Navigating the world of student loans can feel overwhelming, especially when trying to understand who’s responsible for managing your payments. This guide clarifies the role of your student loan servicer, providing essential information to help you effectively manage your student loan debt and ensure a smooth repayment process. We’ll explore how to identify your servicer, understand their responsibilities, and navigate potential issues that may arise.

From understanding different repayment plans and calculating monthly payments to resolving disputes and managing account transfers, we aim to empower you with the knowledge and resources needed to confidently handle your student loan journey. This comprehensive resource covers everything from finding contact information to understanding your loan documents, providing a clear path toward successful repayment.

Identifying Your Loan Servicer

Knowing your student loan servicer is crucial for managing your loans effectively. Your servicer handles your payments, provides account information, and assists with any loan-related issues. Understanding how to locate this information is a key step in responsible student loan management.

Common Student Loan Servicers in the United States

Several companies manage federal student loans in the United States. These servicers are contracted by the government to handle various aspects of loan repayment. Familiarity with these names will aid in quickly identifying your own servicer. It’s important to note that servicers can change, so regularly checking your account information is recommended.

Locating Your Servicer Using the National Student Loan Data System (NSLDS)

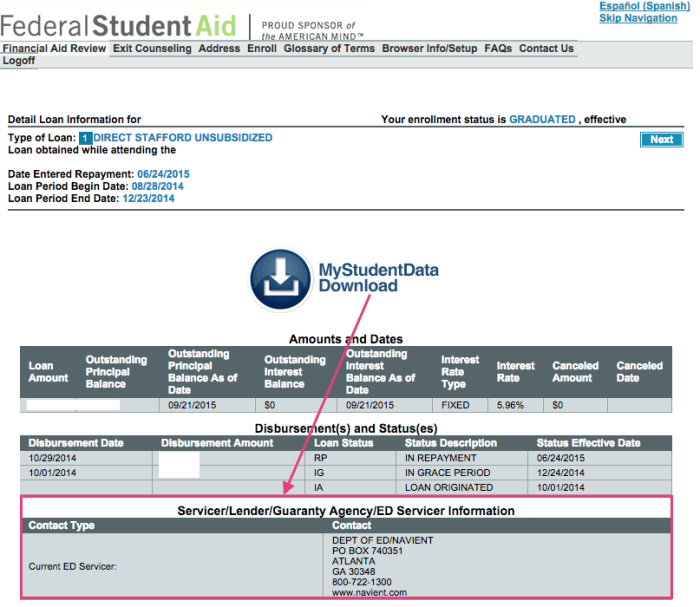

The NSLDS is a free online database maintained by the U.S. Department of Education. It provides a centralized location to access information about your federal student loans, including your loan servicer. To find your servicer using the NSLDS, you’ll need your Federal Student Aid (FSA) ID. Once logged in, you can access a detailed summary of your student loans, clearly indicating the servicer responsible for each loan.

Finding Your Servicer’s Contact Information on Your Loan Documents

Your loan documents, such as your promissory note and welcome letter, will contain your servicer’s contact information. This information usually includes the servicer’s name, website address, phone number, and email address. Carefully review these documents to locate this essential information. If you’re unable to locate these documents, contact the NSLDS or your school’s financial aid office for assistance.

Servicer Contact Information

The following table provides examples of common student loan servicers and their contact information. Remember that this is not an exhaustive list, and your servicer may not be included here. Always verify the information directly with your loan documents or the NSLDS.

| Servicer Name | Website | Phone Number | Contact Email |

|---|---|---|---|

| Navient | www.navient.com | (Example Phone Number – replace with actual number) | (Example Email Address – replace with actual address) |

| Nelnet | www.nelnet.com | (Example Phone Number – replace with actual number) | (Example Email Address – replace with actual address) |

| FedLoan Servicing | studentloans.gov | (Example Phone Number – replace with actual number) | (Example Email Address – replace with actual address) |

| Great Lakes | www.mygreatlakes.org | (Example Phone Number – replace with actual number) | (Example Email Address – replace with actual address) |

Understanding Your Loan Servicer’s Role

Your student loan servicer acts as the intermediary between you and your lender. They handle the day-to-day management of your loan, making the repayment process smoother and more manageable. Understanding their role is crucial for successful loan repayment.

