Navigating the complexities of student loan repayment can feel overwhelming, especially understanding where your interest payments actually go. This journey into the world of student loan interest will demystify the process, exploring how interest accrues, where it’s directed, and ultimately, how it impacts your overall repayment journey. We’ll examine the mechanics behind interest calculations, different loan types, and strategies to mitigate the financial burden.

From understanding the role of your loan servicer to exploring the implications of interest capitalization and government subsidies, we aim to provide a comprehensive overview. This information empowers you to make informed decisions about your student loan repayment strategy, ultimately leading to a smoother and more financially sound future.

Understanding Student Loan Interest Accrual

Student loan interest is a significant factor affecting the total cost of your education. Understanding how interest accrues is crucial for effective repayment planning. This section details the process of interest calculation, influencing factors, and provides examples to illustrate how interest accumulates on different loan types.

Student Loan Interest Calculation

The calculation of student loan interest is generally based on a simple interest formula. The amount of interest accrued depends on the principal loan amount, the interest rate, and the time period over which the interest accrues. The basic formula is: Interest = Principal x Rate x Time. The principal is the original loan amount. The rate is the annual interest rate, expressed as a decimal (e.g., 5% = 0.05). Time is the length of the accrual period, typically expressed in years or fractions of a year. For example, if you have a $10,000 loan with a 5% interest rate, and the interest accrues for one year, the interest accrued would be $10,000 x 0.05 x 1 = $500. However, it’s important to note that interest often compounds, meaning that interest accrued is added to the principal, and subsequent interest calculations are based on this higher amount.

Factors Influencing Interest Rates

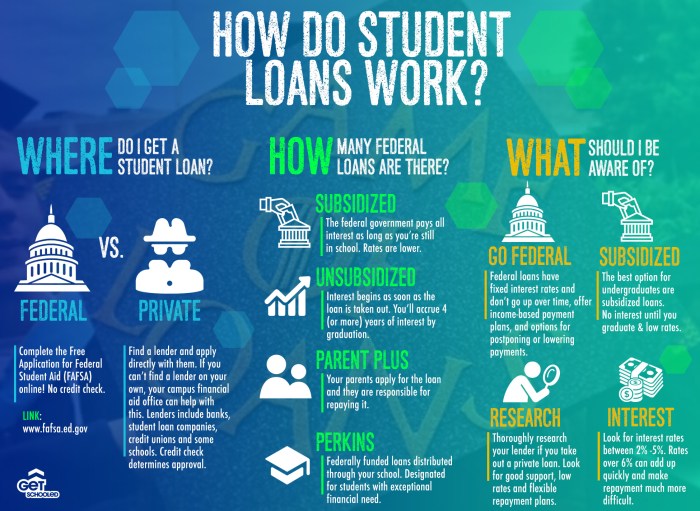

Several factors influence the interest rate you’ll receive on your student loans. The type of loan is a primary determinant. Federal subsidized loans, for example, typically have lower interest rates than unsubsidized loans because the government pays the interest while you’re in school (under certain conditions). Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed, regardless of your enrollment status. Your credit history also plays a role, particularly for private student loans. A strong credit history often translates to lower interest rates. Finally, market interest rates are a major factor, as they influence the rates offered by both federal and private lenders. Changes in the overall economy can lead to fluctuations in interest rates.

Interest Accrual on Different Loan Types

Subsidized federal student loans typically do not accrue interest while you are enrolled at least half-time in school, during a grace period, or during periods of deferment. Unsubsidized federal student loans and private student loans, however, accrue interest from the moment the loan is disbursed. This means that the total amount you owe will grow even before you begin repayment. For example, if you have a $20,000 unsubsidized loan with a 6% interest rate, and you don’t make payments for a year, you’ll accrue $1200 in interest ($20,000 x 0.06 x 1). This $1200 will be added to your principal balance, meaning you’ll start repayment owing more than $21,000.

