Navigating the complex world of student loans can feel overwhelming, but understanding your options is crucial for securing your education. This guide explores the various avenues available for obtaining student loans, from federal programs and private lenders to banks, credit unions, and even state-sponsored initiatives. We’ll break down the advantages and disadvantages of each, helping you make informed decisions about financing your education.

Securing funding for higher education is a significant step, and choosing the right loan source can significantly impact your financial future. This guide aims to demystify the process, providing a clear and comprehensive overview of the landscape of student loan options, enabling you to choose the path that best aligns with your individual circumstances and financial goals.

Federal Student Loan Programs

Federal student loans are a significant source of funding for higher education in the United States, offering various programs designed to meet diverse student needs and financial situations. Understanding the nuances of these programs is crucial for prospective students to make informed borrowing decisions. This section details the different types of federal student loans, their eligibility requirements, interest rates, and repayment options.

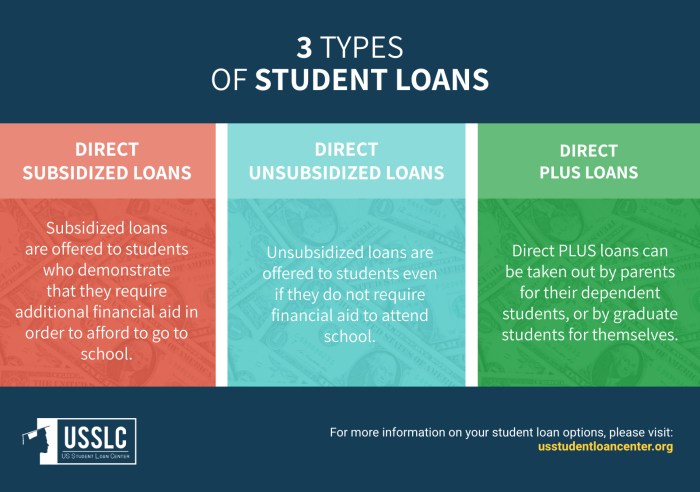

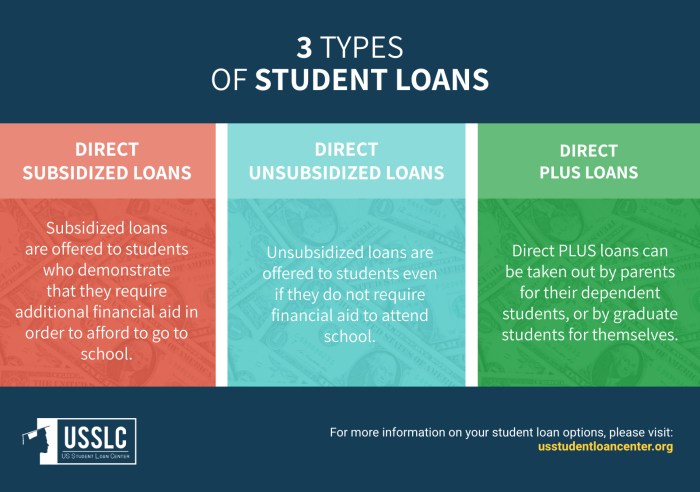

Types of Federal Student Loans

The federal government offers several types of student loans, each with its own eligibility criteria and terms. These loans are generally categorized as either subsidized or unsubsidized, and further differentiated by their purpose and repayment terms. Subsidized loans have the government pay the interest while you’re in school, during grace periods, and during deferment, whereas unsubsidized loans accrue interest throughout your entire loan term.

Eligibility Requirements for Federal Student Loans

Eligibility for federal student loans hinges on several factors. Applicants must be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution. They must also be a U.S. citizen or eligible non-citizen, possess a valid Social Security number, and demonstrate financial need (for subsidized loans). Furthermore, students must complete the Free Application for Federal Student Aid (FAFSA) to determine their eligibility and loan amount. Specific requirements may vary depending on the type of loan and the student’s individual circumstances.