Your loan servicer is responsible for a wide range of tasks related to your student loan. They are not the entity that originally lent you the money, but they are the ones you interact with directly regarding your loan’s administration. This interaction covers various aspects of your loan, from payment processing to providing information about repayment plans.

Servicer Responsibilities and Services

Student loan servicers perform several key functions to ensure the efficient management of your loan. These services are designed to facilitate repayment and keep you informed about your account status.

- Payment Processing: Servicers handle all aspects of payment processing, including receiving payments, applying them to your account, and providing confirmation of payment. They offer various payment methods, such as online payments, mail-in checks, and automatic debit payments.

- Account Management: Servicers maintain your loan account information, providing you with access to your account balance, payment history, and other relevant details. They also handle changes to your personal information, such as address updates.

- Repayment Plan Options: Servicers explain and manage various repayment plans, helping you choose a plan that best suits your financial situation. These options might include standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. They can also assist with applications for deferment or forbearance if you encounter financial hardship.

- Communication and Customer Service: Servicers provide customer service support to answer your questions and address your concerns about your loan. They act as the primary point of contact for all loan-related inquiries.

Servicer vs. Lender

It’s important to differentiate between your loan servicer and the original lender. The lender is the financial institution (such as a bank or government agency) that provided the funds for your education. They are responsible for originating the loan. The servicer, on the other hand, takes over the administrative tasks once the loan is disbursed. You’ll likely interact primarily with your servicer throughout the repayment process, while the lender remains in the background. Think of the lender as the bank that gives you a mortgage, and the servicer as the company that handles your monthly payments and account details.

Communication Flow Between Borrower and Servicer

The following flowchart illustrates a typical communication flow:

[Imagine a flowchart here. The flowchart would begin with the borrower initiating contact (e.g., via phone, mail, or online portal). The communication would then flow to the servicer’s customer service department. The servicer would process the request (e.g., payment, information request, plan change). The servicer would then provide a response to the borrower, confirming the action taken or providing the requested information. The feedback loop could include further questions or clarifications from the borrower, continuing the cycle until the issue is resolved.]

Managing Your Student Loans

Successfully navigating your student loan repayment requires understanding the available options and actively managing your account. This section will Artikel different repayment plans, provide examples of payment calculations, and explain the process of contacting your servicer for assistance. Effective management can significantly impact your long-term financial well-being.

Federal Student Loan Repayment Plans

The federal government offers several repayment plans designed to accommodate various financial situations. Choosing the right plan depends on your income, loan amount, and repayment preferences. Understanding the differences is crucial for responsible debt management.

- Standard Repayment Plan: This is the default plan, typically requiring fixed monthly payments over 10 years. It’s straightforward but may result in higher monthly payments compared to income-driven plans.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can ease the initial burden but lead to higher payments later in the repayment period.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, lowering monthly payments but increasing the total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans tie your monthly payment to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans often result in lower monthly payments and potentially loan forgiveness after 20 or 25 years, depending on the plan and your income.

Calculating Monthly Payments

Calculating your monthly payment involves considering your loan amount, interest rate, and repayment plan. While online calculators are readily available, understanding the basic principles is helpful. The exact formula is complex, but simplified examples can illustrate the concept.

Example 1 (Standard Repayment): Let’s say you have a $20,000 loan at a 5% interest rate with a 10-year repayment period. Using a standard repayment calculator (available online), the estimated monthly payment would be approximately $212. However, this is an estimate and the actual amount may vary slightly depending on the specific calculator used.

Example 2 (Income-Driven Repayment): IDR plan calculations are more intricate, considering your income and family size. These plans typically involve a formula that considers your discretionary income (income above a certain poverty guideline) and loan amount. The exact calculation varies depending on the specific IDR plan. For instance, the REPAYE plan may calculate your monthly payment as 10% of your discretionary income or a fixed amount, whichever is greater.

Requesting a Repayment Plan Change

To change your repayment plan, you need to contact your loan servicer. This usually involves logging into your online account, finding a contact form, or calling their customer service number. You’ll likely need to provide information about your income, family size, and desired repayment plan. The servicer will then guide you through the application process. Be prepared to provide documentation to support your income and family size, such as tax returns or pay stubs.

Reasons for Contacting Your Student Loan Servicer

There are various reasons why you might need to contact your student loan servicer. Proactive communication can prevent potential issues.

