The question on many students’ and graduates’ minds: will student loan interest rates decrease? Navigating the complexities of student loan debt requires understanding current rates, historical trends, and future predictions. This exploration delves into the factors influencing these rates, offering insights into potential scenarios and strategies for managing debt effectively.

From the impact of inflation and Federal Reserve policies to government regulations and expert forecasts, we’ll examine the multifaceted landscape of student loan interest rates. We’ll also provide practical advice on minimizing the financial burden of student loans, empowering you to make informed decisions about your financial future.

Current Student Loan Interest Rates

Understanding current student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the overall cost of your education and your long-term financial health. Rates vary depending on several factors, including the type of loan, the lender, and the borrower’s creditworthiness.

Federal Student Loan Interest Rates

Federal student loan interest rates are set by the government and generally tend to be lower than private loan rates. These rates are often fixed, meaning they remain constant throughout the loan’s life. However, the specific rate depends on the loan type and the borrower’s loan disbursement date. For example, subsidized Stafford loans, which are need-based, often have lower interest rates than unsubsidized Stafford loans. Additionally, graduate student loans usually have slightly higher interest rates than undergraduate loans. The interest rate for federal student loans changes annually, so it’s essential to check the current rates on the Federal Student Aid website. For the 2023-2024 academic year, rates for undergraduate subsidized and unsubsidized loans were fixed at 5.0% and 6.54% respectively. Graduate loans and PLUS loans (for parents and graduate students) had fixed rates slightly higher than those of undergraduate loans.

Private Student Loan Interest Rates

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, private loan interest rates are variable or fixed, and they’re typically higher than federal loan rates. Variable rates fluctuate with market interest rates, potentially leading to unpredictable monthly payments. Fixed rates remain constant over the loan’s term, offering more predictable repayment. The interest rate offered on a private student loan is heavily influenced by the borrower’s credit score, credit history, and income. A borrower with a strong credit history and a high credit score will likely qualify for a lower interest rate than a borrower with a poor credit history and a lower credit score. For example, a borrower with excellent credit might receive a fixed rate of 7%, while a borrower with fair credit might receive a rate closer to 10% or higher.

Comparison of Student Loan Interest Rates

The following table compares interest rates across different lenders and loan programs. Note that these rates are examples and can vary based on several factors. Always check with the lender for the most up-to-date information.

| Lender | Loan Type | Interest Rate (Example) | Repayment Terms (Example) |

|---|---|---|---|

| Federal Government | Subsidized Stafford Loan | 5.0% (Fixed) | 10-20 years |

| Federal Government | Unsubsidized Stafford Loan | 6.54% (Fixed) | 10-20 years |

| Private Lender A | Variable Rate Loan | 7.0% – 9.0% (Variable) | 5-15 years |

| Private Lender B | Fixed Rate Loan | 8.5% (Fixed) | 10-20 years |

Historical Trends in Student Loan Interest Rates

Over the past decade, student loan interest rates have experienced considerable fluctuation, reflecting broader economic conditions and government policy changes. Understanding these historical trends provides valuable context for current rate discussions and helps predict potential future movements. This analysis will examine the key shifts in interest rates, linking them to significant economic events.

Interest rates for federal student loans, which comprise the vast majority of the market, are not entirely market-driven. Instead, they are often tied to government benchmarks, such as the 10-year Treasury note, and are subject to legislative adjustments. This means that economic events impacting Treasury yields and government policy decisions have a significant bearing on the cost of borrowing for students.

Impact of Economic Events on Student Loan Interest Rates

The period from 2013 to 2023 witnessed several significant shifts in the student loan interest rate landscape. The initial years saw relatively stable rates, generally reflecting a low-interest-rate environment following the 2008 financial crisis. However, this stability was disrupted by several factors. For instance, the gradual economic recovery led to a slow increase in rates, reflecting a rising cost of borrowing for the government. Further, changes in government policy, particularly concerning the subsidized versus unsubsidized loan programs, influenced rate adjustments.