Interest Accrual Scenarios

| Loan Amount | Interest Rate | Accrual Period (Years) | Total Interest Accrued |

|---|---|---|---|

| $10,000 | 5% | 1 | $500 |

| $20,000 | 6% | 1 | $1200 |

| $30,000 | 7% | 2 | $4200 |

| $40,000 | 8% | 3 | $9600 |

Where the Interest Payment Goes

Understanding where your student loan interest payments go is crucial for effective debt management. The process involves several key steps, from your payment being received to its impact on your loan balance. This section will detail how your interest payments are handled by your loan servicer and the consequences of not making them.

Interest payments are processed by your loan servicer, the company responsible for managing your student loans on behalf of the lender. When you make an interest payment, the servicer first applies the funds to any outstanding fees or late charges. After that, the remaining amount is applied to your accrued interest. This process ensures that the interest is paid first, preventing it from accumulating further and increasing your overall debt.

Interest-Only Payment Processing

Making an interest-only payment means you’re only paying the accrued interest on your loan, not the principal balance. The servicer will first deduct any fees, then allocate the payment to the interest. If the payment is sufficient to cover all accrued interest, the remaining balance will be recorded as current. If the payment is insufficient, the shortfall remains unpaid and accrues further interest.

Interest Payment and Principal Reduction

Once the interest is paid, the remaining amount of your payment is applied to the principal balance. For example, if you make a payment that covers the interest and leaves some extra money, that extra money will go towards reducing the principal amount you owe. This reduces the overall loan balance and ultimately leads to a faster repayment and less interest paid over the life of the loan. The more you pay towards the principal, the less interest will accrue in the future.

Consequences of Not Paying Interest

Failing to pay interest on your student loans will lead to several negative consequences. The most immediate is the accumulation of more interest, which will significantly increase your total debt over time. This can lead to a larger overall loan balance and potentially longer repayment periods. Additionally, late or missed interest payments can negatively impact your credit score, making it harder to obtain loans or credit in the future. In some cases, lenders may initiate collection actions, including wage garnishment or legal proceedings.

Interest Payment Flowchart

A simplified flowchart depicting the journey of an interest payment would look like this:

Borrower makes payment –> Payment received by loan servicer –> Servicer deducts fees (if any) –> Remaining amount applied to accrued interest –> If payment exceeds interest, remaining amount applied to principal –> Updated loan balance reflected in account statement –> Lender receives payment information.

Impact of Interest on Loan Repayment

Student loan interest significantly impacts the total cost of repayment. Understanding how interest accrues and the various repayment options available is crucial for effective financial planning after graduation. Failing to account for interest can lead to substantially higher overall loan costs and prolonged debt.

The total cost of repaying a student loan is the sum of the principal (the original loan amount) and the accumulated interest. Without interest, you would simply repay the principal amount over the loan term. However, interest charges increase the total amount you owe, potentially by thousands or even tens of thousands of dollars, depending on the loan amount, interest rate, and repayment plan. This difference can be substantial, dramatically impacting your post-graduation financial stability.

Strategies for Minimizing Interest Impact

Several strategies can help minimize the impact of interest on student loan repayment. These strategies primarily focus on reducing the overall time it takes to repay the loan, thus minimizing the total interest accrued.

Making extra payments on your loan is a highly effective strategy. Even small extra payments, made regularly, can significantly shorten the repayment period and reduce the total interest paid. For example, if you can afford an extra $50 or $100 per month, this extra money directly reduces the principal balance, lowering the amount on which interest is calculated in subsequent months.

Refinancing your student loans can also be beneficial, especially if interest rates have fallen since you initially took out your loans. Refinancing involves obtaining a new loan with a lower interest rate to pay off your existing loans. This can result in lower monthly payments and a reduced total repayment amount. However, it’s crucial to carefully compare offers and fees before refinancing.

Long-Term Financial Implications of High Interest Rates

High interest rates on student loans can have significant long-term financial implications. They can delay major life milestones such as buying a home, starting a family, or investing for retirement. The burden of high monthly payments can limit financial flexibility and restrict opportunities for savings and investment. In the worst-case scenario, high interest rates can lead to default, negatively impacting credit scores and creating further financial hardship. For instance, someone with a high-interest loan might struggle to save for a down payment on a house, pushing back homeownership for years.