- Changing your repayment plan

- Updating your contact information

- Inquiring about your loan balance and payment history

- Requesting a deferment or forbearance (temporary suspension of payments)

- Understanding your loan forgiveness options

- Reporting a payment issue or error

- Addressing billing questions

Dealing with Loan Servicing Issues

Navigating the complexities of student loan repayment can sometimes lead to friction with your loan servicer. Understanding common problems and effective resolution strategies is crucial for a smooth repayment experience. This section Artikels typical issues, dispute resolution methods, and the process of filing formal complaints.

Common Problems Borrowers Face with Student Loan Servicers

Types of Servicing Issues

Borrowers frequently encounter various challenges with their student loan servicers. These include inaccurate account information, such as incorrect payment amounts or missed payments reflected on the account statement. Delays in processing payments or loan modifications can also cause significant stress and financial uncertainty. Difficulties in contacting customer service, long wait times, and unhelpful representatives are unfortunately common complaints. Additionally, issues with loan consolidation, forbearance applications, or deferment requests can create significant hurdles for borrowers. Finally, problems with the accuracy of information regarding repayment plans, interest rates, and total loan balances are frequently reported.

Resolving Disputes and Misunderstandings

The first step in resolving a dispute is usually direct communication with your servicer. This often involves reviewing your account statements carefully, gathering all relevant documentation (payment confirmations, communication records, etc.), and contacting customer service. Clearly explain the issue, providing specific examples and dates. Keep detailed records of all communication, including dates, times, names of representatives spoken to, and summaries of conversations. If the initial contact doesn’t resolve the problem, consider escalating the issue to a supervisor or manager. Many servicers have internal dispute resolution processes that you can utilize. Documenting all communication attempts and responses is essential throughout this process. Finally, exploring mediation options through a third-party organization might prove beneficial in resolving complex disagreements.

Filing a Complaint Against a Student Loan Servicer

If internal dispute resolution fails, filing a formal complaint with the appropriate regulatory bodies is a viable option. The Consumer Financial Protection Bureau (CFPB) is a primary resource for lodging complaints against student loan servicers. The Department of Education also offers avenues for addressing complaints, particularly those related to servicing performance or violations of federal student aid regulations. When filing a complaint, be precise and factual, providing detailed information about the issue, dates, and all previous attempts at resolution. Retain copies of all documentation submitted. Remember that these agencies can investigate your complaint and potentially take action against the servicer if they find wrongdoing.

Appealing a Servicer’s Decision

If your servicer denies a request (for example, a loan modification or hardship deferment), you have the right to appeal their decision. This typically involves submitting a formal appeal letter, clearly stating the reasons why you disagree with their decision. Support your appeal with relevant documentation, such as financial statements or medical records (if applicable). The servicer’s appeal process will usually be Artikeld in their communications or on their website. Understand the timeframe for submitting your appeal and ensure you adhere to it. If the appeal is unsuccessful, consider seeking legal counsel or contacting the appropriate regulatory agencies to explore further options.

Transferring Loan Servicers

Student loan servicing transfers are a common occurrence, often happening without much notice to the borrower. These transfers are initiated by the Department of Education and are generally designed to improve efficiency and service delivery. While they can sometimes be disruptive, understanding the process can help borrowers navigate the transition smoothly.

The process of transferring student loan servicers typically involves the current servicer notifying the borrower of the impending change. This notification usually includes the name and contact information of the new servicer, a timeline for the transfer, and instructions on how to access the borrower’s account with the new servicer. The transfer itself is usually seamless; however, there might be a brief period where access to certain account features is limited. The reasons for these transfers can include contract expirations, mergers and acquisitions within the servicing industry, or performance-based decisions made by the Department of Education.

Information Provided During a Servicer Transfer

Borrowers should expect to receive official notification from both their current and new servicers. This notification will clearly state the date of the transfer, the name and contact information of the new servicer, and instructions on how to access their account with the new servicer. The notification may also include information about any potential temporary disruptions to online access or customer service. The new servicer may also send a welcome package with details about their services and contact information. It is crucial to retain all correspondence related to the transfer.