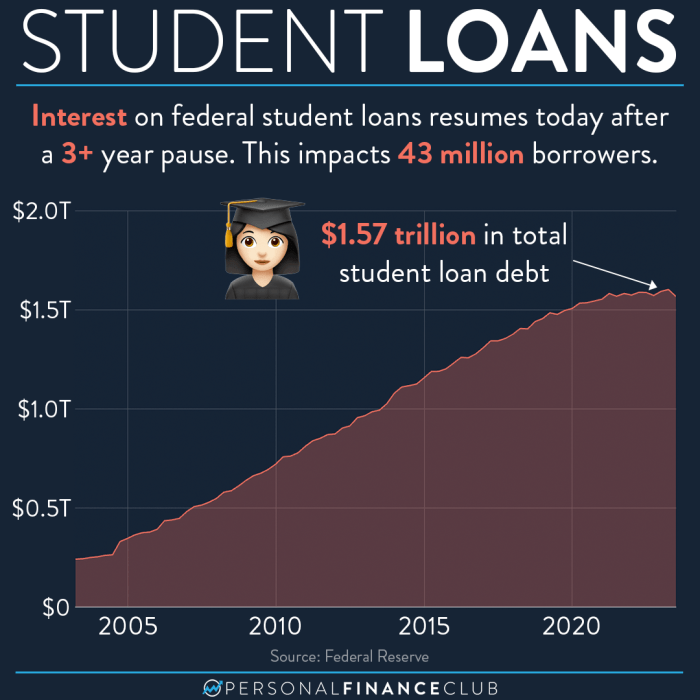

The COVID-19 pandemic in 2020 brought about an unprecedented intervention. The government implemented a 0% interest rate policy on federal student loans as part of economic stimulus measures designed to ease the financial burden on borrowers during the crisis. This period of zero interest significantly impacted the overall historical trend, creating a noticeable dip in the graph below. The subsequent resumption of interest payments and the return to a more market-related rate structure marked another significant shift.

Graphical Representation of Historical Trends

[Imagine a line graph here. The x-axis represents the years from 2013 to 2023. The y-axis represents the interest rate percentage. The graph would show a relatively flat line from 2013 to around 2016, followed by a gradual upward trend until 2020. In 2020, there would be a sharp drop to 0%, representing the pandemic-related interest rate freeze. From 2021 onwards, the line would show a gradual upward climb again, though potentially less steep than the initial increase.]

Caption: This line graph illustrates the fluctuation of average federal student loan interest rates from 2013 to 2023. The graph demonstrates periods of relative stability, gradual increases influenced by economic recovery and policy changes, and a significant disruption caused by the COVID-19 pandemic and subsequent government intervention, resulting in a period of 0% interest. The upward trend after 2020 reflects the resumption of interest accrual and market forces.

Factors Influencing Student Loan Interest Rates

Several interconnected factors influence the interest rates applied to student loans. These rates aren’t set arbitrarily; they reflect broader economic conditions and government policies. Understanding these influences is crucial for borrowers seeking to navigate the complexities of student loan financing.

Several key economic and political factors interact to determine the final interest rate a student borrower will face. These factors can significantly impact the overall cost of a student’s education.

Inflation’s Role in Determining Student Loan Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, plays a significant role in shaping student loan interest rates. Lenders, like any other business, need to protect their investments from the eroding effects of inflation. If inflation is high, lenders will demand higher interest rates to compensate for the reduced purchasing power of the money they lend. Conversely, during periods of low inflation, interest rates tend to be lower. For example, during periods of high inflation in the 1970s and early 1980s, student loan interest rates reflected this economic reality, resulting in higher borrowing costs for students. The current rate of inflation, as measured by indices like the Consumer Price Index (CPI), is a key indicator that influences the overall interest rate environment, impacting the rates offered on student loans.

The Federal Reserve’s Monetary Policy and Interest Rates

The Federal Reserve (the Fed), the central bank of the United States, significantly influences interest rates through its monetary policy. The Fed uses tools like the federal funds rate (the target rate that banks charge each other for overnight loans) to control the money supply and inflation. Changes in the federal funds rate ripple through the financial system, affecting various interest rates, including those for student loans. A tightening of monetary policy (raising interest rates) generally leads to higher borrowing costs across the board, including student loans, while a loosening of monetary policy (lowering interest rates) tends to decrease borrowing costs. For example, during the 2008 financial crisis, the Fed drastically lowered interest rates to stimulate the economy, which indirectly impacted student loan interest rates as well.

Government Policies and Regulations Affecting Student Loan Interest Rates

Government policies and regulations directly impact student loan interest rates. The government plays a significant role in the student loan market, both through direct lending programs and by setting regulatory frameworks for private lenders. For instance, Congress sets the interest rates for federal student loans, often adjusting them annually based on market conditions and economic forecasts. Changes in government subsidies or guarantees for student loans can also influence the rates private lenders offer. Furthermore, government regulations concerning lending practices and consumer protection can affect the overall cost of borrowing. The introduction of income-driven repayment plans, for example, might indirectly influence interest rates offered by lenders, as these plans can mitigate the risk associated with loan defaults.