Repayment Plan Comparison

Different repayment plans affect how quickly the loan is repaid and, consequently, how much interest accrues. The table below compares three common repayment plans.

| Repayment Plan | Interest Accrual Characteristics | Impact on Total Repayment |

|---|---|---|

| Standard Repayment | Interest accrues monthly on the outstanding principal balance. Fixed monthly payments are made over a 10-year period. | Highest total repayment due to the longer repayment period and more time for interest to accumulate. |

| Graduated Repayment | Interest accrues monthly. Payments start low and gradually increase over time. | Total repayment is less than Standard Repayment but higher than Income-Driven Repayment due to longer repayment period. |

| Income-Driven Repayment (Example: ICR) | Interest accrues monthly. Payments are based on your income and family size, potentially leading to lower monthly payments but a longer repayment period. | Lowest total repayment due to lower monthly payments, but interest can accumulate over a much longer period. Forgiveness may be possible after 20-25 years, but any remaining balance is taxable income. |

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal balance of your student loan. This effectively increases the total amount you owe, leading to higher overall interest payments over the life of the loan. Understanding how this process works is crucial for effective loan management.

Interest capitalization occurs when your loan enters a period of deferment or forbearance. During these periods, you are not required to make regular payments on your loan, but interest continues to accrue. Instead of paying this accumulated interest, it’s added to your principal balance, increasing the amount you ultimately need to repay.

Scenarios Leading to Interest Capitalization

Interest capitalization typically happens when a borrower is temporarily unable to make loan payments due to specific circumstances. Common scenarios include periods of unemployment, enrollment in school (for certain loan types), or documented financial hardship. The specific terms and conditions under which interest capitalization applies vary depending on the type of federal or private student loan and the lender’s policies.

Examples of Interest Capitalization and its Impact

Let’s consider two examples to illustrate the effect of interest capitalization.

Example 1: Imagine a student loan with a principal balance of $10,000 and an annual interest rate of 5%. If the borrower enters a one-year deferment period, the interest accrued would be $500 ($10,000 x 0.05). After the deferment, the new principal balance, including capitalized interest, becomes $10,500. The borrower will now be making payments on a larger principal amount, resulting in higher overall interest payments over the loan’s life.

Example 2: Suppose a borrower has a $20,000 loan with a 6% interest rate and experiences two years of forbearance. In the first year, $1200 in interest accrues ($20,000 x 0.06). This is capitalized, bringing the principal to $21,200. In the second year, interest accrues on this higher amount, resulting in approximately $1272 ($21,200 x 0.06). After capitalization, the principal becomes $22,472. Notice how the interest accrued in the second year is higher than in the first year due to the increased principal.

Impact of Capitalization on Total Interest Paid

Capitalization significantly increases the total interest paid over the life of the loan. Because interest accrues on a larger principal balance after capitalization, the total amount repaid is substantially greater compared to a scenario where interest was paid regularly. This compounding effect can dramatically impact the overall cost of borrowing.

Visual Representation of Interest Capitalization

Imagine a graph with time on the x-axis and loan balance on the y-axis. A line representing a loan without capitalization would show a steady decrease in the balance as payments are made. However, a line representing a loan with capitalization would show a sudden jump upwards at the point of capitalization, reflecting the added interest. This jump would then be followed by a slower decrease, as payments are now being made on a larger principal. The area between these two lines visually represents the extra interest paid due to capitalization. The graph clearly illustrates that the loan with capitalization takes longer to repay and results in a significantly higher total cost. The steeper the initial upward jump after capitalization, the greater the impact on the total interest paid.

Government Subsidies and Interest

Government subsidies significantly impact the cost of borrowing for students. Understanding how these subsidies work is crucial for navigating the complexities of student loan repayment. This section will explore the effects of government subsidies on subsidized loans, eligibility requirements, and a comparison with unsubsidized loans.