Interest Rates and Repayment Options for Federal Student Loans

Interest rates for federal student loans are set annually by the government and are generally lower than private loan interest rates. The specific interest rate for a loan depends on the loan type and the year the loan was disbursed. Repayment options include standard repayment plans (fixed monthly payments over 10 years), extended repayment plans (longer repayment periods), graduated repayment plans (payments increase over time), and income-driven repayment plans (payments are based on your income and family size). Income-driven repayment plans can lead to loan forgiveness after 20 or 25 years, depending on the plan.

Comparison of Federal Student Loan Programs

The following table summarizes key features of the most common federal student loan programs. Note that interest rates and repayment options are subject to change.

| Loan Type | Eligibility | Interest Rate (Example – Subject to Change) | Repayment Plans |

|---|---|---|---|

| Subsidized Federal Stafford Loan | Demonstrated financial need, enrolled at least half-time | Variable, typically lower than unsubsidized loans | Standard, Extended, Graduated, Income-Driven |

| Unsubsidized Federal Stafford Loan | Enrolled at least half-time | Variable, typically higher than subsidized loans | Standard, Extended, Graduated, Income-Driven |

| Federal PLUS Loan (Graduate/Parent) | Graduate student or parent of dependent undergraduate student; credit check required | Variable, typically higher than Stafford Loans | Standard, Extended, Graduated |

Private Student Loans

Private student loans are offered by banks, credit unions, and other private lenders, unlike federal student loans which are provided by the government. Understanding the key differences between these two loan types is crucial for making informed borrowing decisions. While both can help finance your education, they carry distinct advantages and disadvantages.

Advantages and Disadvantages of Private Student Loans Compared to Federal Loans

Private student loans can sometimes offer higher borrowing limits than federal loans, potentially covering expenses not fully addressed by federal aid. However, this advantage is often offset by significantly higher interest rates and less favorable repayment terms. Federal loans typically come with borrower protections like income-driven repayment plans and loan forgiveness programs, which are generally absent in private loan options. Furthermore, federal loans often have more lenient eligibility requirements, particularly for students with less-than-perfect credit histories. The absence of these protections makes private loans riskier for borrowers.

Situations Where a Private Loan Might Be Suitable

A private student loan might be a suitable option when a student has exhausted all federal loan options and still faces a funding gap. This might occur when the student’s cost of attendance exceeds the maximum federal loan amount or if their financial aid package doesn’t fully cover tuition and living expenses. Another scenario is when a student needs to consolidate existing high-interest debt, although this requires careful consideration of the terms and interest rates offered by the private lender. Finally, parents may opt for a private loan to help fund their child’s education if they prefer to avoid increasing their own student loan debt.

The Application Process for Private Student Loans

Applying for a private student loan typically involves a more rigorous process than federal loans. Lenders will conduct a thorough credit check to assess the applicant’s creditworthiness. A strong credit history is crucial for securing favorable interest rates and loan terms. Individuals with limited or poor credit history may need a co-signer – typically a parent or other responsible adult with good credit – to vouch for their ability to repay the loan. The application process often includes providing detailed financial information, such as income, assets, and existing debts. The lender will then review the application and determine whether to approve the loan and under what terms.

Private Student Loan Application Flowchart

The following flowchart illustrates the typical steps involved in obtaining a private student loan:

[Imagine a flowchart here. The boxes would be: 1. Determine Funding Needs; 2. Research Private Lenders; 3. Pre-qualify Online; 4. Complete Application (including credit check); 5. Provide Financial Documentation; 6. Lender Review and Decision; 7. Loan Approval/Denial; 8. Loan Disbursement; 9. Repayment Begins. Arrows would connect each step sequentially. If denied, there might be a loop back to step 2 or 3 to explore alternative lenders or address credit issues.]

Banks and Credit Unions

Banks and credit unions represent another avenue for securing student loans, offering a viable alternative to federal and private loan programs. While they may not always offer the same government-backed benefits as federal loans, they can provide competitive interest rates and flexible repayment options, particularly for students with strong credit or co-signers. Understanding the offerings of different banks and credit unions is crucial for securing the best possible loan terms.