Predictions and Forecasts for Future Rates

Predicting future student loan interest rates is inherently complex, influenced by a multitude of interacting economic factors. While no one can definitively say what rates will do, analyzing expert opinions and current economic trends offers valuable insights into potential future scenarios. These predictions often vary depending on the source and the underlying assumptions used in their forecasting models.

Experts from various financial institutions and government agencies offer differing perspectives on the future trajectory of student loan interest rates. These predictions are often intertwined with broader economic forecasts, including inflation rates, the Federal Reserve’s monetary policy, and the overall health of the economy.

Expert Opinions and Predictions

Several factors contribute to the uncertainty surrounding future student loan interest rate predictions. These include the unpredictable nature of inflation, the potential for shifts in government policy regarding student loan programs, and the overall state of the credit markets. For example, some experts predict a period of relative stability, while others anticipate more significant fluctuations depending on macroeconomic conditions. The following bullet points summarize some of these varied viewpoints:

- Financial Institutions: Many major financial institutions, in their economic outlook reports, often incorporate predictions for student loan interest rates. These predictions are usually tied to their overall interest rate forecasts and reflect expectations for inflation and Federal Reserve actions. For example, a report from a major investment bank might predict a gradual increase in rates over the next few years, reflecting an anticipated rise in inflation. This prediction would be based on their internal models which consider factors such as inflation, economic growth, and the Federal Reserve’s monetary policy.

- Government Agencies: Government agencies involved in student loan programs may offer their own assessments, though these are often less specific than those from private financial institutions. These assessments usually focus on the broader economic context and the potential impact on the government’s budget related to student loan programs. For example, the Congressional Budget Office might produce a report outlining potential scenarios for student loan interest rates under different economic assumptions, such as high versus low inflation scenarios.

Economic Scenarios and Their Impact

Different economic scenarios can significantly alter the predicted trajectory of student loan interest rates. A robust economy with low unemployment and moderate inflation generally supports lower interest rates, while an inflationary environment often leads to higher rates as the Federal Reserve attempts to control inflation. Conversely, a recessionary environment might lead to lower rates as the Federal Reserve attempts to stimulate economic activity.

- High Inflation Scenario: In a scenario of persistent high inflation, the Federal Reserve is likely to raise interest rates across the board, including those on student loans. This would aim to cool down the economy and curb inflation. A real-world example of this could be the period of high inflation in the 1970s and early 1980s, when interest rates across the board, including on student loans (though the structure of the loan program was different then), were significantly higher.

- Low Inflation/Recessionary Scenario: Conversely, if inflation remains low or the economy enters a recession, the Federal Reserve might lower interest rates to stimulate economic growth. This would likely translate to lower student loan interest rates as well. The 2008 financial crisis and the subsequent recession led to a period of exceptionally low interest rates across the board, including a period of extremely low interest rates on federal student loans.

Impact of Interest Rate Changes on Borrowers

Fluctuations in student loan interest rates have a significant impact on borrowers, affecting their monthly payments and overall repayment costs. Understanding these impacts is crucial for effective financial planning. A decrease in interest rates generally leads to lower monthly payments and reduced total interest paid over the life of the loan, while an increase has the opposite effect. The long-term financial implications can be substantial, potentially influencing major life decisions like homeownership or retirement planning.

Interest Rate Reductions and Their Effect on Monthly Payments

A decrease in interest rates directly translates to lower monthly payments for student loan borrowers. For example, consider a borrower with a $50,000 loan at a 7% interest rate over a 10-year repayment period. Their monthly payment would be approximately $576. If the interest rate dropped to 5%, the monthly payment would decrease to roughly $530, a savings of $46 per month. This seemingly small difference can accumulate significantly over the loan’s lifespan, resulting in thousands of dollars saved in total interest. This additional disposable income can then be used towards other financial goals.

Long-Term Financial Implications of Interest Rate Fluctuations

Interest rate changes significantly impact the total cost of borrowing over the long term. A seemingly small difference in interest rates can lead to a substantial variation in the total amount paid over the loan’s lifetime. For instance, a 1% increase in the interest rate on a large loan balance can result in thousands of extra dollars in interest payments over 10 or 20 years. This added cost can affect long-term financial planning, potentially delaying major purchases such as a house or retirement savings. Conversely, lower rates free up financial resources allowing borrowers to pursue other opportunities sooner.