The government’s role in managing student loan interest is multifaceted. It involves not only providing subsidies but also setting interest rates, establishing repayment plans, and overseeing loan servicing. This involvement aims to make higher education more accessible and affordable, while also ensuring the responsible lending and borrowing practices.

Subsidized Loan Eligibility

Eligibility for subsidized federal student loans hinges primarily on financial need. Students must demonstrate financial need through the Free Application for Federal Student Aid (FAFSA). Factors considered include parental income, family size, and assets. The amount of the subsidized loan is directly tied to the demonstrated need and the cost of attendance at the student’s chosen institution. Generally, students pursuing undergraduate degrees are more likely to qualify for subsidized loans than those pursuing graduate or professional studies. Maintaining satisfactory academic progress (usually a minimum GPA) is also typically a requirement to continue receiving subsidized loan funds.

Subsidized versus Unsubsidized Loans

Subsidized and unsubsidized federal student loans differ fundamentally in how interest accrues. With subsidized loans, the government pays the interest while the student is enrolled at least half-time and during certain grace periods. This means the student’s loan balance doesn’t grow during these periods. Unsubsidized loans, however, accrue interest from the time the loan is disbursed, regardless of the student’s enrollment status. This can lead to a significantly larger loan balance by the time repayment begins. While both loan types are federal loans and offer fixed interest rates, the absence of government-paid interest during the deferment period makes unsubsidized loans more expensive in the long run.

Government’s Role in Managing Student Loan Interest

The federal government plays a critical role in setting and managing student loan interest rates. These rates are often tied to market indexes, but the government maintains a degree of control to ensure they remain reasonable. Additionally, the government offers various repayment plans, including income-driven repayment plans, which can adjust monthly payments based on income and family size. These plans can help borrowers manage their debt burden and avoid delinquency. The government also oversees loan servicers, ensuring they provide borrowers with accurate information and fair treatment. This regulatory oversight aims to protect borrowers and maintain the integrity of the student loan program.

Key Differences: Subsidized vs. Unsubsidized Loans

Understanding the differences between subsidized and unsubsidized loans is crucial for making informed borrowing decisions. The following points highlight the key distinctions regarding interest:

- Interest Accrual: Subsidized loans do not accrue interest while the borrower is enrolled at least half-time and during grace periods. Unsubsidized loans accrue interest from disbursement.

- Government Payment of Interest: The government pays the interest on subsidized loans during periods of deferment. The borrower is responsible for all interest on unsubsidized loans.

- Eligibility: Subsidized loans require demonstrated financial need. Unsubsidized loans are available to all eligible students, regardless of financial need.

- Overall Cost: Due to the government’s payment of interest during deferment, subsidized loans generally result in a lower overall cost than unsubsidized loans.

Final Wrap-Up

Understanding where your student loan interest goes is crucial for effective repayment planning. By grasping the intricacies of interest accrual, payment processing, and the impact of various repayment options, you can take proactive steps to minimize the total cost of your loan. Remember to explore available resources, consider strategies like extra payments or refinancing, and stay informed about changes in government policies to optimize your repayment journey and achieve financial freedom sooner.

FAQ Overview

What happens if I only pay the interest on my student loan?

Paying only the interest prevents your principal balance from increasing, but it doesn’t reduce the principal amount owed. You’ll continue to accrue interest until the principal is paid.

Can I deduct student loan interest from my taxes?

In some countries, you may be able to deduct a portion of your student loan interest payments from your taxable income. Check with your tax advisor or the relevant government agency for current eligibility requirements.

What is the difference between a fixed and variable interest rate on student loans?

A fixed interest rate remains constant throughout the loan term, providing predictable monthly payments. A variable interest rate fluctuates based on market conditions, potentially leading to higher or lower payments over time.

How does deferment affect my student loan interest?

During a deferment period, you may not be required to make payments, but interest will typically still accrue on unsubsidized loans. The accrued interest may be capitalized at the end of the deferment period, increasing your principal balance.