Many banks and credit unions provide student loans with varying interest rates and terms, often competing with private lenders. The interest rates and loan terms are typically influenced by the borrower’s credit history, co-signer availability, and the chosen repayment plan. The application process generally involves providing documentation similar to that required for private loans, focusing on financial stability and creditworthiness.

Student Loan Offerings from Banks and Credit Unions

Several major banks and credit unions offer student loan products. It’s important to compare offers carefully before committing to a loan. Interest rates and terms vary significantly depending on the institution, the applicant’s creditworthiness, and the type of loan.

- Bank of America: Bank of America offers student loans with varying interest rates dependent on credit history and co-signer availability. They typically require documentation such as tax returns, bank statements, and proof of enrollment. Loan terms can vary from 5 to 15 years.

- Wells Fargo: Wells Fargo also provides student loans, often requiring a creditworthy co-signer for students with limited credit history. The interest rate will depend on the applicant’s credit profile and the co-signer’s creditworthiness. Documentation requirements generally include proof of enrollment and financial statements.

- Navy Federal Credit Union: Navy Federal Credit Union is known for offering competitive interest rates to its members. Eligibility typically requires membership, which is often linked to military service or affiliation. Documentation requirements are similar to other financial institutions.

- Sallie Mae (Bank): While Sallie Mae is widely known for its private student loans, it also works with banks to offer loans. The specific interest rates and terms will vary depending on the partnering bank and the applicant’s qualifications.

Required Documentation for Bank and Credit Union Student Loans

The documentation needed to apply for a student loan from a bank or credit union typically includes:

- Proof of enrollment: Acceptance letter or enrollment verification from the educational institution.

- Financial aid award letter (if applicable): This Artikels any federal or other financial aid received.

- Credit report and score: Banks and credit unions assess creditworthiness to determine interest rates and loan terms.

- Bank statements and tax returns: These documents demonstrate financial stability and income.

- Co-signer information (if required): If a co-signer is needed, their credit report and financial information will also be required.

Online Lenders

Online lenders have become a significant player in the student loan market, offering a convenient alternative to traditional brick-and-mortar institutions. They leverage technology to streamline the application process and often provide a wider range of loan options. However, it’s crucial to understand both the advantages and potential drawbacks before choosing an online lender for your student loan needs.

Online lenders often offer competitive interest rates and flexible repayment options, attracting borrowers seeking better terms than those offered by traditional lenders. The convenience of online applications and digital account management is also a major draw. However, the lack of personal interaction can be a disadvantage for some borrowers, and careful scrutiny of the lender’s reputation and terms is essential to avoid potential pitfalls.

Reputable Online Lenders Specializing in Student Loans

Several reputable online lenders specialize in providing student loans. These lenders typically undergo rigorous vetting processes and adhere to regulatory guidelines, providing a degree of security for borrowers. However, it’s always advisable to independently verify the lender’s legitimacy and compare offerings before committing to a loan. Examples include companies like Sallie Mae (though they also offer federal loan services), Discover Student Loans, and LendKey. These lenders often cater to various student needs, including undergraduate, graduate, and professional degrees. Remember to research each lender thoroughly before applying.

Interest Rates and Repayment Terms Offered by Online Lenders

Interest rates and repayment terms offered by online lenders vary significantly based on factors such as creditworthiness, loan amount, and the borrower’s chosen repayment plan. Generally, borrowers with strong credit scores and higher incomes will qualify for lower interest rates and more favorable repayment terms. Online lenders often offer a range of repayment plans, including fixed-rate and variable-rate options, with varying repayment periods. Some may offer options like graduated repayment, where payments increase over time, or income-driven repayment plans, where payments are tied to the borrower’s income.