Actions Borrowers Should Take During a Transfer

To minimize disruptions during a servicer transfer, borrowers should take proactive steps. First, carefully review all communication received from both the current and new servicers. Secondly, update your contact information with both servicers to ensure that you receive important notifications. Thirdly, familiarize yourself with the new servicer’s website and online portal. Fourthly, verify that all your loan details are accurately transferred to the new servicer. Finally, consider making a note of any upcoming payments to ensure a smooth transition in payment processing.

Sample Email to New Servicer

Subject: Account Confirmation – [Your Name] – [Loan ID Number]

Dear [New Servicer Name],

This email confirms my account transfer from [Previous Servicer Name] on [Date of Transfer]. My name is [Your Name] and my loan ID number is [Loan ID Number]. Please confirm receipt of my loan information and that my payment method, [Payment Method], remains active. I can be reached at [Your Email Address] or [Your Phone Number] with any questions.

Sincerely,

[Your Name]

Understanding Your Loan Documents

Understanding your student loan documents is crucial for effectively managing your debt. These documents contain vital information about your loans, repayment terms, and overall financial obligations. Familiarizing yourself with the key details will empower you to make informed decisions and avoid potential pitfalls.

Key Information on a Student Loan Statement

Student loan statements typically include your loan identifier(s), the principal balance (the original amount borrowed), the accrued interest (interest that has accumulated), your payment history, the minimum payment due, and the due date. You’ll also find information about your loan type (e.g., subsidized, unsubsidized, PLUS), interest rate, and repayment plan. Some statements might also include details about any fees, deferments, or forbearances applied to your loan. It’s essential to review your statement regularly to track your progress and ensure accuracy.

Common Terms and Abbreviations in Student Loan Documents

Several terms and abbreviations are frequently used in student loan documents. Understanding these will help you decipher your statements and related correspondence. For instance, “principal” refers to the original loan amount, while “interest” is the cost of borrowing money. “APR” (Annual Percentage Rate) represents the yearly interest rate, and “subsidized” loans have government-paid interest during certain periods (like while in school). “Unsubsidized” loans accrue interest from the time the loan is disbursed, regardless of your enrollment status. “Deferment” and “forbearance” are temporary pauses in repayment, but they have different eligibility requirements and implications for interest accrual. Finally, “loan servicer” is the company responsible for managing your loan.

Organizing and Storing Your Loan Documents

Keeping your loan documents organized is essential for easy access and efficient management. A dedicated file (either physical or digital) is recommended. If using a physical file, consider using folders to separate different loan types or servicers. For digital storage, cloud-based services offer secure and accessible options. Regardless of your chosen method, ensure you have a system for easy retrieval of important documents. Regularly backing up your digital files is also crucial to prevent data loss.

Checklist of Important Student Loan Documents

Maintaining a comprehensive record of your student loan documents is critical. A checklist can ensure you have all necessary information. This checklist includes: Your loan agreement(s), which Artikels the terms and conditions of your loan(s); your loan disbursement information, showing the amount and dates of each disbursement; your repayment schedule, illustrating your payment plan and projected payoff date; your monthly statements, providing an updated account summary; correspondence with your loan servicer, documenting any communication or changes to your loan; and proof of any deferments or forbearances, confirming temporary pauses in repayment. Keep all these documents securely, ideally in a combination of physical and digital formats for redundancy.

Epilogue

Successfully managing your student loans requires understanding the crucial role of your loan servicer. By knowing how to identify your servicer, communicate effectively, and navigate potential challenges, you can confidently manage your debt and achieve financial stability. Remember to utilize the resources provided and proactively engage with your servicer to ensure a smooth and successful repayment experience. Proactive communication and organization are key to avoiding potential pitfalls and ensuring a positive outcome.

Expert Answers

What happens if my loan servicer changes?

You’ll receive notification of the transfer. Your loan terms generally remain the same, but you should verify your account details with the new servicer and confirm your payment information.

Can I change my student loan servicer?

Generally, you cannot choose your servicer; they are assigned by the Department of Education. However, if you have issues with your current servicer, you can contact the Department of Education to report your concerns.

What if I can’t find my loan servicer information?

Check your loan documents, or use the National Student Loan Data System (NSLDS) website to locate your servicer’s information. If you still have trouble, contact the Federal Student Aid office directly.

What types of repayment plans are available?

Several repayment plans exist, including standard, graduated, extended, and income-driven repayment. The best plan depends on your individual financial circumstances. Your servicer can help you determine the most suitable option.