiveness programs, which often require a certain number of qualifying payments under an IDR plan, you’ll need to continue making timely payments and recertify your income annually. Failure to do so may delay or prevent forgiveness.

Reputable Resources for Borrowers

Several organizations provide valuable resources and support for student loan borrowers. These include:

- Federal Student Aid (studentaid.gov): The official website for federal student aid, offering comprehensive information on repayment plans, loan forgiveness, and other relevant topics.

- National Foundation for Credit Counseling (NFCC): A non-profit organization that provides free and low-cost credit counseling services, including assistance with student loan repayment.

- Your Loan Servicer: Your loan servicer can provide personalized guidance on your repayment options and answer specific questions about your loans.

Benefits and Drawbacks of Different Repayment Strategies

Choosing the right repayment strategy is crucial for long-term financial health. Here’s a comparison:

- Standard Repayment:

- Benefit: Faster loan payoff, less interest paid overall.

- Drawback: Higher monthly payments, potentially straining budget.

- Example: A $50,000 loan at 5% interest with a 10-year standard repayment plan results in higher monthly payments but finishes the loan faster than an IDR plan.

- Income-Driven Repayment (IDR):

- Benefit: Lower monthly payments, potential for loan forgiveness.

- Drawback: Longer repayment period, potentially higher interest paid overall.

- Example: A borrower with a low income might qualify for a significantly lower monthly payment under an IDR plan, making repayment more manageable, but potentially extending the repayment period to 20 or 25 years.

Final Summary

The question of when student loan interest will resume remains a critical one, laden with economic and social implications. While the government’s ultimate decision will depend on a confluence of factors, understanding the historical context, potential consequences, and available resources empowers borrowers to prepare effectively. Proactive planning, including exploring various repayment options and seeking financial guidance, can significantly mitigate the potential financial burden when interest payments resume. Staying informed about official government announcements and utilizing available resources are crucial steps in navigating this important phase of student loan repayment.

FAQ Overview

What happens if I can’t afford my payments when interest resumes?

Contact your loan servicer immediately. They can help you explore options like income-driven repayment plans or forbearance.

Will my interest rate change when payments resume?

Your interest rate will likely remain the same, unless your loan program has specific provisions for rate adjustments.

How will the restart of interest affect my loan balance?

Interest will begin accruing on your outstanding principal balance, increasing the total amount you owe.

Where can I find reliable information about student loan interest?

Consult the official websites of the Department of Education and your loan servicer.