Comparison of Online Lenders

The following table compares three example online lenders. Note that interest rates and fees are subject to change, and these figures are illustrative examples and should not be considered a definitive guide. Always check the lender’s website for the most up-to-date information.

| Lender | Interest Rate (Example) | Fees (Example) | Repayment Options (Example) |

|---|---|---|---|

| Lender A | 4.5% – 10% (Variable) | Origination fee: 1% – 4% | Standard, Graduated, Income-Driven |

| Lender B | 5% – 12% (Fixed) | No origination fee, but potential late payment fees | Standard, Extended |

| Lender C | 6% – 11% (Variable) | Origination fee: 0.5% – 3% | Standard, Accelerated |

State-Sponsored Programs

Many states offer financial aid programs to help residents afford higher education. These programs can supplement federal aid or provide assistance when federal options are insufficient. Understanding the nuances of these state-specific programs is crucial for maximizing financial aid opportunities.

State-sponsored student loan programs vary significantly in their eligibility requirements, application processes, and the types of assistance offered. Some states may provide grants, scholarships, or tax credits, while others focus on low-interest loans or loan repayment assistance programs. Eligibility often depends on factors such as residency, academic performance, and financial need.

Eligibility Criteria and Application Processes

Eligibility for state-sponsored programs is generally determined by factors like residency requirements (typically requiring in-state residency for a specified period), enrollment in an eligible institution (often limited to public colleges and universities within the state), and demonstrated financial need (often assessed using the FAFSA or a similar state-specific application). The application process usually involves completing a state-specific application form, providing supporting documentation such as tax returns and transcripts, and potentially undergoing an interview or additional review. Specific requirements vary widely depending on the individual program and state.

Benefits and Limitations of State Student Loan Programs

State-sponsored programs offer several potential benefits, including lower interest rates compared to private loans, access to funding when federal aid is insufficient, and streamlined application processes compared to some private lenders. However, limitations include limited funding availability (meaning high competition for limited funds), strict eligibility requirements (which may exclude some students), and potential variations in program offerings across different states. Some programs may also have specific repayment terms or restrictions on loan forgiveness.

Examples of State Programs and Their Requirements

Several states have noteworthy programs. For instance, the California Dream Act Application allows eligible undocumented students to access state financial aid. In contrast, the New York State Higher Education Services Corporation (HESC) offers various loan programs with varying eligibility criteria based on factors such as residency, enrollment status, and academic progress. Texas offers a range of grants and scholarships through the Texas Grant Program, with eligibility based on financial need and enrollment in a participating institution. It’s crucial to consult each state’s higher education agency website for the most up-to-date and accurate information on available programs and their specific requirements.

Scholarships and Grants

Scholarships and grants represent a crucial avenue for financing higher education, significantly reducing or even eliminating the reliance on student loans. Unlike loans, which require repayment, scholarships and grants are forms of financial aid that don’t need to be paid back. Securing these funds can alleviate the considerable financial burden associated with college, allowing students to focus on their studies rather than accumulating debt.

Scholarships and grants are awarded based on various criteria, including academic merit, financial need, talent, and community involvement. The availability of these funds varies widely depending on the institution, organization, and specific criteria. Therefore, proactive research and diligent application are key to maximizing the chances of receiving this valuable financial assistance.

Finding Scholarships and Grants

Numerous resources exist to help students locate scholarships and grants that align with their individual profiles. These resources range from government websites and educational institutions to private organizations and scholarship search engines. Effective utilization of these tools can significantly improve the likelihood of securing funding.

The Scholarship and Grant Application Process

The application process for scholarships and grants generally involves completing an application form, providing supporting documentation, and meeting specific deadlines. Applications typically require personal information, academic transcripts, letters of recommendation, and essays outlining the applicant’s qualifications and goals. Deadlines vary significantly, so careful attention to application timelines is essential to avoid missing opportunities. Many scholarships and grants require submission of official transcripts, standardized test scores (such as SAT or ACT), and essays showcasing achievements, experiences, and future aspirations. Some may also require interviews or portfolios.