Impact of Different Interest Rate Scenarios on Total Loan Repayment Costs

The following table illustrates the impact of various interest rate scenarios on a $50,000 student loan, showcasing total interest paid over 10 and 20-year repayment periods. These figures are illustrative and assume a fixed interest rate throughout the repayment term. Actual repayment amounts may vary depending on the loan type and repayment plan.

| Interest Rate | Monthly Payment | Total Interest Paid (10 years) | Total Interest Paid (20 years) |

|---|---|---|---|

| 5% | $530 | $13,600 | $26,000 |

| 6% | $576 | $17,000 | $34,000 |

| 7% | $626 | $20,700 | $42,000 |

| 8% | $679 | $24,700 | $50,000 |

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive approach, especially in the face of potentially high interest rates. Understanding your repayment options and implementing sound financial strategies can significantly reduce the long-term burden and minimize the impact of accruing interest. This section Artikels several key strategies to help borrowers navigate their student loan repayment journey successfully.

Minimizing the Impact of High Interest Rates

High interest rates can dramatically increase the total cost of your student loans over time. Several strategies can help mitigate this impact. Prioritizing high-interest loans for repayment is crucial. This means focusing your extra payments on the loans with the highest interest rates first, thus saving money on interest charges in the long run. Another effective strategy is to explore refinancing options if interest rates fall. Refinancing allows you to consolidate your loans into a new loan with a lower interest rate, potentially saving you thousands of dollars over the life of the loan. Finally, making extra payments whenever possible, even small amounts, can significantly reduce the principal balance and the overall interest paid. For example, an extra $100 per month can shorten your repayment period and reduce your overall interest payments substantially.

Student Loan Repayment Plans: Benefits and Drawbacks

Several repayment plans are available, each with its own advantages and disadvantages. Understanding these differences is critical in selecting the most suitable plan for your individual financial situation.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. The benefit is a shorter repayment period, leading to less interest paid overall. However, the monthly payments can be quite high for some borrowers.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments. The drawback is that you’ll pay significantly more interest over the life of the loan.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be beneficial in the early years when income is typically lower. However, payments can become substantial later on.

- Income-Driven Repayment (IDR) Plans: These plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), base your monthly payment on your income and family size. Payments are typically lower, but the loan repayment period is often extended, leading to higher total interest paid. Forgiveness may be possible after 20 or 25 years, depending on the plan.

Effective Student Loan Debt Management: A Step-by-Step Approach

A structured approach to managing student loan debt is crucial for successful repayment. The following flowchart illustrates a recommended process:

[Flowchart Description: The flowchart would visually represent a step-by-step process. It would begin with “Assess Your Loans,” branching to “List all loans, interest rates, and minimum payments.” The next step would be “Choose a Repayment Plan,” leading to options such as “Standard,” “Extended,” “Graduated,” and “IDR.” From there, the process would branch to “Budget and Prioritize Payments,” followed by “Make on-time payments” and “Consider Extra Payments.” A final step would be “Monitor Progress and Adjust as Needed.” The flowchart would visually connect these steps with arrows, indicating the flow of the process.]

Final Summary

Ultimately, the question of whether student loan interest rates will fall remains complex and dependent on various economic and political factors. While predicting the future is inherently uncertain, understanding the historical trends, influencing factors, and available strategies empowers borrowers to proactively manage their debt and plan for their financial well-being. Staying informed and adapting to changing circumstances is key to navigating the student loan landscape successfully.

Answers to Common Questions

What are the consequences of not repaying student loans?

Failure to repay student loans can result in damaged credit scores, wage garnishment, and potential legal action. The specific consequences vary depending on the type of loan and the lender.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may be an option, but it depends on your credit score and the current market rates. Shop around and compare offers from different lenders before making a decision.

What is the difference between fixed and variable interest rates on student loans?

Fixed interest rates remain constant throughout the loan term, while variable interest rates fluctuate based on market conditions. Fixed rates offer predictability, while variable rates may offer lower initial rates but carry greater risk.

Are there any government programs to help with student loan repayment?

Yes, several government programs offer assistance, such as income-driven repayment plans and loan forgiveness programs for certain professions. Eligibility requirements vary.