Resources for Finding Scholarships and Grants

A proactive search strategy is crucial for identifying and applying for relevant scholarships and grants. Below is a list of websites and organizations that provide comprehensive information and search tools:

- Federal Student Aid (FAFSA): The Free Application for Federal Student Aid is the primary gateway for federal grants, including the Pell Grant. This application is essential for determining eligibility for many forms of financial aid.

- Fastweb: A popular scholarship search engine that allows students to create profiles and search for scholarships based on their specific criteria.

- Scholarships.com: Another comprehensive scholarship search engine with a vast database of scholarships and grants.

- College Board: Provides information on scholarships and grants, as well as college planning resources.

- Individual College and University Financial Aid Offices: Each institution typically offers its own scholarships and grants. Contacting the financial aid office directly is crucial for learning about institution-specific opportunities.

Understanding Loan Terms and Repayment

Navigating the world of student loans requires a solid understanding of the key terms and repayment options available. This section will clarify essential concepts to help you make informed decisions about managing your student loan debt. Understanding these terms is crucial for responsible borrowing and repayment.

Key Loan Terms

Understanding the terminology surrounding student loans is the first step towards effective management. Three core terms are central to comprehending your loan: principal, interest rate, and amortization. The principal represents the original amount of money borrowed. The interest rate is the percentage charged on the principal, representing the cost of borrowing the money. Amortization refers to the process of paying off a loan through a series of scheduled payments, gradually reducing the principal balance.

Repayment Plans

Several repayment plans are available for federal student loans, each offering varying payment amounts and durations. The best plan for you will depend on your individual financial circumstances. The Standard Repayment Plan is the default option, typically involving fixed monthly payments over 10 years. Income-Driven Repayment Plans (IDR) adjust your monthly payment based on your income and family size, often extending the repayment period beyond 10 years. Extended Repayment Plans offer longer repayment terms, leading to lower monthly payments but potentially higher overall interest costs. Graduated Repayment Plans start with lower monthly payments that gradually increase over time.

Consequences of Loan Default

Failing to make timely student loan payments results in default, triggering significant negative consequences. Default can damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. The government may garnish your wages or tax refunds to recover the debt. Furthermore, default can lead to the loss of federal student aid eligibility for yourself or your dependents. In some cases, the defaulted loan may be referred to a collection agency, incurring additional fees and impacting your credit history even more severely.

Example Amortization Schedule

Imagine a $20,000 student loan with a 5% annual interest rate and a 10-year repayment plan. The following is a simplified representation of an amortization schedule. Note that actual schedules can be more complex and may vary slightly depending on the lender.

| Year | Beginning Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000 | $2,300 | $1,000 | $1,300 | $18,700 |

| 2 | $18,700 | $2,300 | $935 | $1,365 | $17,335 |

| 3 | $17,335 | $2,300 | $867 | $1,433 | $15,902 |

| … | … | … | … | … | … |

| 10 | $X | $2,300 | $Y | $Z | $0 |

*Note: The values for X, Y, and Z in the final year represent the calculations after nine years of payments. The interest paid portion decreases each year, while the principal paid portion increases, until the loan is fully repaid.*

Final Thoughts

Ultimately, the best source for your student loans depends on your individual creditworthiness, financial situation, and the amount of funding required. By carefully considering the advantages and disadvantages of federal loans, private loans, and other options, you can create a responsible financial plan that supports your academic aspirations. Remember to thoroughly research each option and compare interest rates, repayment terms, and any associated fees before making a commitment. Proactive planning and careful consideration will pave the way for a smoother path toward achieving your educational goals.

FAQ Insights

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate and monthly payments, but it may involve losing federal loan benefits.

What is a co-signer, and why is it needed for some loans?

A co-signer is someone who agrees to repay your loan if you default. Lenders often require co-signers for borrowers with limited or poor credit history.

How long does it typically take to get approved for a student loan?

Approval times vary depending on the lender and the type of loan. It can range from a few days to several weeks.

What happens if I default on my student loans?

Defaulting on student loans can severely damage your credit score, lead to wage garnishment, and impact your ability to obtain future loans or credit.